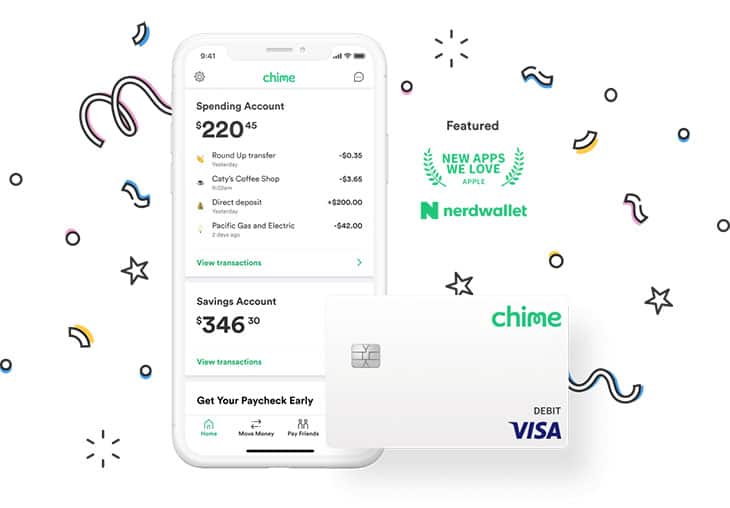

- Chime is a mobile banking and financial services company.

- Chime offers cash back for IRA investments to its customers.

- The cash back reward is paid as cash directly to your Chime account.

Cash back is cash that’s returned to you as a benefit for investing a certain dollar amount or for buying certain products or services. Chime, a mobile banking and financial services company, offers cash back for IRA investments to its customers.

We’ve dedicated hundreds of hours to researching the top precious metals investment companies, perfect for anyone looking to invest.

What Are Chime’s IRA Features?

Chime provides IRAs for individuals who want to invest for retirement, but want to maintain control over their own investments. With Chime’s IRA features, you can open an IRA account and choose investments from dozens of options.

To start, you’ll need to open an IRA with Chime. This involves completing three easy steps:

1.

Select your account type (Traditional or Roth IRA) and open an account.

2.

Choose the features you want, such as cash-back rewards.

3.

Select investments.

Once you open your IRA, you can choose investments from large banks and brokerages, including Fidelity, Schwab, Vanguard, Charles Schwab, and more.

How Chime’s IRA Features Work

Chime’s IRA features are similar to its checking account features. Users of the Chime app can start a Chime account, link a checking account, link their IRA, and then begin doing their banking.

The Chime app has two options for transferring money between an IRA and checking:

Direct Transfer: Chime’s Direct Transfer moves money directly from your checking to your IRA.

Automatic Transfer: Chime’s Automatic Transfer moves money directly from your checking to your IRA on a schedule you set.

Both options have handy features that make it easy to move funds. With Direct Transfer, you can specify a daily or monthly dollar amount, or transfer a percentage amount from each of your checking transactions to your IRA.

With Automatic Transfer, you can schedule your transfers to occur weekly, monthly, or quarterly.

Features of Chime’s IRAs

Chime offers several benefits, including:

Free online and mobile banking

Free ATM reimbursements

Lower fees than its competitors such as banks and online banks

Chime’s IRA accounts offer free and unlimited transactions. There are no minimum balance requirements. All deposits are FDIC-insured up to $250,000.

If you’ve deposited $10,000 or more with Chime, you’ll receive a 1% cash-back bonus. The bonus is paid monthly.

Cash Back

Chime offers automatic cash back for investments you make in your self-directed IRA. When you make eligible investments, the Chime platform automatically calculates the amount of cash back you receive.

Chime allows you to reinvest the cash back into your IRA or withdraw it.

Best Investments

Chime offers cash back for:

Stocks and ETFs

Mutual funds

401(k) plans

529 college savings plans

IRAs

Retirement plans through employers

Health Savings Accounts

FDIC-insured

Federally insured to a balance of $250,000

Account holders have the ability to withdraw from their IRA accounts at any time

Low fees

No minimum balance to open, $0 to open an account, and $10 minimum balance to earn the 2% APY,

No monthly maintenance fees

Earnings

“Earnings” refers to the current-year’s earnings divided by the current-year’s stock price.

Price-to-earnings ratio (P/E ratio)

Price-to-earnings ratio, or P/E ratio, is the price-to-earnings ratio (P/E) of a stock divided by the market capitalization (market cap). The formula is:

P/E = (earnings per share ÷ stock price)

Market capitalization is calculated by multiplying the number of shares outstanding by the stock’s price.

Earnings growth

Earnings growth is the percent change in earnings per share (EPS). It is calculated as:

EPS growth = (EPS ÷ previous EPS)

Dividends

Dividends are cash amounts paid to shareholders based on the number of shares owned.

Returns

Return is the annual rate of return on an investment (gross of fees).

Fees

Setup fees. If you open an IRA and fund it with $10,000 or more, Chime will charge you a $49 setup fee.

Annual maintenance fees. If you fund your IRA with $10,000 or more, Chime will charge you $49 per year for account maintenance.