Top 10 Countries Gold Reserves Ranking 2023-2024

Summary

- The top 10 countries with the largest gold reserves in 2023-2024 are the United States, Germany, Italy, France, China, Russia, Switzerland, Japan, Turkey, and the Netherlands.

- Gold reserves play a crucial role in a country's economic stability and security, serving as a hedge against inflation and economic uncertainty.

- Central banks hold gold reserves to maintain confidence in their own currency and to support the exchange rate system.

- Countries like China, India, and Turkey are increasing their gold reserves, signaling their focus on financial stability and the importance of gold as a strategic asset.

Unveiling the Global Powerhouses: A Glimpse into the World's Gold Reserves Landscape

Understanding Gold Reserves

The top 10 countries with the largest gold reserves in 2023-2024 are the United States, Germany, Italy, France, China, Russia, Switzerland, Japan, Turkey, and the Netherlands. These countries hold significant amounts of gold to diversify their portfolios and mitigate credit risk.

Gold reserves are often seen as a safe haven asset due to their stability and the perception of gold as a hard currency. They can help stabilize a country's exchange rate and provide confidence in its currency.

Understanding the gold reserves of these countries can provide insights into global economic trends and the overall landscape of the financial market.

The Importance of Gold Reserves

Gold reserves play a crucial role in a country's economic stability and security. As a store of value, gold provides a hedge against inflation and economic uncertainty. It also acts as a diversification tool, reducing the risk associated with a country's currency or other assets.

Central banks hold gold reserves to maintain confidence in their own currency and to support the exchange rate system. Gold reserves are considered a hard currency, providing liquidity during times of crisis.

Countries with large gold reserves, such as the United States, Germany, and Russia, have a stronger position in the global economy. These reserves enhance their creditworthiness and serve as a valuable asset for their national portfolios.

In the ranking of top gold reserves, countries like China, India, and Turkey are increasing their holdings, signaling their focus on financial stability and the importance of gold as a strategic asset.

Source: World Gold Council, Forbes.

The Top Gold-Holding Nations

| Rank | Country | Gold Reserves (in metric tons) |

|---|---|---|

| 1 | United States | 8,133.5 |

| 2 | Germany | 3,366.8 |

| 3 | Italy | 2,451.8 |

| 4 | France | 2,436.1 |

| 5 | Russia | 2,299.9 |

| 6 | China | 1,948.3 |

| 7 | Switzerland | 1,040.0 |

| 8 | Japan | 848.2 |

| 9 | India | 695.4 |

| 10 | Netherlands | 612.5 |

Assessing Gold Reserve Trends

Assessing Gold Reserve Trends is crucial for understanding the financial landscape of top countries. Gold reserves serve as a store of value and a hedge against economic uncertainty. Countries like Saudi Arabia, Kazakhstan, and Uzbekistan have been diversifying their portfolios by increasing their gold reserves. This move is aimed at reducing credit risk and maintaining stability in the face of changing economic conditions. Central banks, including those of Portugal and Lebanon, have been actively accumulating gold as a means of protecting their currencies.

With the world witnessing fluctuations in the value of paper money, gold remains a reliable asset. The World Gold Council and Forbes provide valuable insights into the gold reserve rankings of different countries.

Gold Reserves: Actual Values and Statistics

Gold reserves play a crucial role in the global economy, and understanding the actual values and statistics is essential for investors and policymakers alike. In the ranking for the top 10 countries' gold reserves in 2023-2024, several factors come into play. Diversification is a key strategy for central banks, as gold provides stability in times of economic uncertainty. Countries like Lebanon, Portugal, Saudi Arabia, Spain, Kazakhstan, United Kingdom, Poland, Uzbekistan, and Taiwan have consistently maintained significant gold reserves in their portfolios. The correlation between gold reserves and a country's stability is undeniable, as it serves as a hedge against inflation and currency fluctuations.

With each tonne of gold representing a store of value, these reserves continue to shape global financial systems.

