Discover the Fidelity Silver Fund

- The Fidelity Silver Fund (FSCSX) seeks to offer investors exposure to silver prices by investing in equity securities of companies engaged in the precious metals industry.

- The fund's primary benchmark is the Bloomberg Precious Metals Index.

- As of August 2022, Fidelity Silver Fund held 81.95% of its assets in silver, 16.77% in gold, 0.40% in palladium and 0.15% in platinum.

- The fund charges a 1.20% expense ratio.

The Fidelity Silver Fund (FSCSX) seeks capital appreciation by investing in equity securities issued by companies engaged in the precious metals industry. The fund's primary benchmark is the Bloomberg Precious Metals Index.

As of August 2022, Fidelity Silver Fund held 81.95% of its assets in silver, 16.77% in gold, 0.40% in palladium and 0.15% in platinum. The fund charges a 1.20% expense ratio.

Performance

As of Jan. 15, 2021, the Fidelity Silver Fund (FSAGX) has returned 13.7% over the past 12 months. The silver ETF has outperformed its peers, the S&P 500 and the iShares Silver Trust (SLV), by 5.3% and 10.3%, respectively.

Expenses

Annual operating expenses for the Fidelity Silver Fund are 0.43%. The fund's expense ratio is higher than the S&P 500 Index, which charges 0.23%, but lower than the iShares Silver Trust, with an expense ratio of 0.44%.

Holdings

As of Jan. 15, 2021, the Fidelity Silver Fund holds 6.5% of its assets in silver bullion, 6.3% in silver futures, 4.1% in the iShares Silver Trust, and 1.9% in gold mining companies. The holdings of the fund are diversified across 14 different companies worldwide.

Top 10 Holdings

The Fidelity Silver Fund's top 10 holdings as of Jan. 15, 2021, include:

Free Cash Flow Yield

As of Jan. 15, 2021, the Fidelity Silver Fund had a free cash flow yield of 1.15%.

Fund Expenses

Expense Ratio: 0.52%

Minimum Investment: $1k

Maximum Investment: $5M

Inception Date: 10/31/01

The Fidelity Silver Fund is a closed-end fund that is traded on the NYSE Arca. It tracks the Bloomberg Barclays Silver Subindex Total Return Index, which is a subset of the Bloomberg Barclays US Aggregate Bond Index. The fund was designed as a hedge against inflation and as a portfolio diversifier.

The Fidelity Silver Fund is yielding 1.86% as of July 20, 2021. The fund has $2.28 billion in total assets and $2.08 billion in short assets. The fund has an expense ratio of 0.52%, which makes it one of the least expensive silver funds.

The fund's history is relatively smooth, with only 2.5% of the fund's value being lost over the last 10 years. The fund also pays a dividend of $0.0708 per share annually, or $0.11 per share quarterly.

Competitive Advantages

The Fidelity Silver Fund (FSIL) is an equity mutual fund that tracks the UBS Bloomberg CMCI Silver Total Return Index. The fund's main competitive advantages are:

The fund's expense ratio is 0.43%, which is one of the lowest in the silver fund space.

The fund's minimum initial investment is $1,000, making it accessible to individual investors.

The fund's performance has been relatively consistent over time.

Fees and Expenses

Expense ratio: 0.45% per year, or $45 for every $10,000 invested

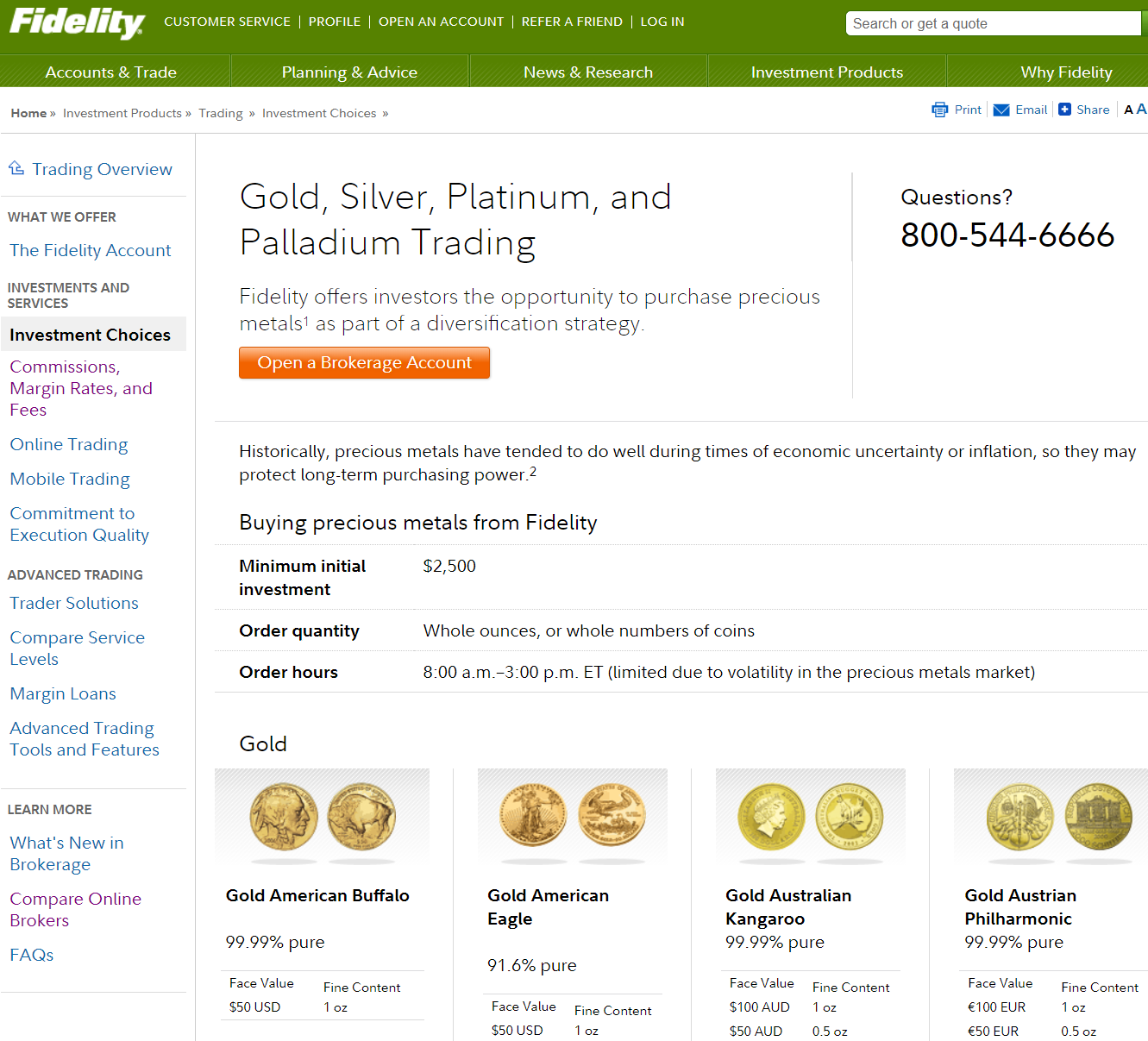

Minimum investment: $2,500

Holdings

SPDR Gold Trust (GLD)

SPDR S&P Metals & Mining ETF (XME)

VanEck Vectors Gold Miners ETF (GDX)

Market Vectors Junior Gold Miners ETF (GDXJ)

iShares Global Gold Miners ETF (GDX)