- A security deposit is money paid by a tenant to a landlord as security for the performance of a lease.

- The security deposit is refundable to the tenant, less any deductions, once the tenant moves out of the property.

- A security deposit is a sum of money paid up front by a potential tenant to the owner and landlord of a property when a lease is signed.

- This money is held by the landlord or owner until the tenant moves out of the property.

A security deposit is a sum of money paid up front by a potential tenant to the owner and landlord of a property when a lease is signed. This money is held by the landlord or owner until the tenant moves out of the property. The security deposit is refundable to the tenant, less any deductions, once the tenant moves out of the property.

We’ve dedicated hundreds of hours to researching the top precious metals investment companies, perfect for anyone looking to invest.

Calculate Your Annual Gross Income

Calculate Your Annual Net Income

Calculate Your Total Debt Service Ratio

Calculate Your Total Debt Service Ratio

Calculate Your Total Debt Service Ratio

Calculate Your Total Debt Service Ratio

Calculate Your Total Debt Service Ratio

Calculate Your Total Debt Service Ratio

Calculate Your Annual Gross Housing Expense

Multiply your gross annual housing expense by 0.839

This is your annual gross housing expense

Calculate your annual 30% of annual gross housing expense

Multiply your annual gross housing expense by 0.266

This is your annual 30% of annual gross housing expense

Calculate your annual 15% of annual gross housing expense

Multiply your annual gross housing expense by 0.133

This is your annual 15% of annual gross housing expense

Calculate your annual 10% of annual gross housing expense

Multiply your annual gross housing expense by 0.077

This is your annual 10% of annual gross housing expense

Calculate your annual 5% of annual gross housing expense

Multiply your annual gross housing expense by 0.042

This is your annual 5% of annual gross housing expense

Calculate your annual 3.3% of annual gross housing expense

Multiply your annual gross housing expense by 0.026

This is your annual 3.3% of annual gross housing expense

Calculate Your Annual Net Housing Expense

Your annual net housing expense (ANH) is the sum of your housing costs, including mortgage interest, property taxes, and insurance, minus any rent you’re paying.

Calculate Your Required Annual Net Income

Your required annual income is the sum of the annual net housing expense and the annual net cost of your child’s education.

Calculate Your Annual Total Expense

Your annual total expense is the sum of your required annual income and your annual net transportation expense.

Calculate Your Child’s Maximum Annual Allowance

The maximum annual allowance is the sum of your annual total expense and the annual net cost of transportation.

Calculate Your Disposable Income

Your disposable income is the difference between your annual total expense and your annual total income.

Calculate Your Annual Gross Income After Taxes

Gross Income After Taxes = Gross Income – Taxes

Gross Income = Salary

Taxes = Federal Tax Rate X Federal Income Tax Return

For example, if you are in the 28% tax bracket and file a Form 1040, your total taxes owed for the year is 28% of your gross income.

Calculate Your Monthly Expenses

Monthly Expenses = Rent or Mortgage

+ Utilities

+ Car Payment

+ Car Insurance

+ Gas

+ Food

+ Cable/Internet

+ Gym/Health Club

+ Phone Plan

+ Credit Card Payments

+ Student Loan Payments

+ Others

Calculate Your Net Worth

Net Worth = Assets – Liabilities

For example, if you have $10,000 in savings and $15,000 in outstanding student loans, your net worth would be zero.