Analyzing Gold Reserve Data

When looking at the ranking of countries' gold reserves in 2023-2024, several key factors come into play. Diversification in finance plays a crucial role as countries aim to balance their portfolios and reduce risks. Gold, being a tangible asset, provides stability and serves as a hedge against inflation and currency fluctuations. Central banks, responsible for managing a country's money supply, often hold gold as a reserve asset. This is particularly important in a fixed exchange rate system or when pegging a currency to the United States dollar.

Gold reserves also provide confidence to investors and act as a store of value. Countries like Spain, the United Kingdom, Poland, and Taiwan have been actively increasing their gold reserves in recent years, reflecting the correlation between gold holdings and economic stability. As gold is measured in tonnes, it is essential to consider the quantity of gold held by each country to accurately rank their reserves.

Reserve Frequencies and Reporting Standards

Reserve frequencies and reporting standards play a crucial role in determining a country's gold reserves ranking. These factors ensure transparency and consistency in reporting the actual amount of gold held by central banks. Adhering to these standards helps to maintain the trust and credibility of the financial markets. Countries with a high gold reserve ranking often prioritize diversification in their portfolios to hedge against currency fluctuations and economic uncertainties. Gold reserves serve as a store of value and can act as a stabilizing factor in times of financial crisis.

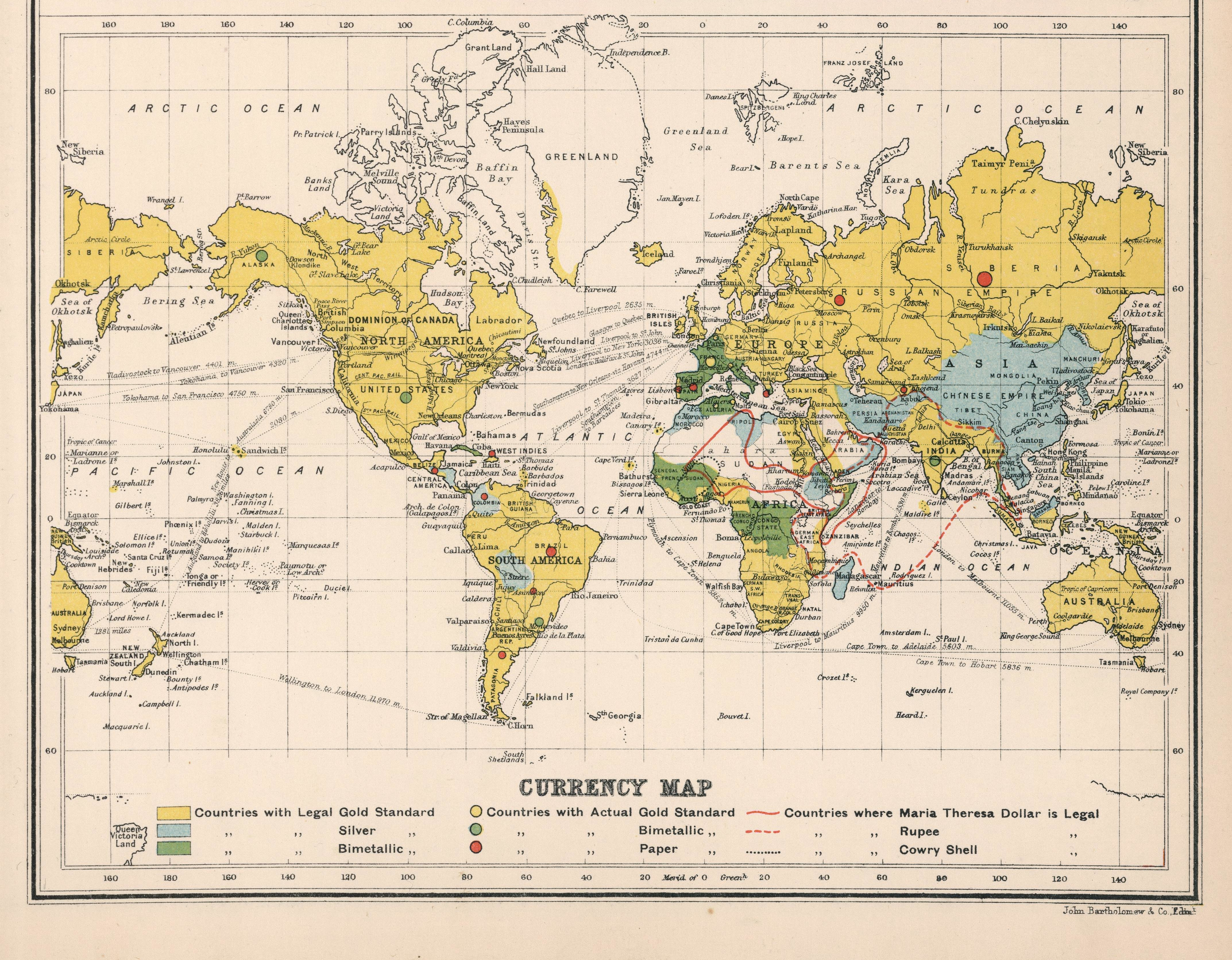

As the world moves away from the gold standard and the fixed exchange rate system, gold reserves continue to play a significant role in global finance.

Current and Historical Gold Reserve Figures

| Rank | Country | Current Gold Reserves (in metric tons) | Historical Gold Reserves (in metric tons) |

|---|---|---|---|

| 1 | United States | 8,133.5 | 8,133.5 |

| 2 | Germany | 3,363.6 | 3,363.6 |

| 3 | Italy | 2,451.8 | 2,451.8 |

| 4 | France | 2,436.0 | 2,436.0 |

| 5 | Russia | 2,299.9 | 2,299.9 |

| 6 | China | 1,948.3 | 1,948.3 |

