Secure Your Retirement with IRA-Eligible Gold Investments

In uncertain times, securing your retirement with IRA-eligible gold investments is becoming an increasingly popular strategy.

Why IRA-Eligible Gold is a Smart Investment Choice

Investing in IRA-eligible gold is a smart choice for those who want to secure their retirement. Gold has been a reliable store of value for centuries and has proven to be a hedge against inflation and economic uncertainty. Gold prices have historically increased during times of economic downturns, making it an ideal investment in times of market volatility.

IRA-eligible gold investments provide a level of diversification that can help protect your retirement savings from market fluctuations. By adding gold to your IRA, you can balance your portfolio and reduce your exposure to traditional investments like stocks and bonds. Gold is a tangible asset that you can hold in your hands, and it has intrinsic value that is not dependent on the performance of a company or government.

Another advantage of investing in IRA-eligible gold is that it offers tax benefits. You can defer taxes on your gains until you withdraw your funds from your IRA, which can help you maximize your returns over time. Additionally, investing in gold through an IRA allows you to avoid the costs and hassles of storing and insuring physical gold yourself.

Understanding the Eligibility Requirements for IRA Gold Investments

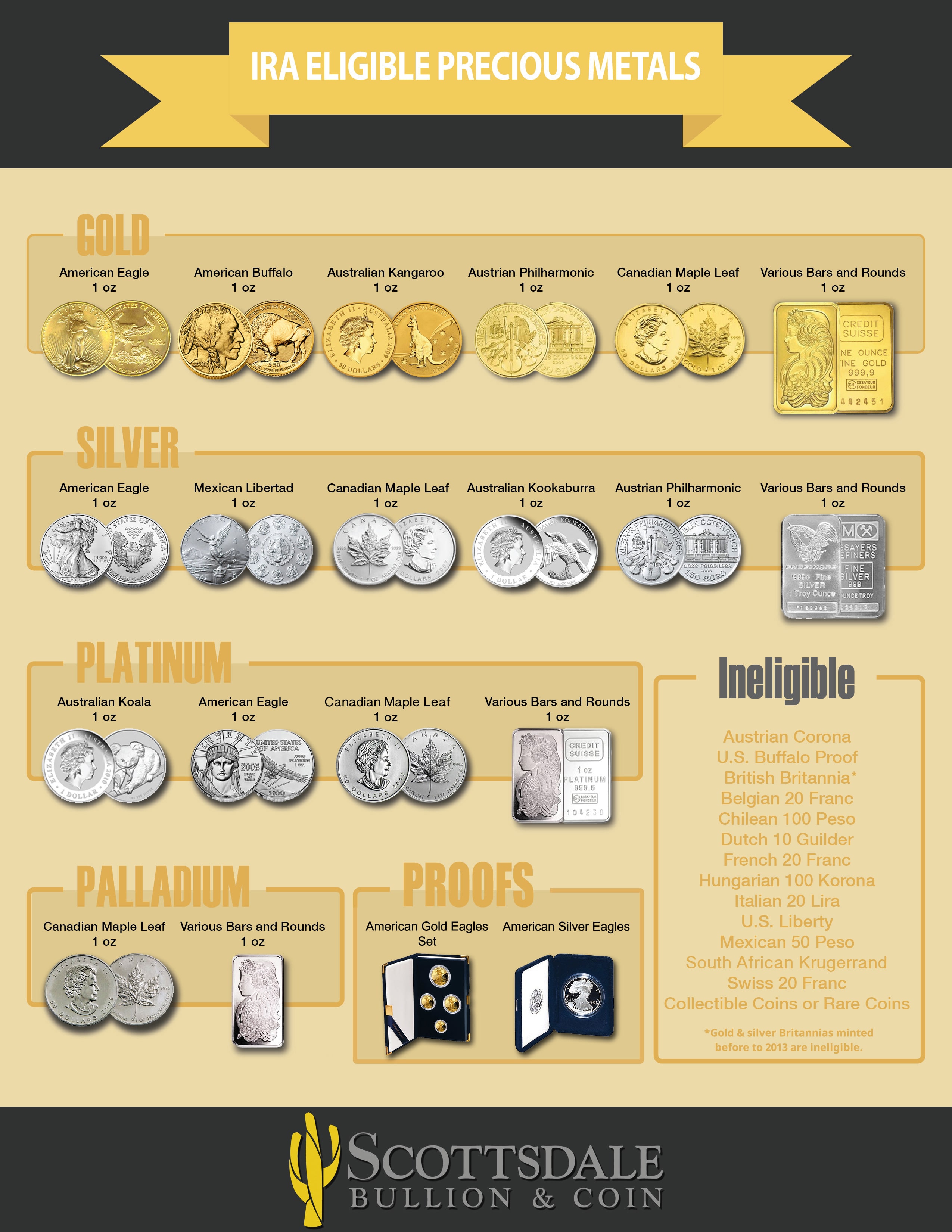

Investing in gold through an Individual Retirement Account (IRA) can be a wise decision for securing your retirement. However, not all types of gold are eligible for IRA investments. The IRS has set certain eligibility requirements that gold must meet to be included in an IRA.

Firstly, the gold must be in the form of coins or bars that meet the fineness standards set by the IRS. For example, gold coins must be at least 99.5% pure and produced by a recognized government mint. Gold bars must also meet certain purity standards and be produced by a recognized refinery.

Secondly, the gold must be held by a custodian approved by the IRS. The custodian is responsible for managing the gold and ensuring that it meets IRS requirements.

Lastly, any transactions involving the gold must be made through the IRA custodian. You cannot take physical possession of the gold or use it for personal purposes.

How to Invest in IRA-Eligible Gold

