Your Options for a 403b Investment Plan

- The 403b retirement plan is a tax-deferred plan, which allows employees to save for retirement, while their employer can deduct the contributions. 403(b) plans are tax-deferred retirement plans offered by public schools and nonprofit hospitals to their employees.

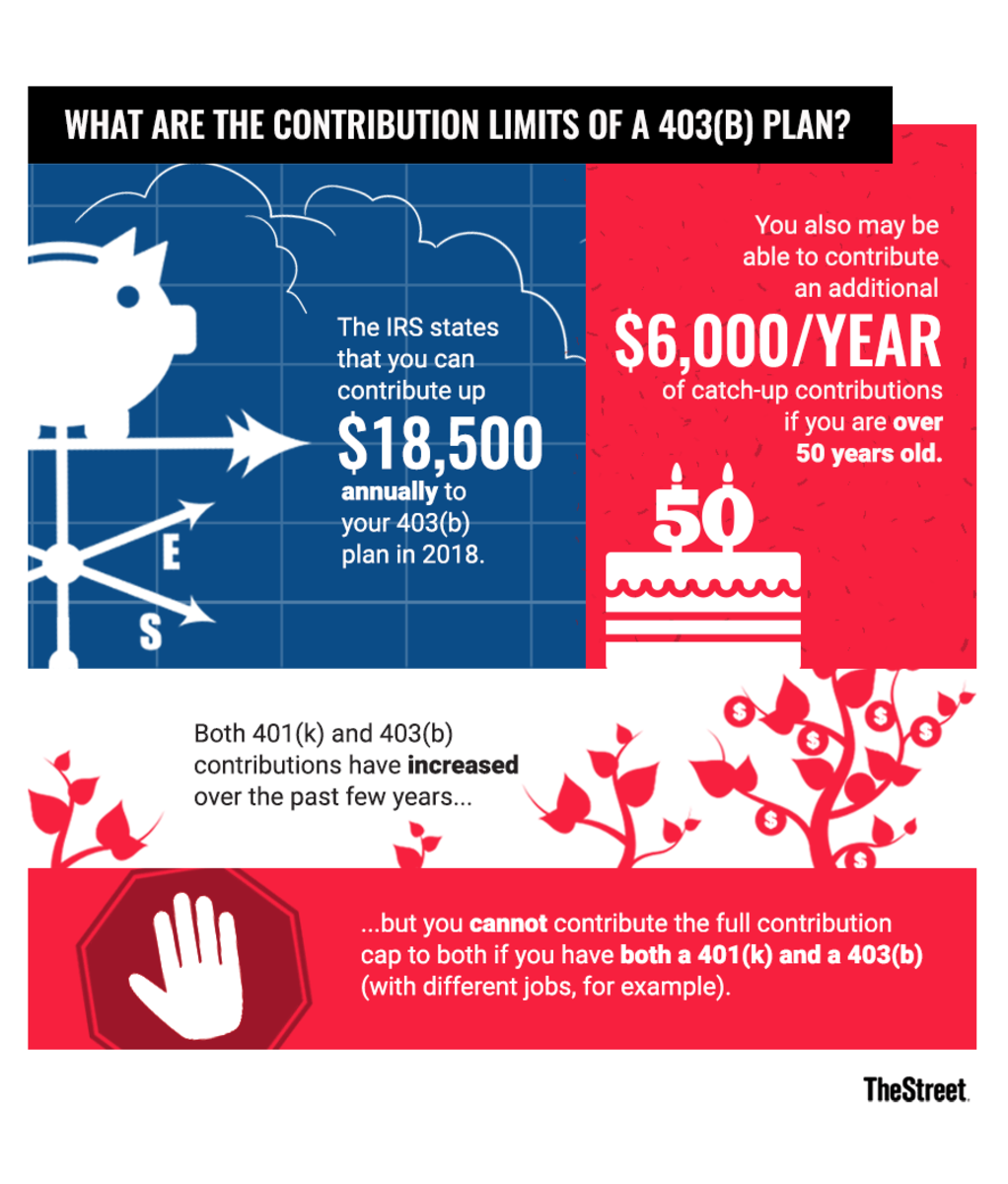

- Employees can allocate up to $19,000 of their pre-tax income toward their retirement, with a maximum of $6,000 of that amount from an employer's matching contribution.

An employer-sponsored retirement plan, such as a 403b plan, is offered by companies to their employees. These plans allow employees to set aside a portion of their earnings before taxes are taken out. The money grows tax-free until it is withdrawn. Some 403b plans also have brokerage arms that offer mutual funds.

What Is a 403b Investment Plan?

A 403b plan is a retirement plan for employees of public schools, tax-exempt hospitals, and tax-exempt charitable organizations. Many employees of public schools, tax-exempt hospitals, and tax-exempt charitable organizations are eligible to participate.

There are two types of 403b plans:

403b defined contribution plan - Participants, including employers, contribute pretax dollars to a 403b defined contribution plan. Employers typically match pretax dollars (similar to a 401k).

403b salary reduction plan - Employees contribute a portion of their salary (pretax or after tax) to a 403b salary reduction plan.

The basic concept is the same: You set aside money for retirement. But these plans have different benefits and tax implications.

Understanding a 403b Investment Plan

A 403b plan is a retirement plan offered by many public and private employers. These plans have certain advantages such as:

Tax-deferred growth: Contributions to a 403b plan are withheld from your paycheck prior to being taxed.

Tax-free withdrawals: Distributions from your 403b account are tax-free, and if you make withdrawals before age 591⁄2, you may be subject to an additional 10% federal tax.

Self-employed individuals without a retirement plan through their employer can also open their own 403b plan.

Types of Options in a 403b Investment Plan

The available 403b investment options vary widely from plan to plan. Most plans offer traditional mutual funds, such as Vanguard Group, TIAA-CREF or Fidelity, and target date funds. Target date funds effectively pick the right mix of investments for you by automatically adjusting your asset allocation as you progress toward retirement.

Many plans offer either real estate funds or real estate investment trusts (REITs). Real Estate Investment Trusts (REITs) are companies that own, operate or finance income-producing real estate such as apartments, office buildings, shopping centers or hotels.

Some plans offer other investment options, such as stocks, bonds, derivatives or exchange-traded funds (ETFs).

403b investment options can also include annuities and life insurance. Annuities are long-term contracts between you and an insurance company. Annuities can provide a steady stream of income, tax deferral and the potential for growth.

403b investment plans may also include life insurance, such as whole life insurance, universal life insurance or term life insurance.

Roth vs. Traditional

There are two main options when it comes to investing your 403b plan: a Roth 403b or a traditional 403b. A Roth 403b is a qualified, tax-advantaged account. Contributions are made with after-tax dollars, but qualified withdrawals come out tax-free.

Employer's Choice of Provider

If your employer offers this 403b investment plan, you are free to choose any of the providers in the plan. The choice is all yours.

This 403b investment plan is very popular with 403b participants because it allows them to choose from several providers.

One caveat: Employers may limit your choices to just a few 403b investment providers.

DC Plan

A DC plan is a 403b investment plan offered by your employer. Typically, DC plans are managed by a third-party investment firm, such as Fidelity or Vanguard.

A DC plan is managed by a custodian, such as Fidelity or Vanguard. A custodian is a third party that takes care of your investment accounts.

A custodian holds your investment, invests it according to your wishes, and pays you interest or dividends.

A 403b plan managed by a custodian is also known as a defined contribution plan.