Welcome to the heartland of education where the Missouri Teachers’ Pension System takes center stage. In this article, we delve into the intricacies of this esteemed pension system, unraveling its role in supporting the dedicated educators who shape the future of our great state.

We’ve dedicated hundreds of hours to researching the top precious metals investment companies, perfect for anyone looking to invest!

>> Click Here to See Our Top 5 Companies List <<

Understanding Missouri Teacher Pensions

Members contribute a percentage of their salary to the pension system, and employers also make contributions on behalf of their employees. The pension structure is a defined benefit (DB) formula, which calculates retirement benefits based on factors such as years of service and final average salary.

In addition to retirement benefits, the PSRS/PEERS also provides disability benefits to eligible educators. Withdrawal information, including webinars and resources, is available for those who may need to access their pension funds before retirement.

Calculating and Qualifying for Teacher Pensions in Missouri

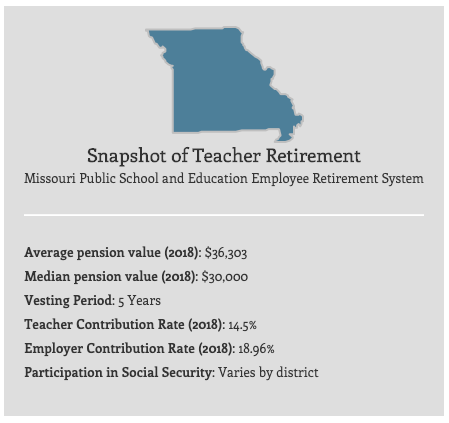

Calculating and qualifying for teacher pensions in Missouri is a crucial aspect of planning for retirement as a teacher. The Missouri Teachers’ Pension System, also known as the Public School & Education Employee Retirement Systems (PSRS/PEERS), offers lifetime retirement benefits to public school teachers and school employees. As a member of this system, understanding how your contributions and years of service factor into the pension formula is essential. Additionally, knowing how to designate beneficiaries and understanding the withdrawal options available to you is important. The PSRS/PEERS website provides comprehensive information, webinars, and resources to guide individuals through the process of navigating teacher pensions in Missouri.

Managing Finances and Taxes in Missouri Teacher Pensions

The Missouri Teachers’ Pension System provides retirement benefits to public school teachers and school employees. Managing your finances and taxes in relation to your Missouri teacher pension is crucial for securing your financial future. As a member of the system, it is important to understand beneficiary designation and ensure that your beneficiary information is up to date. The member section of the Education Employee Retirement Systems of Missouri website provides resources and information on retirement funds, withdrawals, and disability benefits. Consider seeking professional assistance for teacher pension analysis and tax planning.

Funding and Contributions for Missouri Teacher Pensions

Missouri Teachers’ Pension System

The Missouri Teachers’ Pension System is responsible for providing retirement benefits to teachers in the state of Missouri. The system is funded through various sources, including contributions from both teachers and the state government.

Funding and Contributions

| Source | Description |

|---|---|

| Teacher Contributions | Teachers in Missouri contribute a percentage of their salary towards their pension fund. |

| State Government Contributions | The state government of Missouri provides funding to support the pension system and ensure its sustainability. |

| Investment Returns | The pension system invests the funds in various financial instruments, such as stocks and bonds, to generate returns and increase the overall value of the pension fund. |

| Other Contributions | In addition to teacher and government contributions, the pension system may receive additional funding from other sources, such as donations or grants. |

Gold IRA: Should You Open One To Save For Retirement?