World's Biggest Gold Reserves by Country

Unveiling the Global Powerhouses: Countries with the Most Astonishing Gold Reserves

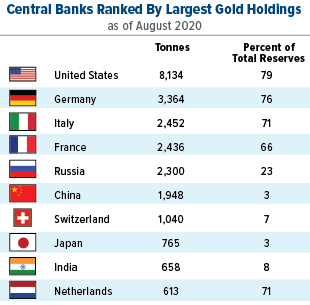

Gold Reserves Around the World

World's Biggest Gold Reserves by Country

| Country | Gold Reserves (in metric tons) |

|---|---|

| United States | 8,133.5 |

| Germany | 3,363.6 |

| Italy | 2,451.8 |

| France | 2,436.0 |

| Russia | 2,299.9 |

| China | 1,948.3 |

| Switzerland | 1,040.0 |

| Japan | 765.2 |

| India | 657.7 |

| Netherlands | 612.5 |

The World's Biggest Gold Stockpile

The world's biggest gold stockpile is held by the United States, with its reserves exceeding all other countries. These reserves are primarily held by the U.S. government and the Federal Reserve banks. The stockpile serves as a hedge against economic uncertainties and a guarantee for the value of the U.S. currency. Other countries, such as Italy, France, and Germany, also hold significant gold reserves. These reserves are often seen as a safe haven asset in times of war, economic crisis, or pandemics like COVID-19. The World Gold Council estimates that central banks and governments hold around five tonnes of gold, making it a sought-after commodity asset. The demand for gold remains a key driver in the global gold market.

Key takeaways:

- The United States holds the world's biggest gold stockpile.

- Other countries, such as Italy and France, also hold significant gold reserves.

- Gold serves as a hedge against economic uncertainties and a guarantee for currency value.

- Central banks and governments hold around five tonnes of gold.

- The demand for gold remains a key driver in the global gold market.

Gold Reserves of Major Nations

World's Biggest Gold Reserves by Country

| Rank | Country | Gold Reserves (in metric tonnes) |

|---|---|---|

| 1 | United States | 8,133.5 |

| 2 | Germany | 3,384.2 |

| 3 | Italy | 2,451.8 |

| 4 | France | 2,436.2 |

| 5 | China | 1,948.3 |

| 6 | Russia | 1,889.8 |

| 7 | Switzerland | 1,040.0 |

| 8 | Japan | 836.2 |

| 9 | Netherlands | 612.5 |

| 10 | India | 625.2 |

Significance of Gold Reserves in Times of War and Crisis

During times of war and crisis, gold reserves play a crucial role in stabilizing economies and providing a safe haven for governments. These reserves, held by central banks, act as a financial buffer and provide a tangible asset that can be used to back a nation's currency.

Gold is considered a reliable store of value, making it highly sought after during uncertain times. Its value is not easily influenced by market fluctuations or geopolitical events, making it a reliable asset for governments to rely on.

Countries with substantial gold holdings are better equipped to navigate through economic turmoil and maintain stability. Gold reserves can be used to bolster confidence in a nation's currency, protect against inflation, and provide a source of liquidity during times of crisis.

According to the World Gold Council, the countries with the largest gold reserves include the United States, Germany, Italy, France, and Russia. These nations hold significant amounts of gold to safeguard their economies against potential risks.

In recent years, the COVID-19 pandemic has further highlighted the importance of gold reserves. Central banks across the globe have increased their gold purchases, recognizing its value as a safe haven asset in times of uncertainty.

International Monetary Fund and Officially Reported Gold Holdings

The International Monetary Fund (IMF) maintains a record of officially reported gold holdings by countries around the world. These holdings are a reflection of the gold reserves held by a country's central bank or government. The data is publicly available and can be accessed on the IMF's website or through sources like Wikipedia or encyclopedia entries. Changes in these reported holdings can provide insights into a country's economic policies or financial stability. It is important to note that not all countries report their gold holdings to the IMF, so the data may not capture the full picture. However, it still offers valuable information for investors, note holders, and buyers in the gold market.

Gold IRA: Should You Open One To Save For Retirement?