- A backdoor Roth IRA is a formal process that allows a taxpayer to convert a traditional IRA to a Roth IRA.

- A backdoor Roth IRA conversion is a formal process that allows the taxpayer to convert a traditional IRA to a Roth IRA.

- A backdoor Roth IRA strategy involves converting a traditional IRA to a Roth IRA.

The Roth IRA is a personal savings plan that offers many of the same advantages as the more traditional 401(k) plan. In fact, the Roth IRA and 401(k) are considered by many to be the two best retirement savings vehicles. The Roth IRA, however, has one major advantage over its cousin: unlike the 401(k) plan, the Roth IRA is not subject to mandatory withdrawals during retirement.

A backdoor Roth IRA is a formal process that allows a taxpayer to convert a traditional IRA to a Roth IRA. There is no age requirement for establishing a Roth IRA; however, some back door strategies require the taxpayer to be at least 59 1/2 years old.

We’ve dedicated hundreds of hours to researching the top precious metals investment companies, perfect for anyone looking to invest.

What Is a Backdoor Roth IRA?

A backdoor Roth IRA is a retirement savings account that can be opened by a taxpayer who does not have a traditional IRA or Roth IRA (with earnings or contributions). Here’s how it’s typically done:

First, open a traditional IRA.

Next, open another IRA at a traditional brokerage.

Contribute to the IRA at a traditional brokerage and designate it as a backdoor Roth IRA contribution.

Roll the traditional IRA to the brokerage account, and designate it as a rollover to the backdoor Roth IRA.

When you reach the $5,500 annual contribution limit, contribute the max amount to your traditional IRA and rollover the $5,500 to the brokerage account.

Contribute the remaining $1,000 to your backdoor Roth IRA.

This process, while a bit convoluted, allows you to easily contribute the $5,500 maximum amount each year.

Understanding the Difference Between a Traditional and Roth IRA

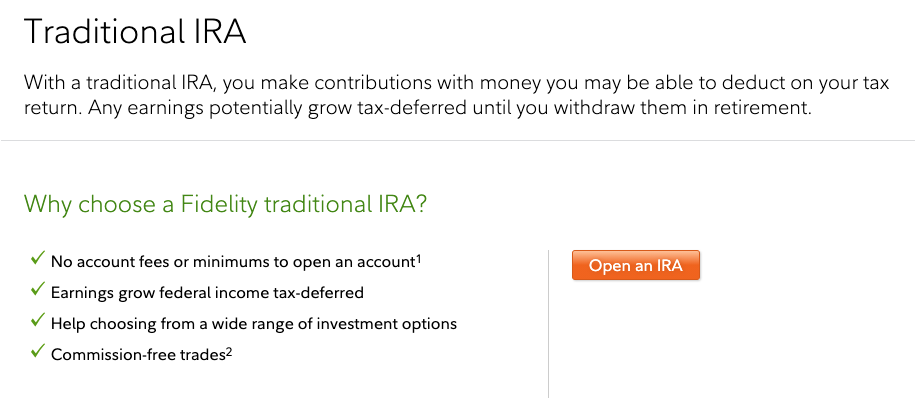

A traditional IRA, or Individual Retirement Account, is a tax-advantaged retirement account that allows individuals to contribute up to $6,000 annually. Any eligible individual, regardless of age, can contribute to a traditional IRA, regardless of their income level and the amount contributed is tax-deductible.

Income taxes are taken when funds are withdrawn from the account and that age requirement prevents individuals under the age of 701⁄2 from withdrawing funds without a penalty.

Roth IRAs are similar to the traditional IRA, except that the funds are not tax-deductible. Roth IRAs are subject to the same income restrictions and withdrawal restrictions as traditional IRAs.

Converting Your Traditional IRA to a Roth IRA

In order to convert a traditional IRA to a Roth, you must pay income tax on the funds in the account, less your basis (the pre-tax contributions). The tax, however, is much less than it would be had you withdrawn the money.

What Can You Contribute to a Roth IRA?

A traditional IRA or a Roth IRA allows you to contribute up to $6,000 in 2021 or 2022, depending on your income.

A backdoor Roth IRA allows you to establish an IRA under the 2002 income limit ($100,000 for singles and $120,000 for married couples filing jointly in 2021 or 2022), and then convert to a Roth IRA.

The required minimum distributions (RMDs) that are required from a traditional IRA, such as a 401(k), are not required from a Roth IRA.

The Roth IRA offers more investment options.

The Roth IRA offers tax-free withdrawals if certain conditions are met.

Who Can Contribute to a Roth IRA?

Both you and your spouse can have Roth IRA accounts.

How Much Can You Contribute?

You can contribute up to $7,000 ($7,500 for 2019), or the amount of your earnings for the year (whichever is lower), whichever is less, to a Roth IRA. Anyone aged 50 or older can contribute up to $7,000 ($7,500 for 2019).

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

The backdoor Roth IRA has become a popular vehicle for saving for retirement in recent years, largely due to the growth of the 401(k) and other defined contribution plans.

The backdoor Roth IRA allows for a deduction of contributions on taxable income, while distributions and earnings are tax-free. It can be especially useful for high-income taxpayers who might otherwise not be eligible to contribute to traditional Roth IRAs, and for whom Traditional IRA contributions may not make sense.