| 7 | Switzerland | 1,040.0 | 1,040.0 |

| 8 | Japan | 765.2 | 765.2 |

| 9 | India | 687.8 | 687.8 |

| 10 | Netherlands | 612.5 | 612.5 |

Gold Reserve Records and Extremes

The ranking of countries' gold reserves for 2023-2024 reveals interesting trends and extremes in global holdings. Central banks continue to prioritize gold as a safe haven asset, diversifying their portfolio to protect against market volatility. The United States retains its top position, with a substantial gold reserve backing the dollar. Other leading countries, such as Germany and Italy, maintain significant holdings as well.

Exploring Gold Reserve Consensus Figures

When exploring the gold reserve consensus figures for the top 10 countries, it is important to consider their ranking for 2023-2024. These figures reveal the countries with the largest gold reserves, providing valuable insights for investors and economists. Gold reserves play a crucial role in diversifying a country's portfolio, serving as a hedge against inflation and currency fluctuations. Central banks hold significant amounts of gold as a store of value and to support their currency. The United States dollar's status as a global reserve currency and the gold standard's historical significance also influence these figures. Understanding the gold reserves of different countries can provide valuable insights into their economic strength and stability.

Forecasting Gold Reserve Trends

In the next few years, the ranking of countries with the largest gold reserves is expected to experience some changes. Forecasting these trends is crucial for investors and economists alike. While the United States is likely to maintain its position as the country with the highest gold reserves, other nations such as China and Russia are expected to continue increasing their holdings. This diversification of gold reserves reflects a desire for stability and a hedge against economic uncertainties. Central banks play a significant role in these rankings as they actively manage and accumulate gold to bolster their portfolio. As we approach 2023-2024, it will be interesting to see how countries adapt their banknote and gold reserve strategies to maintain financial security.

