Discover the Truth About Direct Bullion Reviews

- Bullion is gold, silver, or other precious metals in the form of bars or coins.

- Bullion coins include American Eagle, Canadian Maple Leaf, Austrian Philharmonic, Australian Kangaroo, and South African Krugerrand.

- The precious metals industry has grown rapidly in the past 20 years.

The precious metals markets are rapidly growing, with investors looking to diversify into hard assets as a hedge against inflation, a currency devaluation, or geopolitical turmoil. However, while gold and other precious metals are easy to buy and sell, it is far more difficult to buy quality bullion that is free of defects or fakes.

What Is Direct Bullion Reviews?

Direct Bullion Reviews is a website dedicated solely to the buying, selling, and investing of precious metals. The site has several goals, including:

To provide objective, reliable information about precious metals, including bullion, numismatics, and jewelry

To help people sell their unwanted precious metals

To offer specialized services to investors, including market analysis and portfolio advice

In 2020, the site was acquired by London Bullion Market Association (LBMA).

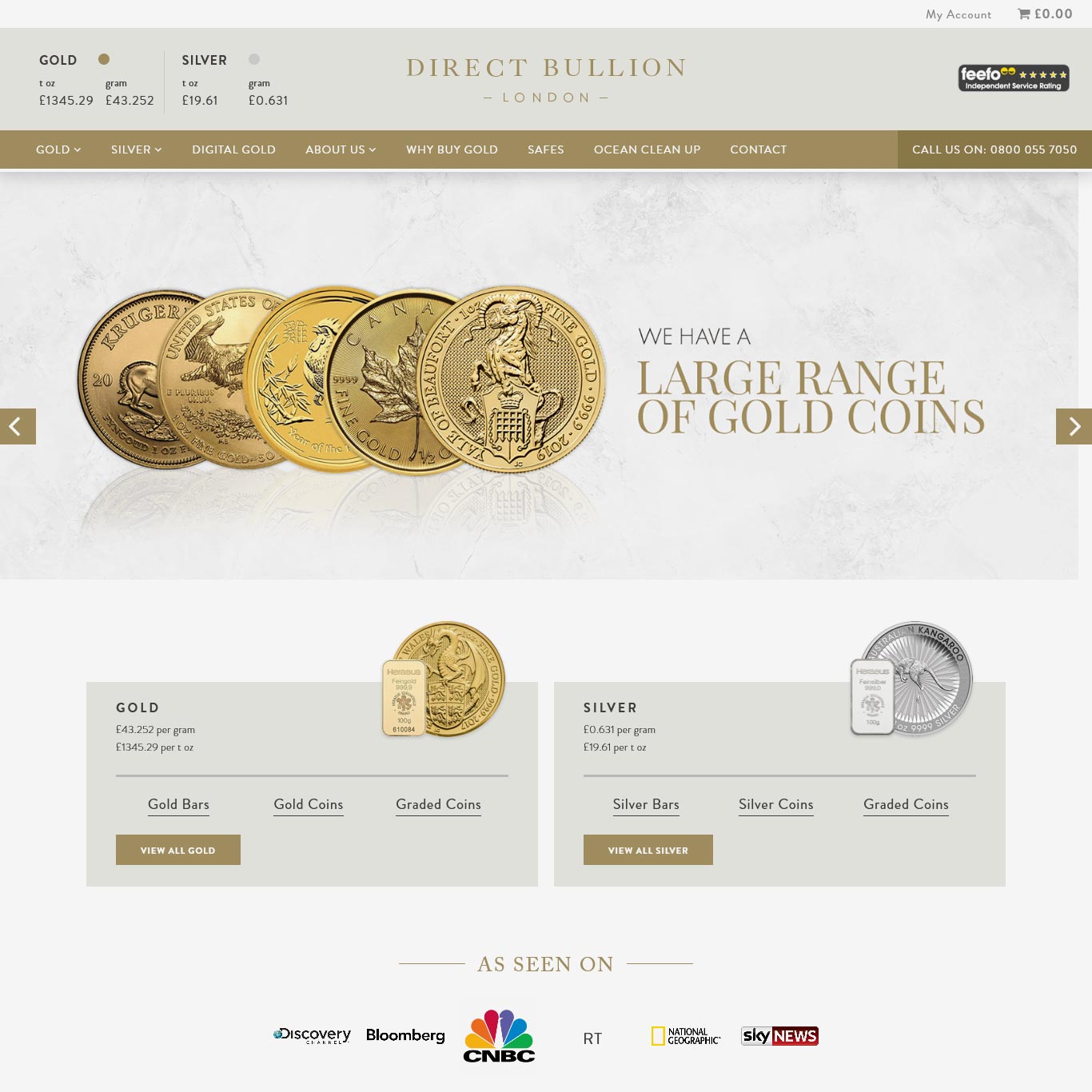

Direct Bullion Company Overview

Direct Bullion Company (DBC) is a U.S.-based precious metals dealer founded in January 2005. The company's headquarters is located in Fort Lauderdale, Florida. Direct Bullion's core focus is on providing retail investors with the opportunity to own physical gold and silver. The company offers bullion bars, coins, and minted bars.

Direct Bullion and its subsidiary, Direct Gold, are located in Fort Lauderdale, Florida. The company's core business is the sale of physical gold and silver bullion products. Direct Gold's website shows a variety of products, including:

Gold bars

Silver bars

Coins and bars

Custom fabrication

Jewelry

Direct Bullion sells its products directly to consumers. Direct Bullion's website states its pricing is "based on the cost to acquire and market your precious metals."

Direct Bullion vs. Goldline, Inc.

Goldline, Inc. (GLD) and Goldline International (GGLD) are precious metals and coin dealers based in California. They sell bullion, coins, and precious metals-related products and accessories.

Goldline was founded in 1989 and went public in 1997. It was acquired by The Monex Group in 2017.

Goldline was publicly traded until September 2021, when Monex acquired the company.

Goldline is currently listed on the New York Stock Exchange (NYSE).

Direct Bullion vs. Money Metals Exchange

Money Metals Exchange ($XAU), headquartered in Utah, is a precious metals dealer that also sells coins. It also sells IRA-eligible gold and silver products. Money Metals Exchange was founded in 2010 and went public in 2011.

Money Metals Exchange was publicly traded until September 2021, when Monex acquired the company.

Money Metals Exchange is currently listed on the New York Stock Exchange (NYSE).

Direct Bullion vs. Kitco

Kitco ($KGC) is a precious metals dealer that is based in Canada. It also sells coins, bullion, and IRA-eligible gold and silver products. Kitco was founded in 1977 and went public in 2006. It was acquired in 2020 by Monex Group.

Kitco was publicly traded until September 2021, when Monex acquired the company.

Kitco is currently listed on the New York Stock Exchange (NYSE).

Gold IRA: Should You Open One To Save For Retirement?

Direct Bullion vs. BullionVault

Both the Direct Bullion and BullionVault websites are based around the concept of providing investors with the ability to buy and sell precious metals. Both sites have offices in Los Angeles and London.

Both companies also offer storage options for precious metals. However, BullionVault offers a much wider range of options, including:

Storage at a secure vault in London, New York, and Hong Kong

Secure storage at a bank in Switzerland

Storage in a client's home, including safes, safety deposit boxes, and home vaults

Direct Bullion and BullionVault both offer gold and silver bullion products for sale, but some bullion products only offered by Direct Bullion include platinum, palladium, and rhodium.

Direct Bullion offers clients two levels of account, one of which is free.