Simple IRA Investment Guide for Small Business Retirement

Summary

- When selecting a SIMPLE IRA plan provider, consider their experience, reputation, investment options, fees, and customer support.

- A SIMPLE IRA is a retirement plan for small businesses that allows tax-deductible contributions and tax-free growth until retirement.

- To establish a SIMPLE IRA plan, choose a custodian bank, determine the contribution formula, and start investing.

- Employee participation, maintaining compliance, and understanding contribution limits and withdrawal guidelines are crucial for the success of a SIMPLE IRA plan.

Welcome to our comprehensive guide on Simple IRA investments for small business retirement. Whether you're a business owner or an employee, this article will provide you with valuable insights and tips to navigate the world of Simple IRA investments and secure a brighter financial future.

Selecting a SIMPLE IRA Plan Provider

When selecting a SIMPLE IRA plan provider for your small business retirement, there are a few key factors to consider. First, evaluate the provider's experience and reputation in the industry. Look for a provider that offers a range of investment options, such as mutual funds, exchange-traded funds, and annuities, to meet your employees' needs. Consider the provider's fee structure and expense ratios to ensure they align with your budget and investment goals. Additionally, make sure the provider offers a user-friendly platform and provides reliable customer support. Finally, consult with a financial advisor or tax professional to ensure the provider meets all legal requirements and regulations set by the Internal Revenue Service.

Understanding SIMPLE IRA Mechanics

A SIMPLE IRA is a retirement plan for small businesses that allows both employers and employees to contribute to an individual retirement account. Contributions are tax-deductible and grow tax-free until retirement, but early withdrawals are subject to taxes and penalties.

Establishing Your SIMPLE IRA Plan

To establish a SIMPLE IRA plan, choose a custodian bank or financial institution, determine the contribution formula, and start investing in various options. Regularly review and adjust your plan as needed.

Completing a Written Agreement

To complete a written agreement for your Simple IRA investment, review the terms, seek legal advice if necessary, fill in the required information, sign and date the document, and keep copies for your records.

Providing Annual Notices to Employees

Annual notices play a crucial role in keeping employees informed about their Simple IRA investment options. These notices provide important information about contribution limits, investment options, and employer matching contributions. It is essential for employers to distribute these notices in a timely manner to ensure employees have enough time to make informed decisions about their retirement savings. By providing clear and concise annual notices, employers can help their employees navigate the complexities of retirement planning and make the most of their Simple IRA investment.

Timing Considerations for Plan Setup

When setting up a Simple IRA for your small business retirement plan, it's important to consider factors such as the ideal start date, choosing a reputable custodian bank or financial institution, determining your asset allocation strategy, understanding any fees or expenses, and ensuring you have all necessary documentation in place.

Employee Participation in the Plan

Employee participation in the Simple IRA plan is crucial for the success of your small business retirement strategy. To encourage participation, provide educational resources, offer incentives, and ensure access to a variety of investment options. Regularly communicate with employees and provide support to help them make informed decisions.

Maintaining and Operating the Plan

Properly maintaining and operating a Simple IRA plan is crucial for small business retirement. This involves ensuring compliance with IRS regulations, regularly reviewing and updating plan documents, monitoring assets and investment performance, and partnering with a reputable provider. Stay informed on trust law and IRS guidelines, communicate with employees, and help secure their future retirement.

Contribution Guidelines and Limits

| Contribution Type | Contribution Limit | Additional Catch-Up Contribution (Age 50+) |

|---|---|---|

| Employee Salary Deferral Contribution | $13,500 (2021) | $3,000 (2021) |

| Employer Matching Contribution | 3% of employee's compensation or 2% non-elective contribution | N/A |

| Total Contributions (Employee + Employer) | $58,000 (2021) | N/A |

Opting Out of Employee Contributions

Not requiring employee contributions to a retirement plan can give business owners more control and save on administrative costs. However, it may also impact employee participation and morale. Consulting with a financial advisor is important to consider all factors and explore alternative options.