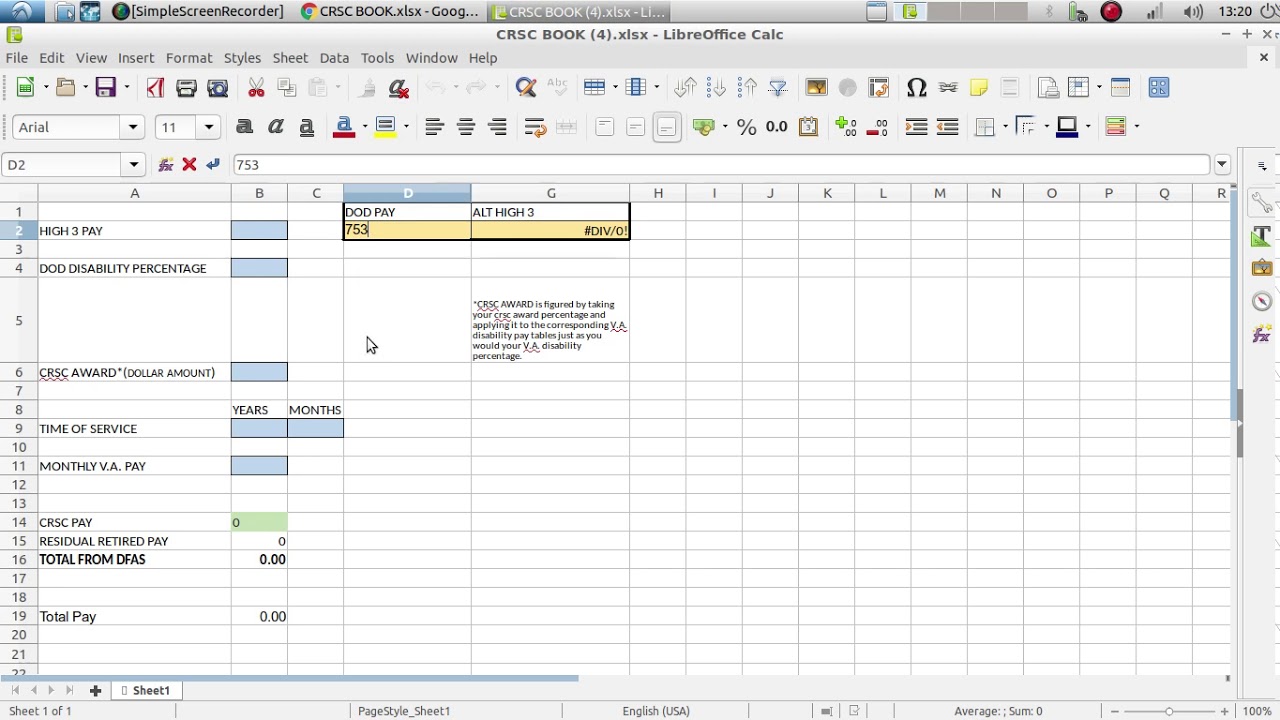

Calculate Your Minimum CRSC Security Deposit

Minimum CRSC Security Deposit = Net Worth – Monthly Expenses

For example, if your net worth is $10,000 and your monthly expenses are $1,000, your minimum CRSC Security Deposit would be $9,000.

Calculate Your Annual Net Income After Taxes

Multiply Your Annual Net Income After Taxes by 0.2

Calculate the Percentage Change in Your Annual Net Income After Taxes From the Previous Year

Divide the Percentage Change in Your Annual Net Income After Taxes From the Previous Year by 100

Multiply the Percentage Change in Your Annual Net Income After Taxes From the Previous Year by 0.2

Calculate the Annual Net Income Multiplier

Multiply the Annual Net Income Multiplier by 6.5

Calculate Your Annual Net Income

Divide the Annual Net Income Multiplier by the Annual Net Income After Taxes

Calculate the CRSC Security Deposit

Divide the Annual Net Income Multiplier by the Annual Net Income After Taxes

Calculate Your Annual Housing Expense

For 2021, the HUD announced annual housing costs for 12-month leases to be about $28,000.

Calculate Your Annual Transportation Expense

For 2021, the HUD announced annual transportation costs for 12-month leases to be about $6,000.

Calculate Your Annual Food Expense

For 2021, the HUD announced annual food costs for 12-month leases to be about $7,000.

Calculate Your Annual Income Tax Rate

Multiply your yearly income by that rate to determine your yearly tax liability.

Calculate Your Annual Federal Tax Withholding

Divide your yearly tax liability by 12 to determine your annual federal tax withholding from paychecks.