Gold Holdings by Country

| Rank | Country | Gold Holdings (in metric tons) |

|---|---|---|

| 1 | United States | 8,133.5 |

| 2 | Germany | 3,363.6 |

| 3 | Italy | 2,451.8 |

| 4 | France | 2,436.1 |

| 5 | Russia | 2,299.9 |

| 6 | China | 1,948.3 |

| 7 | Switzerland | 1,040.0 |

| 8 | Japan | 765.2 |

| 9 | India | 687.8 |

| 10 | Netherlands | 612.5 |

Economic Implications of Gold Reserves

The economic implications of gold reserves are significant for countries with large holdings. Gold reserves serve as a hedge against economic uncertainties and fluctuations in currency values. They provide stability and confidence to investors, especially during times of financial crisis. Central banks often hold gold reserves as a means of diversifying their portfolios and ensuring the stability of their currencies. Gold also plays a role in international trade, as it is used as a store of value and a medium of exchange. Additionally, countries with substantial gold reserves have the potential to influence global financial markets.

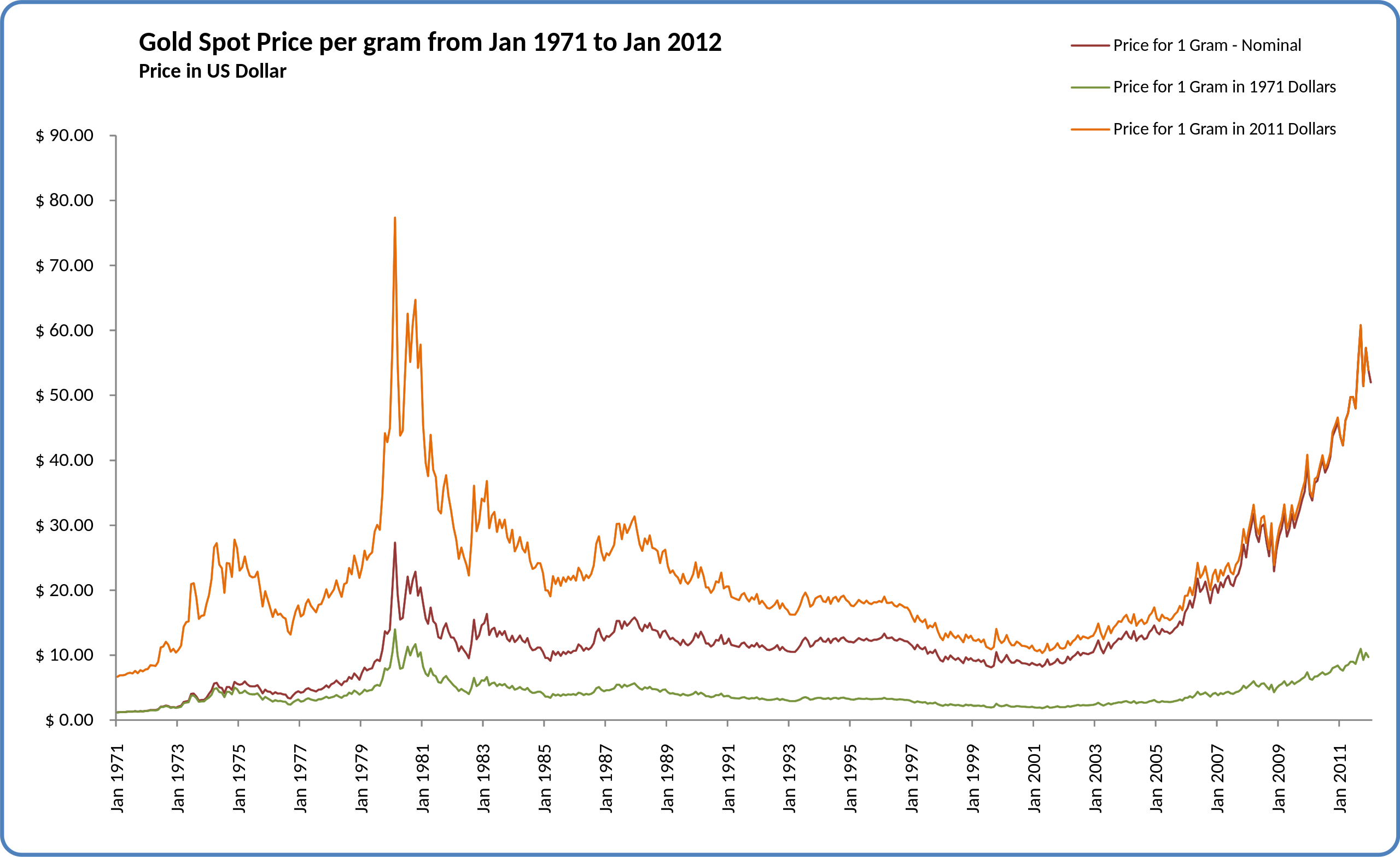

Reserve Currency Impacts on Gold

The status of a currency as a reserve currency can have a significant impact on the price of gold. When a currency is widely recognized and accepted as a reserve currency, central banks and investors tend to hold more of that currency in their reserves. This increased demand for the currency can lead to a decrease in the price of gold, as investors allocate their funds towards the reserve currency instead. On the other hand, when a currency loses its status as a reserve currency, there is often an increase in demand for gold as a safe haven asset. This can drive up the price of gold as investors seek to diversify their portfolios.

Gold Reserves and National Security

