- Gold is a precious metal that has both industrial and monetary uses.

- It is a popular commodity for investment purposes, given its stability and volatility relative to the value of the dollar.

- Gold has a value beyond its monetary value, as it is also a material that has aesthetic appeal, provides a sense of security, and has universal value.

Gold has always been a popular commodity for investment purposes. Its value has long been considered stable and volatile in inverse proportion to the value of the dollar.

Gold is prized for more than just its monetary value. It is a material that has aesthetic appeal, provides a sense of security, and is believed to have universal value.

Gold is used in many industrial applications, including electronics, dentistry, and medicine.

Bullion

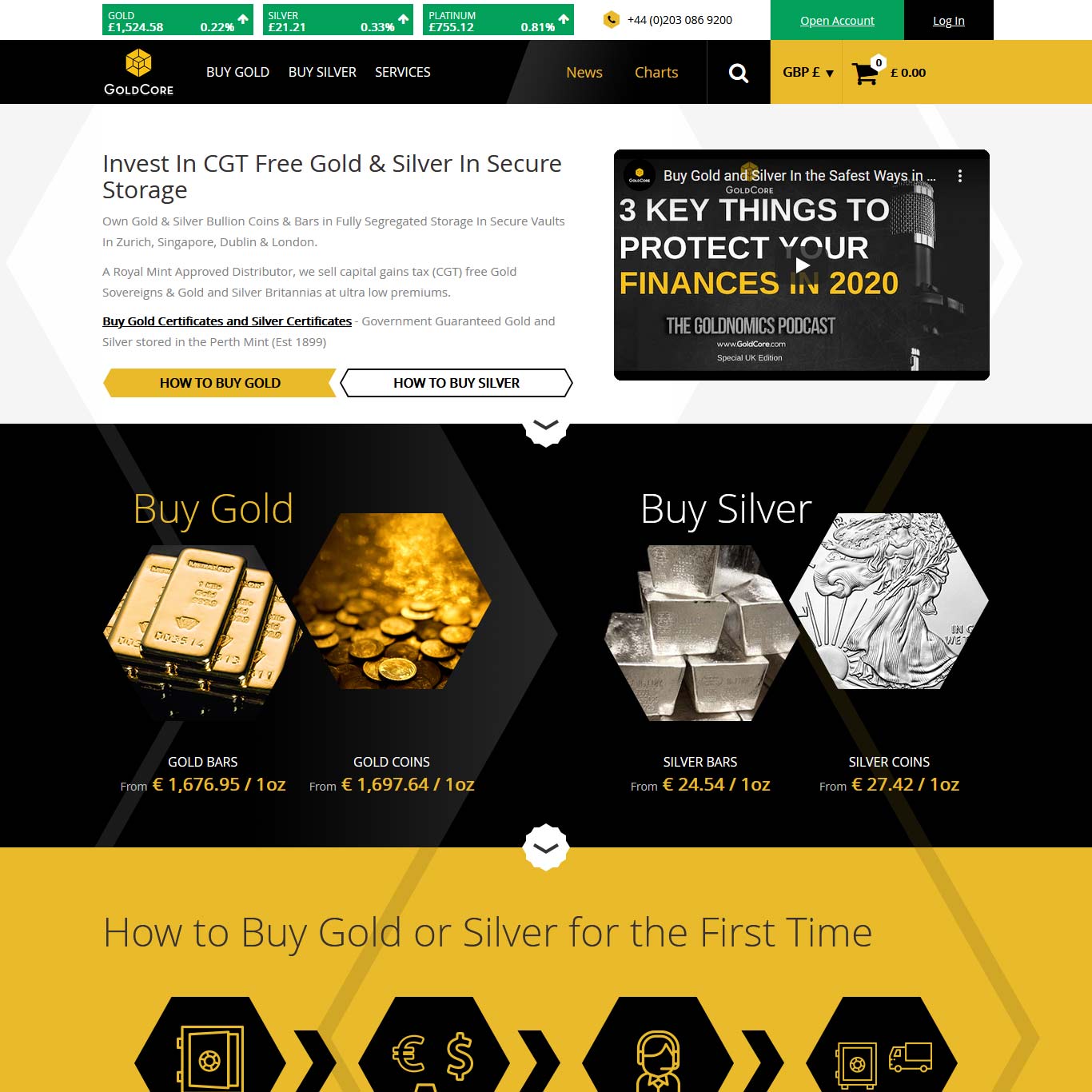

Investing directly in gold bullion is the simplest way to get access to physical gold. While the price of gold is volatile, it is not affected by interest rates, government actions, or economic conditions like stocks or bonds. In addition, gold is a tangible asset that is easy to hold onto and trade, if necessary.

The drawback to investing in physical gold bullion is that it is difficult to value. While it is easy to buy, it is difficult to price bullion. Investors must rely on online or online tools to tell them how much their gold is worth.

Bullion is riskier than gold in the form of ETFs, which trade on public exchanges, and are largely backed by gold bullion.

Precious metals ETFs

Gold ETFs are a popular way to invest in physical gold. These funds trade on public exchanges and are priced throughout the day. Like stocks, ETFs are backed by real assets, in this case, gold bullion. Investing in gold ETFs is a good way to invest in gold without incurring the costs of buying gold bullion.

Coins

Gold coins come in a variety of different weights, ranging from 1/10 ounce to 1 kilogram. As you increase your investment, you can invest in larger gold coins. The larger the coin, the better the liquidity.

Bars

Gold bars come in a variety of weights and styles, such as cast bars, minted bars, and ingots. Gold bars are popular because they are easily bought and sold, but there is some liquidity risk.

Paper

Paper gold provides an opportunity to invest in gold without the hassle of storing it. Gold certificates, for example, can be purchased from a bank or brokerage account. You can also purchase shares in a gold mining company, and these shares are backed by gold.

Bars

Gold bars can be a good option for long-term investors. They generally come in sizes ranging from 1 gram to 1 kilogram, and the prices per ounce can be higher than gold bullion coins. Smaller gold bars can be a good option for investors who want to add a small amount of gold to their investment portfolio.

Bullion Coins

Gold bullion coins are minted by private mints and government mints and come in different sizes. They can be a good choice for investors who want to add some variety to their investment portfolio. Investors who want higher purity coins can buy 24 karat gold coins, and they can increase the value of their investment portfolio.

Gold Bullion Bars and Gold Bullion Coins

Investors who want to add gold bullion to their investment portfolio should buy gold bullion bars and gold bullion coins. They can offer higher purity than gold coins and can be a good choice for investors who want to acquire gold bullion at a lower price than gold bars.

Mining Stocks

If you invest in gold mining stocks, then pure gold exposure is a given. These stocks, however, do carry other risks, most notably the cyclical nature of production.

Additionally, mining stocks are subject to high leverage, with debt used to fund projects. The volatility of the gold price means that miners often lose money when their gold price falls and must pay it all back with interest.

Gold ETFs

Gold ETFs are another common way to invest in gold. Investing in gold ETFs gives you direct exposure to gold bullion without the need for physical delivery of that bullion. Gold ETFs are baskets of gold stocks, so they offer exposure to every gold company in the world. The gold price is also generally lower for gold ETFs than for gold bullion.