Gold Trading on Fidelity

Fidelity, one of the world's largest investment firms, now offers gold trading as part of its investment options.

Understanding the Basics of Gold Trading

Gold trading on Fidelity can be a profitable investment strategy if done correctly. The first step is understanding the basics of gold trading. Gold is a precious metal that has been used as a currency and store of value for centuries. It is a safe-haven asset that tends to hold its value during economic downturns.

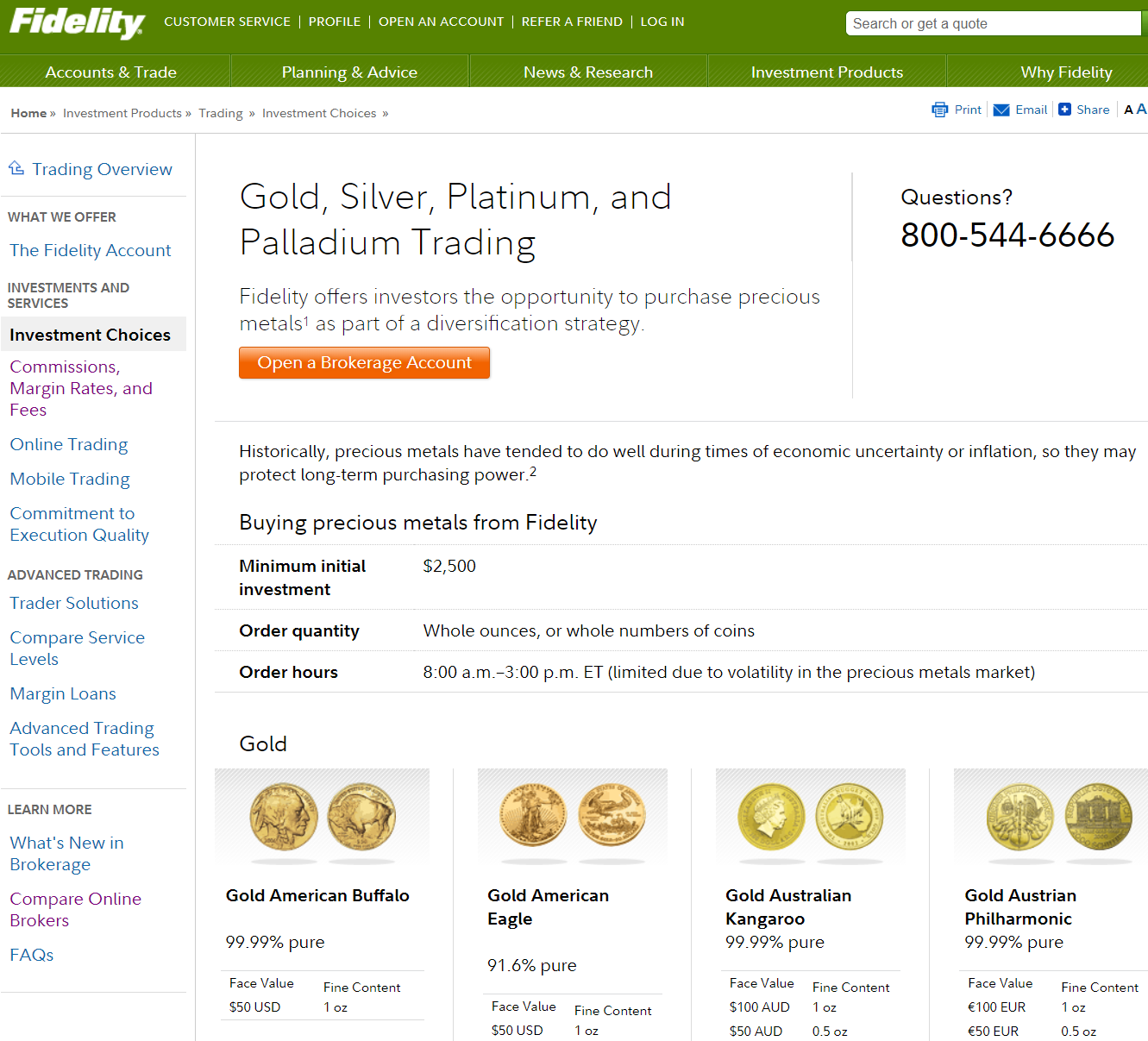

Investors can trade gold in various forms, including physical gold, gold ETFs, and gold futures. Physical gold can be bought and sold in the form of coins or bars. Gold ETFs are exchange-traded funds that track the price of gold. Gold futures are contracts that allow investors to buy or sell gold at a specific price in the future.

Fidelity offers various investment options for gold trading, including gold ETFs and mutual funds that invest in gold-related companies. Investors can also trade gold futures on Fidelity's platform.

