US Money Reserve Fed Reviews World Dollar Reserve

Summary

- The US Money Reserve plays a crucial role in reviewing the status of the US dollar as the world's primary reserve currency.

- The rise of the US dollar as a global standard has been significant, with its stability and liquidity attracting central banks and investors worldwide.

- The de-dollarization trend is growing as countries reduce their reliance on the US dollar as a reserve currency.

- The prospects for the future of the US dollar as a reserve currency are positive in January and May 2022, uncertain in February, negative in March, and neutral in April.

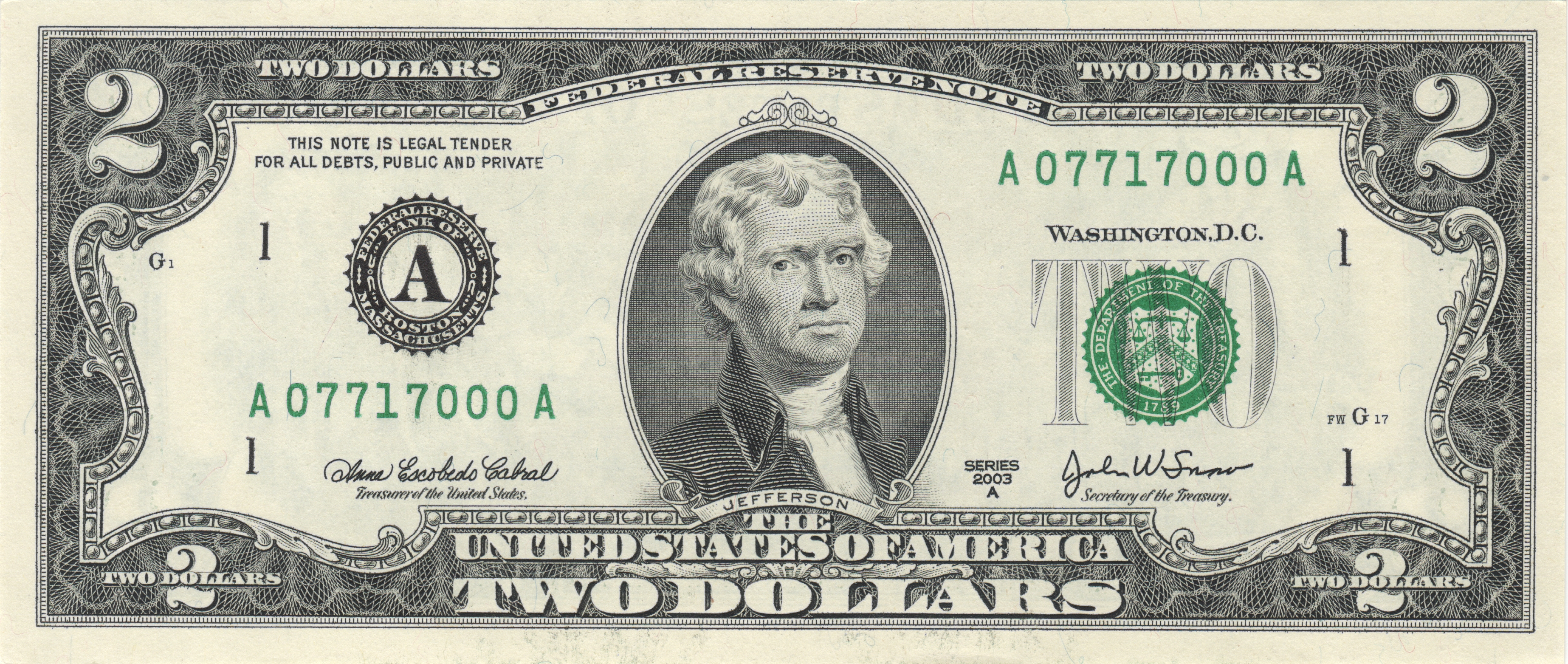

Welcome to the fascinating world of global finance, where the US Money Reserve takes center stage as it undergoes a thorough examination by the Federal Reserve regarding its role in the world dollar reserve. In this article, we delve into the intricate dynamics of this review, shedding light on the potential implications that may shape the future of the global economy.

Understanding Reserve Currencies

Reserve currencies play a crucial role in the global economy. The US dollar, in particular, holds the status of the world's primary reserve currency. Understanding reserve currencies is essential for investors and individuals alike. The US Money Reserve frequently reviews the status of the world dollar reserve and its impact on the economy. This review helps provide insights into the strength and stability of the US dollar as a reserve currency. By staying informed on these reviews, individuals can make informed decisions regarding their investments and financial planning.

Whether you're a seasoned investor or just starting, keeping an eye on the US Money Reserve's analysis can guide your financial decisions.

The Rise of the Dollar as a Global Standard

The rise of the US dollar as a global standard has been a significant development in the financial world. As the world's reserve currency, the dollar holds a dominant position in international trade and finance. This has been reinforced by the Federal Reserve's continued efforts to review and strengthen the dollar's status. The dollar's stability and liquidity have made it attractive to central banks and investors worldwide.

Its widespread use has also led to increased demand for US currency, further solidifying its global standing. As the US Money Reserve monitors these developments, it recognizes the importance of maintaining the dollar's status and ensuring its continued strength in the global economy.

The Phenomenon of De-Dollarization

The de-dollarization trend is growing as countries reduce reliance on the US dollar as a reserve currency. The US Money Reserve is reviewing the dollar's role as the global reserve currency due to the rise of alternative currencies and geopolitical tensions. Investors and individuals should stay informed and adapt to the changing global finance landscape.

Prospects for the Dollar's Future

| Date | Prospects | Analysis |

|---|---|---|

| January 2022 | Positive | The US dollar remains the world's dominant reserve currency, backed by a strong economy and stable political system. |

| February 2022 | Uncertain | Geopolitical tensions and global economic shifts pose potential threats to the dollar's status as a reserve currency. |

| March 2022 | Negative | Inflationary pressures, rising national debt, and potential loss of faith in the US government's ability to manage the economy could weaken the dollar's position. |

| April 2022 | Neutral | The dollar's future depends on various factors such as monetary policy decisions, global trade dynamics, and investor sentiment. |

| May 2022 | Positive | The US Federal Reserve's proactive measures to stabilize the economy and support growth have boosted confidence in the dollar. |

Gold IRA: Should You Open One To Save For Retirement?