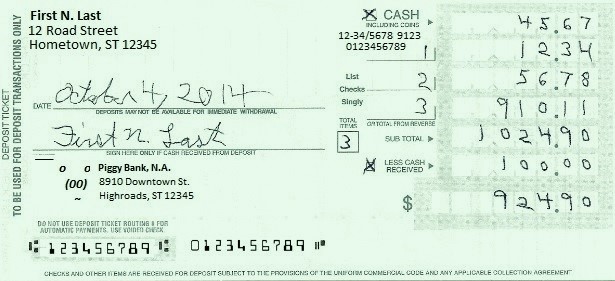

Depository Requirements for Contributions

| Depository Requirements for Contributions | ||

|---|---|---|

| Contribution Type | Minimum Deposit | Frequency |

| Employee Salary Deferral | $0.00 | Deducted from paycheck |

| Matching Contributions | Varies | Typically deposited per pay period |

| Profit Sharing Contributions | Varies | Deposited annually or as specified |

| Non-Elective Contributions | Varies | Deposited annually or as specified |

| Roll-over Contributions | Varies | Deposited as per rollover instructions |

Deadline for Contribution Deposits

The deadline for contribution deposits to a Simple IRA is an important date to remember for small business retirement planning. It is crucial to meet this deadline to avoid penalties and maintain compliance with retirement plan regulations.

Ownership of Plan Contributions

When it comes to the ownership of plan contributions in a Simple IRA, it's important to understand the rules and regulations. In a Simple IRA, contributions are made by both the employer and the employee. The employer's contributions are immediately vested, meaning they belong to the employee right away.

Information Required for Employees

Employees looking to invest in a Simple IRA for their small business retirement should have information about their employment status, income, and cost of living. They should also be aware of different investment options and understand fees, taxes, and trust law. Consulting with a financial advisor or doing research is recommended.

Fundamental Withdrawal Guidelines

When it comes to withdrawing funds from your Simple IRA, understanding the fundamental guidelines is crucial. The first step is to determine if you meet the eligibility requirements for withdrawal, such as reaching the age of 59 ½ or experiencing a qualifying event. Next, you'll need to decide on the withdrawal method that best suits your needs, whether that's a lump sum, periodic payments, or annuities. Keep in mind that early withdrawals may result in penalties and taxes, so it's important to consult with a financial advisor or tax professional. Additionally, be aware of any restrictions or limitations that may apply to your specific situation.

Understanding Rollover Options

When it comes to managing your Simple IRA investment for small business retirement, understanding rollover options is crucial. Rollover refers to the process of transferring funds from one retirement account to another without incurring taxes or penalties. This allows you to take control of your retirement savings and make strategic investment decisions. Whether you're considering a traditional IRA, a 529 plan, or a mutual fund, knowing your rollover options can help you maximize your returns and minimize unnecessary fees.

Clarifying Participant Loan Restrictions

Participant loans in a Simple IRA are subject to restrictions. The maximum loan amount is $50,000 or 50% of the participant's vested account balance, whichever is less. Loans must be repaid within 5 years, unless used to buy a primary residence. Not all employers offer participant loans, so it's important to check with your employer and plan documents. Consult a financial advisor or tax professional for personalized advice. The IRS website and plan trustee can provide more information.

Compliance, Notices, and Filing Obligations

Complying with the various regulations and filing obligations is crucial when managing a Simple IRA for your small business retirement plan. The Internal Revenue Service (IRS) sets the guidelines for these obligations, which include providing notices to employees, submitting necessary forms, and ensuring compliance with contribution limits. Failure to comply can result in penalties and potential legal issues. It is essential to stay updated on IRS regulations and deadlines to avoid any complications. Consider seeking guidance from a financial advisor or retirement plan specialist to ensure you meet all compliance requirements. Keeping accurate records and documentation is also important to demonstrate your adherence to the rules.

Gold IRA: Should You Open One To Save For Retirement?