NJ Teacher Benefits & Retirement

Exploring the Path to Secure Futures: Unveiling the Alluring World of New Jersey Teacher Benefits & Retirement

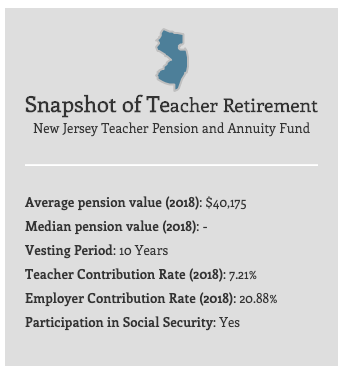

Understanding Teacher Pensions in New Jersey

In New Jersey, teacher pensions are an important part of the benefits and retirement package for educators. The state's Teacher Pension and Annuity Fund (TPAF) provides retirement benefits for teachers and other education professionals. As an employee, understanding how the pension system works can help you plan for your future.

One key aspect of teacher pensions in New Jersey is that they are based on a defined benefit system. This means that your pension is calculated based on a formula that takes into account factors such as your years of service and your final average salary. The TPAF offers a range of retirement options to meet your individual needs and goals.

It's also important to be aware of the health benefits available to retirees. The state offers a variety of health insurance plans for retired teachers, allowing you to maintain coverage and access to healthcare services.

To learn more about teacher pensions in New Jersey, you can visit the NJEA website or speak with a representative from the NJEA Go program. They can provide information and resources to help you navigate the pension system and make informed decisions about your retirement.

Retirement Options for New Jersey Teachers

NJ Teacher Benefits & Retirement

| Retirement Option | Description |

|---|---|

| Defined Benefit Pension Plan | A traditional pension plan where teachers receive a fixed monthly benefit based on their years of service and final average salary. |

| Defined Contribution Plan | A retirement savings plan where teachers contribute a portion of their salary, and the employer may also contribute. The eventual retirement benefit depends on the investment performance of the individual account. |

| Deferred Compensation Plan | A supplemental retirement savings plan where teachers can contribute a portion of their salary on a pre-tax basis. The contributions grow tax-deferred until retirement. |

| Social Security | Teachers in New Jersey are covered by Social Security, which provides additional retirement income based on their earned credits. |

| Healthcare Benefits | New Jersey teachers may be eligible for various healthcare benefits, including medical, dental, and vision coverage, both during their employment and in retirement. |

| Retirement Counseling Services | Teachers can access retirement counseling services provided by the New Jersey Division of Pensions and Benefits to help them navigate their retirement options and plan for a financially secure future. |

Navigating New Jersey's Pension and Benefits System

Navigating New Jersey's Pension and Benefits System can be overwhelming, but understanding the ins and outs of the system is crucial for NJ teachers. As an employee or retiree, it's important to stay informed about the various benefits and resources available to you. Take advantage of the NJEA Go platform, which provides access to health benefits, teaching certification, and career development opportunities. Stay connected with the local education community through events like the ConventionPremier and webinars.

Keep an eye out for legislative updates and news regarding retirement systems and benefit programs.

The Impact of Teacher Benefits on New Jersey's Finances

The Impact of Teacher Benefits on New Jersey's Finances

| Year | Total Teacher Benefits Cost (in millions) | State Contribution (in millions) | Local Contribution (in millions) |

|---|---|---|---|

| 2015 | 2,500 | 1,200 | 1,300 |

| 2016 | 2,600 | 1,300 | 1,300 |

| 2017 | 2,700 | 1,400 | 1,300 |

| 2018 | 2,800 | 1,500 | 1,300 |

| 2019 | 2,900 | 1,600 | 1,300 |

Gold IRA: Should You Open One To Save For Retirement?