Top 20 Gold Reserve Countries 2023

Summary

- National gold reserves serve as a store of value and a hedge against economic uncertainty.

- Gold reserves help diversify central bank portfolios and reduce exposure to credit risk.

- Gold can serve as international currency and support a country's exchange rate.

- The top holders of gold reserves in 2023 include the United States, Germany, Italy, France, Russia, China, and Switzerland.

Unveiling the Powerhouses: Unveiling the Gold Reserve Giants of 2023

Purpose of National Gold Reserves

The purpose of national gold reserves is to provide a store of value and a hedge against economic uncertainty. Gold is considered a safe haven asset, particularly in times of financial crisis or inflation. Central banks hold gold reserves to diversify their portfolios and reduce their exposure to credit risk. Gold can also serve as a form of international currency, as it is widely recognized and accepted.

Additionally, gold reserves can help support a country's exchange rate and maintain confidence in its currency. Many countries, including the United States, Germany, and China, hold significant gold reserves to safeguard their economies and provide stability in the global financial landscape.

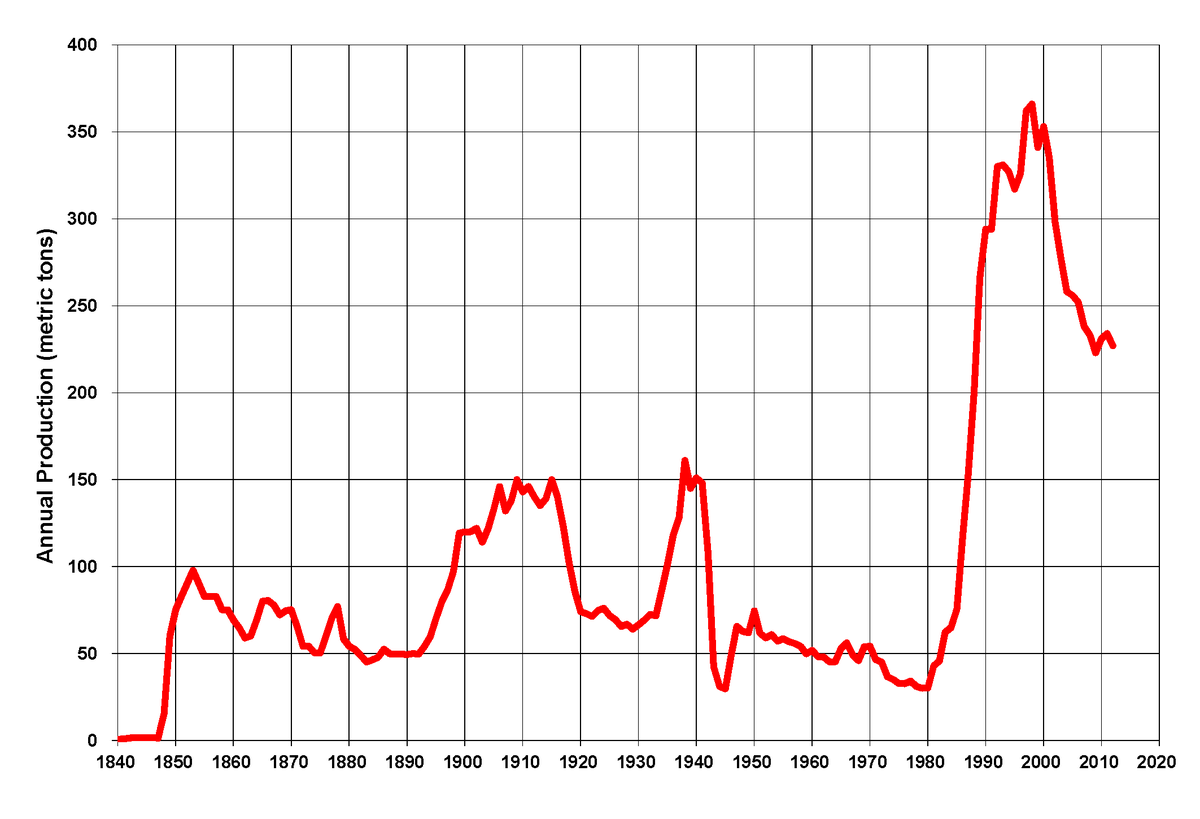

Gold Reserves: Historical Data and Trends

| Rank | Country | Gold Reserves (in metric tons) |

|---|---|---|

| 1 | United States | 8,133.5 |

| 2 | Germany | 3,364.2 |

| 3 | Italy | 2,451.8 |

| 4 | France | 2,436.1 |

| 5 | Russia | 2,299.9 |

| 6 | China | 1,948.3 |

| 7 | Switzerland | 1,040.0 |

| 8 | Japan | 765.2 |

| 9 | Netherlands | 612.5 |

| 10 | India | 614.6 |

| 11 | Turkey | 582.0 |

| 12 | Kazakhstan | 361.9 |

| 13 | Uzbekistan | 341.1 |

| 14 | Saudi Arabia | 322.9 |

| 15 | United Kingdom | 310.3 |

| 16 | Lebanon | 286.8 |

| 17 | Spain | 281.6 |

| 18 | Austria | 280.0 |

| 19 | Belgium | 227.4 |

| 20 | South Korea | 104.4 |

International Monetary Fund and Official Gold Records

The International Monetary Fund (IMF) and official gold records play a crucial role in determining the top 20 gold reserve countries in 2023. These records measure the amount of gold held by central banks and are an indicator of a country's financial stability and economic power. Gold is considered a hard currency and a store of value, making it an attractive asset for diversification and risk management. Countries like the United States, Lebanon, Portugal, India, Saudi Arabia, Spain, Kazakhstan, United Kingdom, Poland, Uzbekistan, Taiwan, Switzerland, Netherlands, France, Japan, Turkey, Russia, and Italy are among the top holders of gold reserves. These countries recognize the importance of gold as a stable and reliable form of money in an uncertain global economic landscape.

Gold IRA: Should You Open One To Save For Retirement?