Gold reserves play a crucial role in a country's national security. They provide stability and confidence in times of economic uncertainty. The top 10 countries with the highest gold reserves in 2023-2024 are a testament to their commitment to safeguarding their economy. These countries understand the importance of diversification and have strategically allocated their resources to gold. Central banks hold gold reserves as a store of value, and it serves as a hedge against inflation and currency fluctuations.

Gold is not just a shiny metal; it is a vital asset that strengthens a nation's financial portfolio. With each tonne of gold, these countries are securing their future and ensuring stability for their citizens.

Historical Gold Reserve Movements

| Rank | Country | Gold Reserve (2023) | Gold Reserve (2024) | Movement |

|---|---|---|---|---|

| 1 | United States | 8,134.0 tonnes | 8,134.0 tonnes | No Change |

| 2 | Germany | 3,362.4 tonnes | 3,362.4 tonnes | No Change |

| 3 | Italy | 2,451.8 tonnes | 2,451.8 tonnes | No Change |

| 4 | France | 2,436.0 tonnes | 2,436.0 tonnes | No Change |

| 5 | Russia | 2,299.9 tonnes | 2,299.9 tonnes | No Change |

| 6 | China | 1,948.3 tonnes | 1,948.3 tonnes | No Change |

| 7 | Switzerland | 1,040.0 tonnes | 1,040.0 tonnes | No Change |

| 8 | Japan | 765.2 tonnes | 765.2 tonnes | No Change |

| 9 | India | 663.5 tonnes | 663.5 tonnes | No Change |

| 10 | Netherlands | 612.5 tonnes | 612.5 tonnes | No Change |

Gold Reserve Updates and Revisions

As the global economic landscape evolves, countries are constantly reassessing their gold reserves. The ranking of the top 10 countries' gold reserves for 2023-2024 has witnessed significant updates and revisions. Central banks are actively diversifying their portfolios, recognizing the importance of gold as a safe-haven asset. These revisions reflect a strategic move to protect against market uncertainties and inflation risks. Gold reserves play a crucial role in stabilizing economies and providing confidence in a country's currency.

As investors and economists closely monitor these updates, it is clear that gold continues to hold its value and relevance in the ever-changing financial world.

