Summary

- Retired employees of Union Pacific are entitled to a pension plan based on years of service and salary.

- Union Pacific also offers a 401(k) plan for pre-tax retirement savings, with potential matching contributions.

- Salary ranges and vacation days vary based on job position, with higher-level positions receiving more benefits.

- Medical and insurance benefits are provided for retirees, including coverage for healthcare, dental, vision, and life insurance.

Welcome to the comprehensive guide that aims to assist retired employees of Union Pacific in understanding and maximizing their pension plan benefits.

We’ve dedicated hundreds of hours to researching the top precious metals investment companies, perfect for anyone looking to invest!

>> Click Here to See Our Top 5 Companies List <<

Retirement Benefits

As a retiree of Union Pacific Railroad, you are entitled to a range of retirement benefits. These benefits include a pension plan, which provides you with a steady income during your retirement years. The pension is calculated based on your years of service and your salary. It is important to note that you need to be vested in the pension plan to qualify for these benefits. Additionally, Union Pacific offers a 401(k) plan, which allows you to save for retirement on a pre-tax basis.

This plan allows you to contribute a portion of your salary, and Union Pacific may also provide a matching contribution. It is crucial to review the plan’s details and consult the provided documents for specific information on your retirement benefits.

Salary and Vacation Provisions

| Position | Salary Range | Vacation Days |

|---|---|---|

| Entry Level | $40,000 – $50,000 | 10 |

| Intermediate Level | $50,000 – $70,000 | 15 |

| Senior Level | $70,000 – $100,000 | 20 |

| Executive Level | Above $100,000 | 25 |

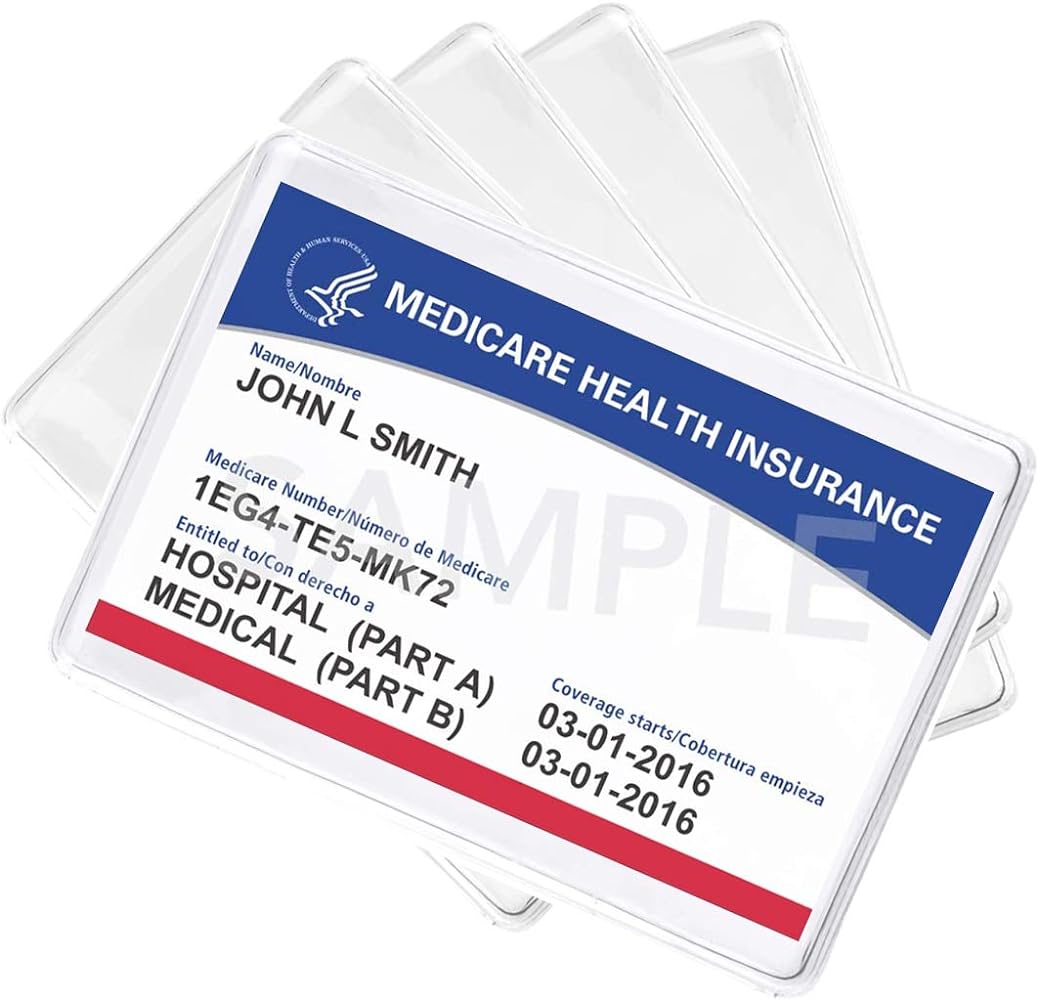

Medical and Insurance Benefits

Medical and insurance benefits are an essential part of the Union Pacific Pension Plan for retirees. These benefits provide comprehensive coverage for a retiree’s healthcare needs. The plan includes options for medical, dental, and vision coverage, ensuring retirees have access to quality care. Additionally, the plan offers life insurance coverage to provide financial security for loved ones.

It’s important to understand the details of these benefits, including any premium costs and coverage limitations. Retirees should review the plan documents carefully to make informed decisions about their healthcare. The Union Pacific Pension Plan Benefits Guide for Retirees provides valuable information on these benefits to help retirees navigate their options and make the best choices for their needs.

Gold IRA: Should You Open One To Save For Retirement?