Summary

- Converting your traditional IRA to a Gold IRA can protect your retirement savings and diversify your investment portfolio.

- Initiating a self-directed IRA allows investors to diversify their portfolio with gold, a precious metal that can act as a hedge against inflation and market volatility.

- When funding a Gold IRA account, consider your investment strategy and goals, and work with a reputable financial adviser specializing in gold IRAs.

- When converting your IRA to a Gold IRA, choose IRA-eligible precious metals, consider secure storage options, and monitor and rebalance your investment portfolio. Understand the costs and fees involved and consider diversification, tax advantages, and potential risks. Choose a reputable company to handle the conversion process.

Welcome to the ultimate guide on how to convert your IRA to gold and set up a Gold IRA. In this article, we will explore the benefits, process, and important considerations involved in making this strategic financial move. Whether you’re a seasoned investor or new to the world of precious metals, get ready to discover a secure and potentially lucrative pathway to safeguarding your retirement funds.

We’ve dedicated hundreds of hours to researching the top precious metals investment companies, perfect for anyone looking to invest!

>> Click Here to See Our Top 5 Companies List <<

Understanding Gold IRA Conversion

Converting your traditional IRA to a Gold IRA can protect your retirement savings and diversify your investment portfolio. It allows you to invest in precious metals and potentially gain tax advantages. Research reputable companies and experts in the gold IRA industry for a smooth and secure transfer process. Consider factors like reputation, customer service, fees, and the security of the bank vault where your precious metals will be stored. Understanding the process and regulations will help you make an informed decision and maximize the benefits.

Initiating a Self-Directed IRA

Initiating a self-directed IRA allows investors to diversify their portfolio with gold, a precious metal that can act as a hedge against inflation and market volatility. By converting an existing IRA to a gold IRA, investors can take advantage of the tax benefits and potential for growth that gold offers. This process involves transferring funds from the traditional IRA or 401(k) into a self-directed IRA, which gives investors the flexibility to choose their own investments. Setting up a gold IRA requires working with a reputable financial institution or expert who can guide investors through the process and ensure compliance with IRS regulations. With proper research and guidance, investors can successfully initiate a self-directed IRA and incorporate gold as part of their investment strategy.

Funding Your Gold IRA Account

When funding a Gold IRA account, consider your investment strategy and goals. Diversifying with precious metals like gold can provide protection against inflation and market volatility. Transfer funds from your existing IRA or 401(k) into a self-directed IRA that allows for precious metal investments. Work with a reputable financial adviser specializing in gold IRAs and research different custodians for factors like reputation, fees, customer service, and security. Monitor the price of gold and other precious metals to make informed investment decisions.

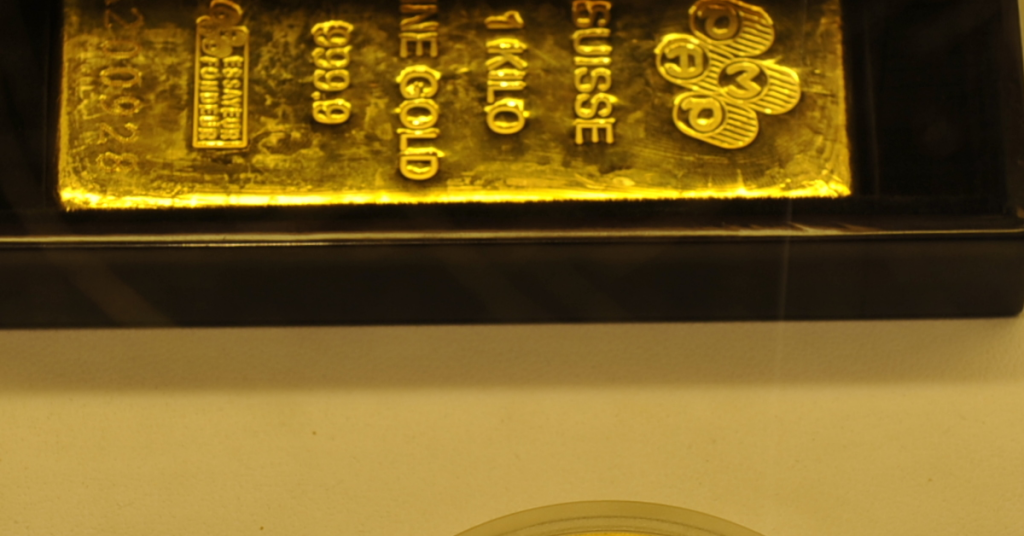

Choosing IRA-Eligible Precious Metals

| Asset | Description | Eligibility |

|---|---|---|

| Gold | Physical gold bars or coins | Eligible for IRA investment |

| Silver | Physical silver bars or coins | Eligible for IRA investment |

| Platinum | Physical platinum bars or coins | Eligible for IRA investment |

| Palladium | Physical palladium bars or coins | Eligible for IRA investment |

When converting your IRA to a Gold IRA, it’s important to choose IRA-eligible precious metals. The table above provides a list of the commonly accepted precious metals for IRA investment, including gold, silver, platinum, and palladium. These physical metals can be purchased in the form of bars or coins and are eligible for inclusion in your IRA portfolio.

Secure Storage Solutions for Precious Metals

When converting your IRA to gold, it’s important to consider secure storage options such as bank vaults or reputable financial institutions that specialize in secure storage. These options provide advanced security measures and insurance coverage for your precious metals. Consulting with a financial adviser or expert can help you choose the best storage solution for your gold IRA.

Advantages of a Precious Metals IRA

Investing in a Precious Metals IRA offers diversification, tax advantages, protection against inflation, portfolio protection, tangible assets, and professional guidance.

Monitoring and Rebalancing Investment Portfolio

Monitoring and rebalancing your investment portfolio is crucial when it comes to managing a Gold IRA. Regularly tracking the performance of your assets and adjusting your allocation helps ensure that your investment strategy aligns with your financial goals. By monitoring the market, you can make informed decisions about when to buy or sell gold bullion or coins. Rebalancing involves adjusting the distribution of your assets to maintain diversification and manage risk.

It’s important to consider factors such as fees, taxes, and market conditions when rebalancing your portfolio. With careful monitoring and rebalancing, you can maximize the potential of your Gold IRA and protect your retirement savings.

Navigating Costs and Fees

When converting your IRA to gold, it’s essential to understand the costs and fees involved. One important factor to consider is the price of gold. The price can fluctuate, so it’s crucial to monitor the market and be aware of any potential risks. Additionally, there may be fees associated with the conversion process, such as transaction fees or storage fees if you choose to store your gold in a bank vault. It’s also important to be aware of any tax advantages or regulations that may apply to your specific situation.

Final Considerations in Precious Metals IRAs

When converting an IRA to a gold IRA, it is crucial to take into account a few final considerations. One important aspect is diversification, as adding gold to your portfolio can provide a hedge against market volatility. Additionally, be aware of any fees associated with the transfer and setup of a gold IRA. It’s also important to understand the tax advantages and regulations surrounding precious metals IRAs, as well as the potential risks involved.

Lastly, ensure that you choose a reputable and experienced company to handle the conversion process. By carefully considering these factors, you can make informed decisions and confidently set up a gold IRA to protect and grow your retirement savings.

Gold IRA: Should You Open One To Save For Retirement?