Find the Best Gold Bullion for Your Investment Goals

- Investing in gold bullion can be a lucrative strategy, but you must be careful about who you buy from.

- Gold bullion refers to bars of gold of a certain weight and purity that have been refined from raw ore.

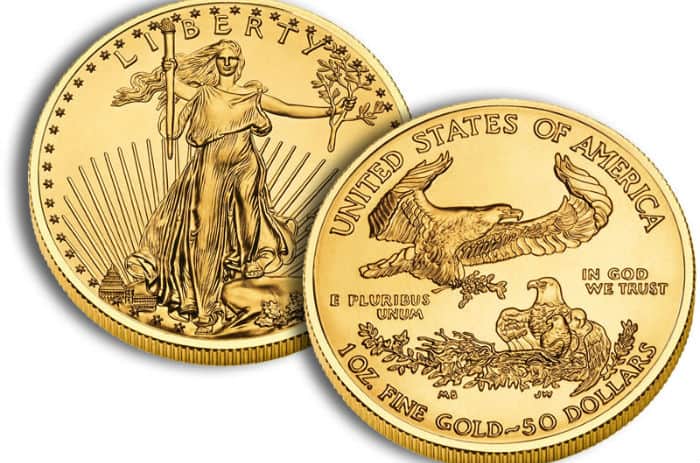

- Some bullion coins are also considered gold bullion.

Investing in gold bullion can be a lucrative strategy. However, it's important to choose a reliable dealer who can help you with your purchase.

To invest successfully in gold bullion, it's important to have a clear understanding of your goals. Your goals are likely to determine what type of gold bullion to invest in.

What Information Should You Consider When Choosing Gold Bullion?

Gold bullion comes in two forms: gold bars and gold coins. Gold bars are one-ounce, 10-ounce, 1-kilogram, and 400-ounce bars, usually with cast and stamped designs. Gold coins come in 1-ounce, 10-ounce, 1-kilogram, and 400-ounce bullion coins, and are always minted from .999 fine gold.

Gold coins are more expensive than gold bars due to the extra costs of minting, and certain gold coin designs, such as the Canadian Gold Maple Leaf, are popular among investors. However, gold bars offer greater liquidity for investors than gold coins do.

Gold bars are also easy to sell or trade, and their value will not vary by the price of gold. Gold coins have fluctuating value, but are much more convenient for investors, and their value will not vary by the price of gold.

Types of Gold Bullion

When investors buy gold bullion, they are purchasing gold bars or rounds. For investors who produce their own gold, they may purchase gold bullion ingots, known as "bullion bars," or gold wafers.

Investors can buy gold bullion in 1 oz., 5 oz., 10 oz., or 100 oz. weights.

Investors can buy gold bullion in either .999 pure or .9999 pure.

Investors can buy gold bullion in a 1 gram, 10 gram, or 1,000 gram weight.

Investors can buy gold bullion in a 1 oz., 5 oz., 10 oz., 100 oz., or 1,000 oz. weight.

Investors can buy gold bullion in 9 carat, 12 carat, or 24 carat weights.

Investors can buy gold bullion in a 1 oz., 5 oz., 10 oz., 100 oz., or 1,000 oz. weight.

Investors can buy gold bullion in 1 kilo, 2 kilo, 5 kilo, 10 kilo, 20 kilo, or 50 kilo weights.

Investors can buy gold bullion in a 1 oz., 5 oz., 10 oz., 100 oz., or 1,000 oz. weight.

Investors can buy gold bullion in a 1 kilo, 2 kilo, 5 kilo, 10 kilo, 20 kilo, or 50 kilo weight.

Gold Bullion vs. Gold Coins

Gold bullion is the purest form of gold. Investors who purchase gold bullion bars and coins do so with the intention of storing it, and using it to make purchases. This form of gold is usually sold by the troy ounce.

Gold coins, on the other hand, are legal tender. These coins are minted by a government mint. They are often issued to commemorate a particular event or person, and are tradable at gold bullion dealers.

For investors, gold bullion bars are a relatively inexpensive way to purchase gold. They are sold based on weight, but the difference in purity between gold bullion coins and gold bullion bars is negligible.

Gold Bullion vs. ETFs

If you're looking at gold bullion, you have several choices. These choices include:

Gold coins

Gold bars

Gold rounds

Gold rounds

The coins are typically made of 1 gram, 1 ounce, 1 kilogram, or 1 kilogram for platinum. Bullion bars are 401.6 grams for silver, 400 ounces for gold, 400 ounces for platinum, and 1,000 ounces for palladium.

Gold rounds typically weigh 1 ounce and are made of 24-karat gold. These rounds are popular for investors who don't want to deal with coins or bars.

Advantages of Gold Bullion

Gold bullion bars or coins are some of the most popular ways to invest in gold. One advantage is that they can be purchased in small increments. In other words, you could purchase a single coin or bar of 1 oz. gold. Buying a single gold coin or bar allows you to easily diversify your holdings.

Another advantage is the cost. Gold bullion typically costs less than pure gold or gold jewelry.

Disadvantages of Gold Bullion

Gold bullion is an efficient way of owning gold. However, there are potential disadvantages to owning gold bullion.

Gold bullion generally carries commission or storage fees.

Gold bullion carries storage fees. These fees vary from one bullion dealer to another.

Gold bullion is vulnerable to theft and loss.

The gold bullion market is very volatile.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

Gold bullion is viewed by investors as a safe way to store wealth.

Gold is traded in troy ounces, 1 ounce being equal to 28.3495 grams. The most popular form of gold bullion is gold coins, which come in 1 troy ounce, 1/2 troy ounce, and 1/4 troy ounce sizes.