A Mark Silver Bars - Invest in a Secure Investment

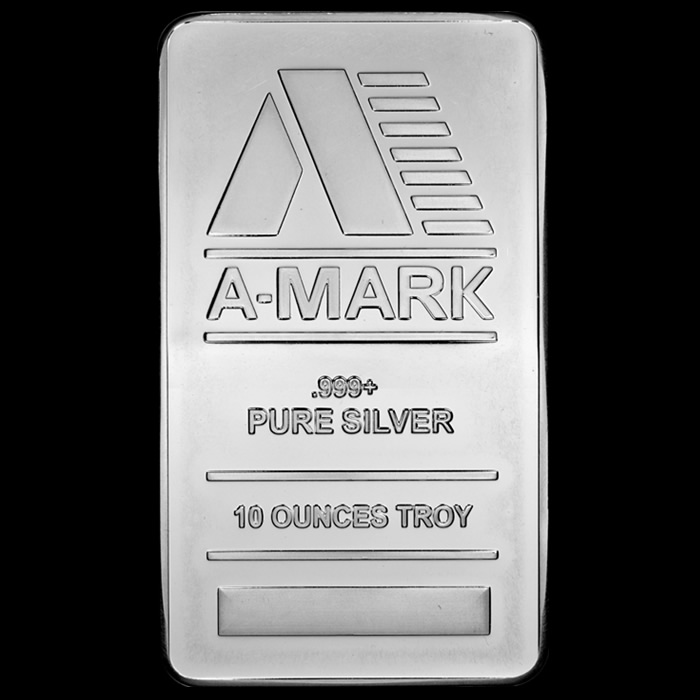

- Mark Silver Bars, which are minted from .999 silver, are a popular investment among silver investors.

- They carry the hallmark of ".999 Fine Silver", weigh 1 Troy Ounce, and come in four different sizes.

- The sizes of the bars are small, medium, large, and extra-large.

Mark Silver Bars are a huge investment because of their purity and strength. Mark Silver Bars are world-famous for their high purity, and they are also known for their long-lasting durability, making them a great investment.

Mark Silver Bars are minted from .999 silver, making them almost pure silver bullion. They are manufactured by the Sunshine Minting company, and they carry the hallmark of ".999 Fine Silver". These silver bars weigh 1 Troy Ounce, and they come in four different sizes. The sizes of the bars are small, medium, large, and extra-large.

What Is Mark Silver Bars?

Mark Silver Bars is a secure investment. Purchasing silver bars allows you to buy silver in bulk, and at wholesale prices. Buying silver in bar form can be less expensive than buying silver coins. Silver bars are a useful investment because they are easy to store and transport.

Understanding Mark Silver Bars

Mark Silver Bars, also known as "Security Silver Bars", are bars of .999 fine silver that are manufactured, packaged, and distributed by Security Metals. These silver bars are sealed in protective plastic and sealed in protective packaging.

They are distributed through UPS, FedEx, and USPS. Mark Silver Bars are packaged with one assay card and one investor card.

The assay card states the purity of the bar (.999 fine silver), the security number, the name of the issuing company, and the bar's weight.

The investor card, also known as the "Investor Information Card", contains information about the security, including the name, address, telephone number, and website of the issuing company.

Physical Silver: What Is It?

Silver bars, in the most basic of terms, are bars of silver. Some bars contain silver minted into a particular shape, while others contain silver coins that have been melted and molded into bars.

Silver bars offer investors the security of owning silver bullion in a tangible form. Unlike silver coins, which are easy to lose, silver bars are fairly safe. Silver bars are bought and sold by weight and are typically produced in sizes up to 1000 ounces. Silver bars can be divided down to one-twentieth of an ounce.

Mark Silver Bar Advantages

Investing in a Mark Silver Bar is safer than investing in precious metals. Unlike coins, bars are not susceptible to counterfeiting. Also, the 1 oz. and 100 oz. Mark Silver Bars are minted by the Royal Canadian Mint.

Disadvantages

The Royal Canadian Mint does not deal directly with the investor. Instead, you have to deal directly with the store that you purchase your Mark Silver Bars from.

The Royal Canadian Mint also does not deal directly with the investor. Instead, you have to deal directly with the store that you purchase your Mark Silver Bars from.

Mark Silver Bar Disadvantages

The disadvantages in investing in Mark Silver Bars are:

1. The Silver Bars you buy have to be with an authorized dealer.

2. You have to buy 100 ounces in any one purchase.

3. You cannot sell just a portion of your Silver Bar.

4. You cannot make partial payments.

5. You have to pay an extra 8.5% in fees.

6. There is only a 30-day return guarantee on your investment.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

The Mark Silver Bars are physically traded, meaning they are individually owned by investors with actual bars in their possession. This eliminates the middleman and fees, and investors are in direct contact with the refineries and mining firms.

Mark Silver Bars offer direct exposure to silver prices. This makes them an attractive investment, but you must carefully weigh the risks, including storage, liquidity, and volatility.