What's My AJPM Gold Price?

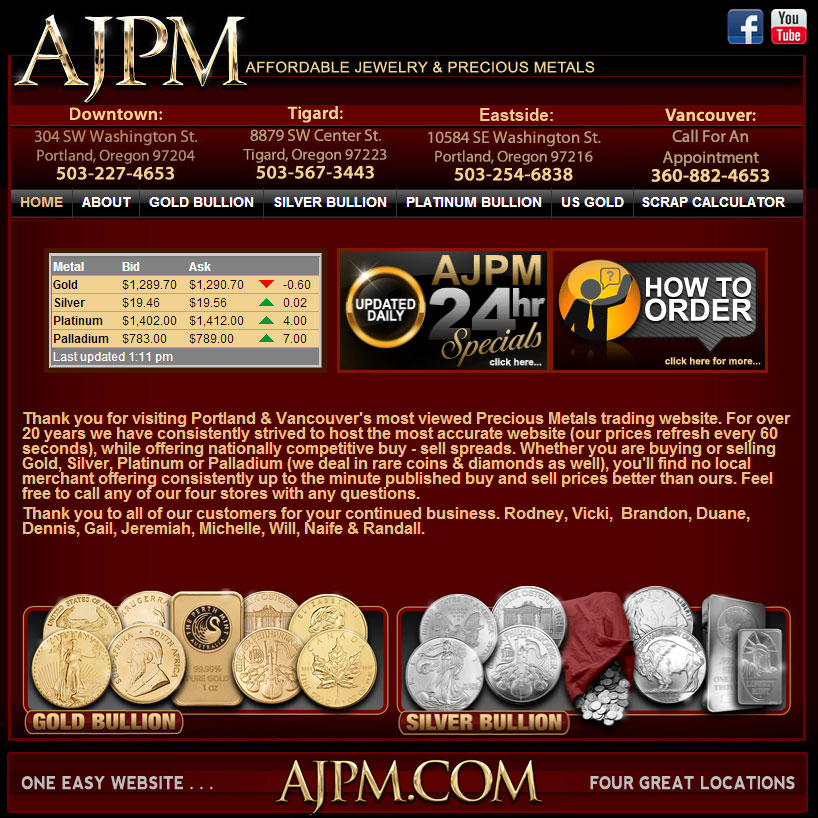

- The 2022 American Precious Metals, or AJPM, gold price is the real-time value of one ounce (31.1 grams) of gold, as of 2:30 p.m. 1.

- The price of gold is used to determine the day-over-day, or after-hours, price fluctuations in the metals markets.

The 2021 American Precious Metals, or AJPM, gold price is the real-time value of one ounce (31.1 grams) of gold, as of 2:30 p.m. EST. The price of gold is used to determine the day-over-day, or after-hours, price fluctuations in the metals markets.

What Is My AJPM Gold Price?

To check the price of your gold bullion, log in to your AJPM account and click on "Sell Gold," which is located on the right-hand side of the home page. From there, enter the amount of gold you wish to sell, as well as your preferred payment method.

What Is the AJP Metals & Mining Fund ETF (AJPM)?

The AJP Fund is an actively managed exchange-traded fund (ETF) that tracks the Dow Jones U.S. Metals & Mining Index. The ETF's underlying index covers companies that mine for metals such as gold, silver, nickel, and platinum. The index includes metals producers such as Barrick Gold, Newmont Mining, and Goldcorp.

The AJP ETF's underlying index is comprised of 25 metals companies. This index is rebalanced quarterly according to market cap. The AJP ETF provides exposure to smaller mining companies that tend to be overlooked by investors.

The AJP fund charges an expense ratio of 0.50%. The fund's net asset value (NAV) is $15.02. As of May 1, 2020, the fund held 21 gold stocks including Newmont Mining, Barrick Gold, and Goldcorp. The fund's largest holding, Newmont Mining, makes up 13.96% of the fund.

Understanding the AJP Metals & Mining Fund ETF

The AJP Metals & Mining Fund ETF (AGM), which tracks the performance of the S&P Global Metals & Mining Index, is a physically-backed gold fund. The fund's gold allocation is capped at 30%.

The S&P Global Metals & Mining Index is a benchmark index that measures the performance of global companies involved in mining, metals, and related industries. Companies included in the index must meet specific size, liquidity, and sector requirements.

The index is divided into the S&P Global Base Metals Index, S&P Global Precious Metals Index, and S&P Global Natural Resources Index.

The S&P Global Base Metals Index is weighted by market capitalization, and consists of both precious metals and base metals companies. The index is a subset of the S&P Global Metals & Mining Index and consists of 20 companies. Base metals include copper, zinc, aluminum, and nickel.

The S&P Global Precious Metals Index is composed of 15 companies, while the S&P Global Natural Resources Index consists of 17 companies.

How to Purchase the AJP Metals & Mining Fund ETF

The AJP Metals & Mining Fund ETF (NYSEARCA:XME) trades on the NYSE Arca and the ticker symbol is XME. Investors can purchase the fund through the iShares website or the broker of their choice. When purchasing the fund, keep in mind the commissions will be incurred upon purchase, and the fund isn't commission-free.

AJPPM Holdings

(

AJPM

), formerly Affiliated Managers Group, Inc., is a publicly traded holding company of publicly traded investment management firms. In November 2017, the company adopted the new name AJPPM Holdings, Inc.

AJPM Holdings' current major holdings include Affiliated Managers Group, L.P. (AMG), The AMG Funds, Inc. (AMG), The AMG Funds II, Inc. (AMG II), AMG Advisor, Inc. (AMAG), and AMG Trust Company, N.A. (AMGT).

AJPPM Performance

The mutual fund, AJPPM, has returned 13.34% and 6.58% since inception in 1987 and 1989, respectively.

The AJPPM fund has returned 1.9% annually over the past five years (as of March 2019). This compares to a 1.4% annual return for the S&P 500.

AJPPM Fees

When you invest in gold, your holdings will be valued daily based on the current price of the metal. The gold price differs slightly from the price of each specific coin, but you can track AJPPM's gold price through the American Eagle Gold Coin.

Live precious metal prices can be obtained at a variety of websites, but one of the most popular is Kitco.com.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

If you're considering an investment in gold, it's a good idea to read the fine print of any fund's offering documents. Some funds charge annual storage fees, while others might buy back gold at a higher price than what you originally paid. By doing careful research, you can make sure that the fund you choose is right for your investment goals.