Calculate Your Annual State Tax Withholding

Calculate your yearly state tax liability using the tax rate of your state.

Add Up Your Annual Federal Tax and State Tax Withholding

Add your annual federal and annual state income tax withholding to determine your total annual tax withholding.

Calculate Your Required Minimum Distributions (RMDs)

The RMD is calculated as the total amount of your account balance divided by your life expectancy.

Calculate Your Total Annual Federal and State Tax Withholding

Divide your required minimum distributions by your remaining life expectancy to calculate your total annual tax withholding.

Calculate Your Annual CRSC Security Deposit

Divide your total annual tax withholding by 12 to determine your required annual CRSC security deposit.

Calculate Your Annual Net Income

First, add up all income you receive during the prior year. Include salary and wages, interest, dividends, capital gains, and pension income.

Divide your net income by 12 and multiply the result by 100. For example, if your income during the prior 12 months was $75,000, divide by 12 to get 7,500. Multiply by 100 to get $75,000.

Your annual net income is $75,000.

Calculate Your Net Worth

Next, add up all of your assets during the prior year. Include your home, car, savings, investments, and other property.

Divide your combined assets by 12 and multiply the result by 100. For example, if your home and savings are valued at $250,000 and your investments are valued at $150,000, divide by 12 to get the combined total is $30,000. Multiply by 100 to get $300,000.

Your net worth is $300,000.

Calculate Your Debt

Add up all of your debts during the prior year. Include your mortgage, car loans, student loans, and any other loans you have.

Divide your debt by 12 and multiply the result by 100. For example, if your mortgage is $300,000, divide by 12 to get $30,000. Multiply by 100 to get $300,000.

Your debt is $300,000.

Calculate Your Net Worth to Debt Ratio

Divide your net worth by your debt. In this example, net worth is $300,000 and debt is $300,000, so divide $300,000 (net worth) by $300,000 (debt) to get 1.00.

Your net worth to debt ratio is $1.00.

Calculate Your CRSC Deposit

Multiply your net worth to debt ratio by $200. In this example, net worth to debt ratio is $1.00. Multiply by $200 to get $200.

Your CRSC deposit is $200.

Calculate Your Annual Debt

Subtract your annual debt payments from your assets. Don’t forget to include principal, interest, and fees.

For example, let’s say you have $200,000 in assets and $150,000 in annual debt payments. Your annual debt is $150,000.

Calculate Your Annual Income

Calculate your income by subtracting your annual debt from your annual assets.

So, if your annual debt is $150,000 and your annual assets are $200,000, then your income is $50,000.

Calculate Your Net Worth

Calculate your net worth by subtracting your annual debt from your annual income.

So, if your annual debt is $150,000 and your annual income is $50,000, then your net worth is $100,000.

Calculate Your Debt-to-Income Ratio

Divide your annual debt by your annual income. So, if your annual debt is $150,000 and your annual income is $50,000, then your debt-to-income ratio is 3.5 (150,000/50,000).

Calculate Your Net Worth-to-Income Ratio

Divide your net worth by your annual income. So, if your net worth is $100,000 and your annual income is $50,000, then your net worth-to-income ratio is 5.0 (100,000/50,000).

Calculate Your Debt-to-Equity Ratio

Divide your debt by your net worth. So, if your debt is $150,000 and your net worth is $100,000, then your debt-to-equity ratio is 1.5 (150,000/100,000).

Calculate Your Net Worth-to-Equity Ratio

Divide your net worth by your net worth. So, if your net worth is $100,000 and your net worth is $100,000, then your net worth-to-equity ratio is 1.0 (100,000/100,000).

Gold IRA: Should You Open One To Save For Retirement?

If you’re in the market for a house, you typically pay a security deposit. This money is held by the landlord until it’s returned when you move out. The landlord has the option of keeping the deposit for any damages, or returning it to you.

The same concept applies to CRSCs, which are security deposits paid to a landlord to lease a house.

The cost of your CRSC deposit will depend on several factors, including:

The monthly rent

The security deposit required

Your credit history and score

Your outstanding debts