Investing in IRA-eligible gold can be a secure way to diversify your retirement portfolio. To invest in gold through your Individual Retirement Account (IRA), you need to follow some specific steps. First, you need to open a self-directed IRA account with a custodian who allows gold investment. Then, you can purchase gold coins or bullions that meet the IRS standards for purity and weight. Make sure to keep the gold in a secure storage facility that is approved by the custodian to maintain the IRA eligibility. IRA-eligible gold can provide protection against inflation and economic uncertainties, making it a valuable addition to your retirement portfolio. However, it is essential to do your research and understand the risks associated with investing in gold before making any decisions. Investing in IRA-eligible gold can be a smart move for your retirement plan, but it is important to consult with a financial advisor to determine if it is the right investment option for you.

Maximizing Your Retirement Savings with Gold IRAs

| Maximizing Your Retirement Savings with Gold IRAs | |

|---|---|

| Article Title: | Secure Your Retirement with IRA-Eligible Gold Investments |

| What is a Gold IRA? | A Gold IRA is a self-directed individual retirement account that allows you to invest in physical gold and other precious metals as a way to save for your retirement. |

| Advantages of Gold IRAs: |

|

| How to Set Up a Gold IRA: |

|

| Conclusion: | Investing in a Gold IRA can be a smart way to secure your retirement savings, diversify your portfolio, and protect against inflation. With the help of a reputable custodian, you can easily set up a Gold IRA and start investing in physical gold and other precious metals today. |

The Potential Risks and Rewards of Gold IRA Investments

Investing in gold through an IRA can offer a hedge against inflation and market volatility, but it is not without its risks. One of the main benefits of investing in gold is that it has historically held its value and is considered a safe haven asset. However, the price of gold can be volatile and is subject to market fluctuations.

Another risk to consider is the fees associated with gold IRA investments. Custodial fees, storage fees, and transaction fees can add up and eat into your returns. It's important to research and compare fees from different IRA custodians to find the best option for your investment goals.

On the other hand, the potential rewards of gold IRA investments are significant. Gold can offer diversification in your portfolio and protect your retirement savings from inflation. Additionally, gold IRAs can offer tax benefits, as contributions are tax-deductible and gains are tax-deferred until retirement.

Ultimately, investing in gold through an IRA can offer a secure and potentially lucrative retirement strategy. However, it's important to carefully weigh the potential risks and rewards before making any investment decisions.

Gold IRA: Should You Open One To Save For Retirement?