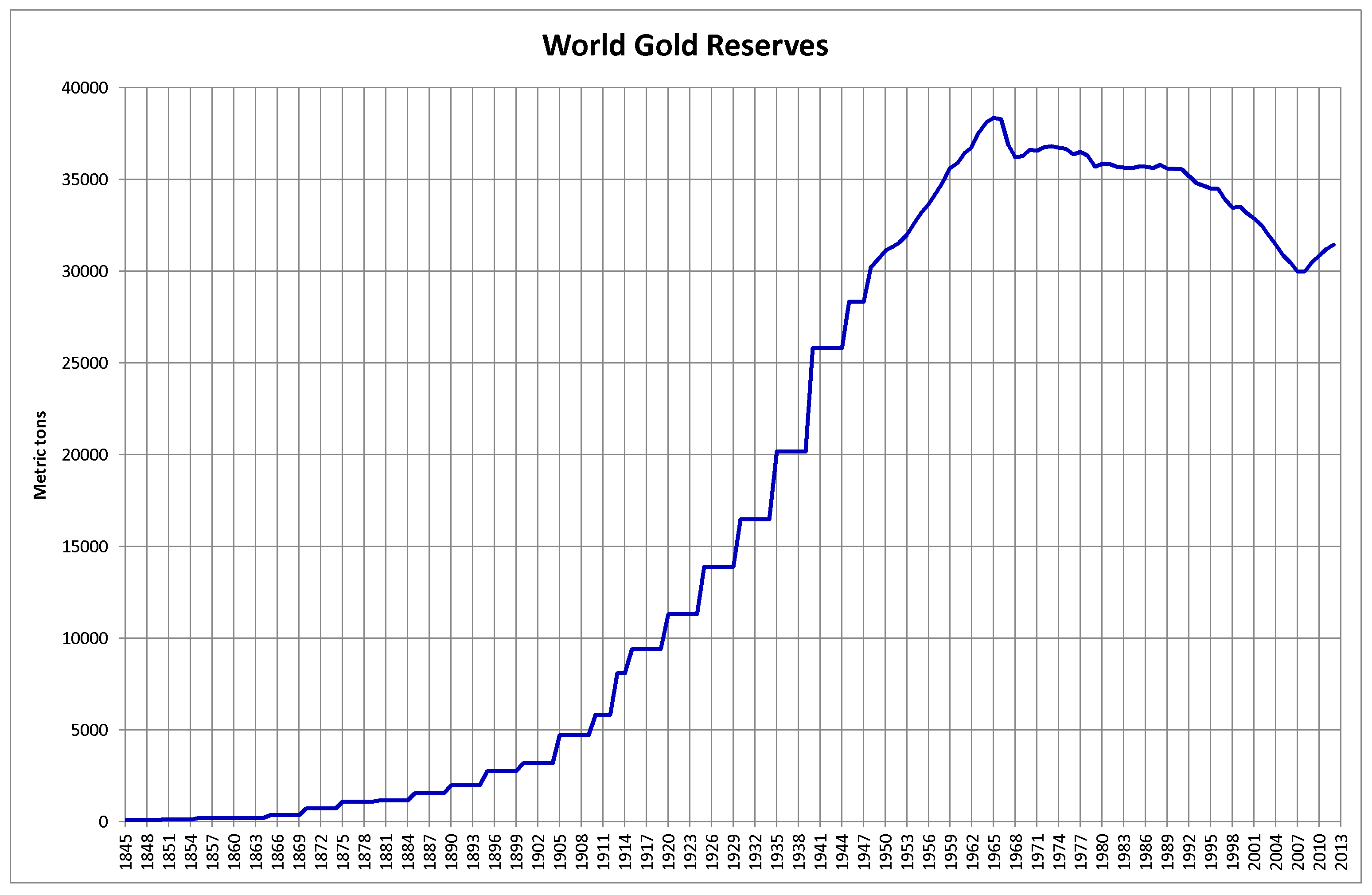

Links to Gold Reserve Historical Charts

Links to Gold Reserve Historical Charts are essential for investors and individuals interested in tracking the gold reserves of different countries. These charts provide valuable insights into the historical trends and fluctuations in gold reserves, allowing users to analyze and compare the performance of various countries over time. By studying these charts, investors can make informed decisions about diversifying their portfolios and understanding the strategies adopted by central banks. Additionally, these charts can help individuals understand the role of gold in finance, including its significance as a tangible asset and a store of value. Accessing these charts is crucial for anyone interested in following the global gold market and its impact on the economy.

Gold IRA: Should You Open One To Save For Retirement?