It is essential to research the market and understand the risks involved in gold trading before investing. Factors that can affect the price of gold include global economic conditions, geopolitical events, and inflation.

Opening a Fidelity Account for Gold Trading

If you're interested in trading gold, opening a Fidelity account is a great option. Fidelity offers a range of investment products and services, including the ability to buy and sell gold through their brokerage platform. To open an account, you'll need to provide personal and financial information, including your name, address, social security number, and employment status. Once your account is open, you can fund it with cash or securities and start trading gold immediately.

One of the benefits of trading gold through Fidelity is their competitive pricing. They charge a flat rate of $4.95 per trade, with no additional fees or commissions. Additionally, Fidelity offers a range of educational resources and tools to help you make informed trading decisions. You can access market research, news, and analysis, as well as use their trading platform to track your investments and execute trades.

Researching and Analyzing Gold Market Trends

When it comes to trading gold on Fidelity, it's important to stay up-to-date on the latest market trends. This means conducting thorough research and analysis to gain a better understanding of the factors that drive price fluctuations.

One key factor to keep an eye on is the global economic climate. In times of uncertainty or instability, gold tends to perform well as investors seek out safe-haven assets. Additionally, geopolitical tensions, inflation rates, and currency values can all have an impact on the price of gold.

Another important factor to consider is supply and demand. Gold is a finite resource, and production levels can have a significant effect on its price. Factors such as mining output, recycling rates, and central bank gold reserves can all impact supply levels.

By researching and analyzing these and other market trends, traders can make more informed decisions when it comes to buying and selling gold on Fidelity. Whether you're a seasoned investor or just starting out, keeping a close eye on the gold market is key to success in this exciting and dynamic sector.

Placing Your First Gold Trade on Fidelity

If you're new to gold trading on Fidelity, you may be wondering how to get started. Fortunately, the process is straightforward and user-friendly. Here's a step-by-step guide to help you place your first gold trade on Fidelity:

1. Log in to your Fidelity account and navigate to the trading platform.

2. Select the "Gold" tab to view the current price of gold and related assets.

3. Choose the type of gold investment you want to make, such as buying physical gold or investing in gold ETFs.

4. Enter the amount of money you want to invest and review the order details.

5. Click "Place Trade" to execute your investment.

6. Monitor your investment and make adjustments as needed.

Remember to do your research and consult with a financial advisor before making any investment decisions. With Fidelity's easy-to-use trading platform and wealth of resources, you can confidently start your gold trading journey today.

Managing Your Gold Portfolio on Fidelity

| Managing Your Gold Portfolio on Fidelity | |

|---|---|

| What is Gold Trading on Fidelity? | Gold trading on Fidelity is the process of buying and selling gold investments, such as gold exchange-traded funds (ETFs), mutual funds, and individual stocks, through the Fidelity investment platform. |

| Why Invest in Gold? | Gold is often considered a safe-haven investment during times of economic uncertainty or inflation. It can also serve as a diversification tool for a well-rounded investment portfolio. |

| How to Invest in Gold on Fidelity | Fidelity offers a variety of gold investments, including ETFs, mutual funds, and individual stocks. To invest in gold on Fidelity, follow these steps: 1. Log in to your Fidelity account 2. Click on the "Trade" tab 3. Select the investment type (ETF, mutual fund, individual stock) 4. Search for the gold investment you want to buy or sell 5. Enter the trade details and submit your order |

| Managing Your Gold Portfolio on Fidelity | Once you have invested in gold on Fidelity, it is important to monitor your portfolio and make adjustments as needed. Fidelity offers tools and resources to help you manage your portfolio, including: 1. Portfolio analysis and reporting tools 2. Alerts and notifications for price changes or news events 3. Access to investment research and analysis 4. Professional guidance and advice from Fidelity advisors |

| Conclusion | Investing in gold can be a valuable addition to any investment portfolio, and Fidelity provides a user-friendly platform to buy and sell gold investments. By monitoring and managing your gold portfolio on Fidelity, you can make informed investment decisions and potentially benefit from the long-term performance of gold investments. |

Selling Your Gold Investments on Fidelity

Selling your gold investments on Fidelity is a straightforward process that can be completed in just a few clicks. First, log in to your Fidelity account and navigate to the "Trade" tab. From there, select "Sell" and then choose the gold investment you wish to sell. Review the current market price and enter the number of shares or dollar amount you wish to sell. Confirm the details and submit your order. Fidelity will execute the trade and the proceeds will be deposited into your account. It's important to note that there may be fees associated with selling your gold on Fidelity, so be sure to check the fee schedule beforehand. Additionally, it's important to consider the tax implications of selling your gold investments, as you may incur capital gains taxes. Overall, selling your gold investments on Fidelity is a simple and convenient process, but it's important to do your due diligence and consider all factors before making any trades.

Gold IRA: Should You Open One To Save For Retirement?