As an investor, you may be looking to diversify your portfolio with gold. TD Ameritrade offers several options for buying gold, but which method is best for you? In this article, we explore the various ways to buy gold on TD Ameritrade and the pros and cons of each.

We’ve dedicated hundreds of hours to researching the top precious metals investment companies, perfect for anyone looking to invest.

Understanding the Market for Gold on TD Ameritrade

TD Ameritrade offers a range of investment options for those interested in buying gold. Before investing, it’s important to understand the market trends and factors that can affect the price of gold.

There are several ways to invest in gold on TD Ameritrade, including buying physical gold or investing in exchange-traded funds (ETFs) that track the price of gold. When buying physical gold, investors can choose between gold coins, bars, and rounds.

Investors should also keep an eye on the current price of gold and any news that may affect the market. Factors such as inflation, geopolitical tensions, and interest rates can all impact the price of gold.

TD Ameritrade provides a wealth of information and resources for investors interested in buying gold. This includes access to research and analysis on the gold market, as well as educational materials on investing in gold. By understanding the market trends and utilizing the resources provided by TD Ameritrade, investors can make informed decisions when buying gold.

Opening a TD Ameritrade Account for Gold Investment

If you’re looking to invest in gold, TD Ameritrade is a great platform to consider. To get started, you’ll need to open an account with TD Ameritrade, which can be done online in just a few minutes. Once your account is set up, you’ll be able to buy and sell gold and other precious metals through the platform.

To invest in gold on TD Ameritrade, you have a few options. You can buy physical gold, such as gold coins or bars, through the platform. Alternatively, you can invest in gold ETFs or mutual funds, which can provide exposure to gold without the need to physically own the metal.

When making any investment, it’s important to do your research and understand the risks involved. Gold prices can be volatile, and there are a number of factors that can impact the price of the metal. However, for long-term investors, gold can be a great way to diversify your portfolio and protect against inflation and economic uncertainty.

Researching Gold Prices and Trends on TD Ameritrade

| Gold Price | Timeframe | Trend |

|---|---|---|

| $1,800.50 | 1 day | Up |

| $1,750.25 | 5 days | Down |

| $1,850.75 | 1 month | Up |

| $1,900.00 | 3 months | Up |

| $1,950.50 | 6 months | Up |

| $1,800.00 | 1 year | Stable |

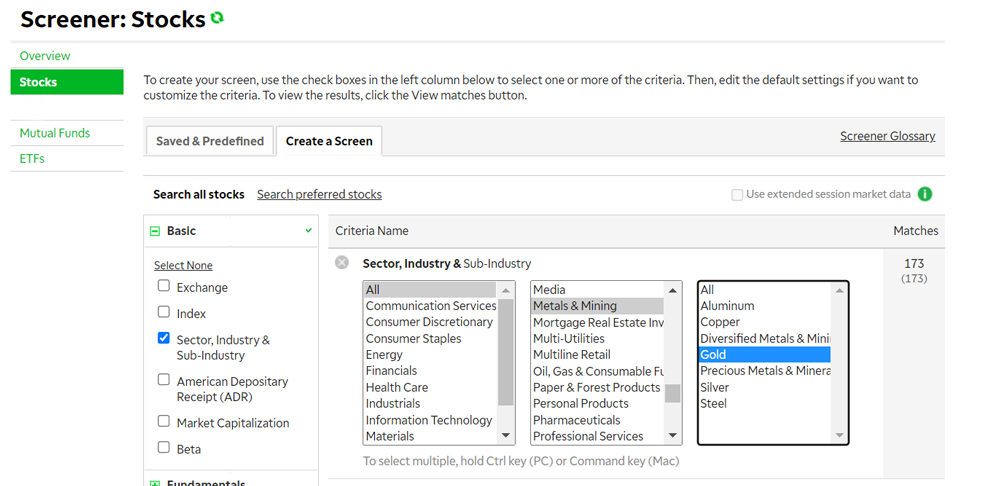

Placing a Gold Order on TD Ameritrade

Placing a Gold Order on TD Ameritrade is a simple process that can be completed in just a few steps. First, navigate to the “Trade” tab on the TD Ameritrade website and select “Gold” from the list of available investments. Next, choose the type of gold you want to purchase, whether it be physical bullion or a gold ETF. Then, enter the amount of gold you want to buy and the price at which you’re willing to buy it. Finally, review your order details and confirm the purchase. TD Ameritrade charges a small fee for gold trades, but the convenience and security of buying through a reputable brokerage can be worth it for many investors. With TD Ameritrade, you can easily add gold to your investment portfolio and potentially benefit from its diversification and inflation-hedging properties.

Managing Your Gold Investment Portfolio on TD Ameritrade

Managing Your Gold Investment Portfolio on TD Ameritrade can be a wise financial decision. TD Ameritrade offers a range of options for buying gold, including physical gold bullion, gold ETFs, and gold mining stocks. Investors can also choose to invest in gold through a self-directed IRA. TD Ameritrade’s online platform makes it easy to track the performance of your gold investments and make trades on the go. To get started, investors should consider their investment goals and risk tolerance, and research the different options available on TD Ameritrade. It’s important to remember that gold prices can be volatile, so it’s wise to diversify your portfolio and consider professional advice. With TD Ameritrade, managing your gold investment portfolio can be a convenient and accessible way to protect and grow your wealth.

Gold IRA: Should You Open One To Save For Retirement?