Explore the Possibilities of a Portland IRA

- A Portland IRA is a tax-deferred retirement savings plan that allows individuals to contribute up to $5,500 annually.

- These contributions are made with pre-tax dollars, which reduces one's adjusted gross income (AGI).

- The more someone contributes to their Portland IRA, the more it reduces their tax burden.

A Portland, Oregon IRA is a tax-deferred retirement savings plan that allows individuals to contribute up to $5,500 annually. These contributions are made with pre-tax dollars, which reduces one's adjusted gross income (AGI). The more someone contributes to their Portland IRA, the more it reduces their tax burden. Those with a Portland IRA can invest in a variety of investment options with varying risk levels, including stocks, bonds, mutual funds, and even real estate.

Traditional IRAs in Portland

A traditional IRA can be a smart way to invest for retirement. Because a traditional IRA is a tax-advantaged account, it allows you to defer tax on your contribution, and any earnings on the funds in the account grow tax-deferred until withdrawal.

The contributions you make to a traditional IRA may be tax-deductible, if you are covered by the retirement plan at work. You can begin taking distributions from a traditional IRA once you reach age 59 1/2. If you withdraw funds before age 59 1/2, there is a 10% penalty.

The contributions you make to a traditional IRA may be tax-deductible, if you are covered by the retirement plan at work. You can begin taking distributions from a traditional IRA once you reach age 59 1/2. If you withdraw funds before age 59 1/2, there is a 10% penalty.

Roth IRAs in Portland

There are special rules for Roth IRAs in Portland. With Portland's high cost of living, many residents might want to retire early. Portland residents can open Roth Traditional IRAs and Roth IRAs, but they must be residents of the state. Roth IRAs in Portland do not have the same contribution limits that they do for traditional IRAs.

Traditional IRAs in Portland

Portland residents have different options regarding traditional IRAs. They can open traditional IRAs, non-deductible IRAs, and deductible IRAs.

Rollover IRAs

The rollover IRA is the simplest form of the IRA. The account owner takes funds from a traditional IRA or 401(k) and transfers the funds to a new IRA. This transfer can be done online or by submitting a rollover IRA form or check. The money is deposited in the new IRA and the owner has 60 days to report the funds to the IRS.

Direct Rollover

The direct rollover works in the same way, but it allows the owner to roll funds from another account besides a traditional IRA. For example, the owner of the IRA can take funds from a SEP-IRA or SIMPLE IRA and transfer them to the new IRA.

Inherited IRAs

The inherited IRA works the same way as the rollover IRA. However, the funds are transferred from a traditional IRA to a beneficiary's IRA. The beneficiary is not the owner of the IRA, but the owner's estate.

Roth IRA Conversions

The Roth IRA conversion allows the owner to convert a traditional IRA into a Roth IRA. The conversion must be done within 60 days of receiving the funds from the traditional IRA. The conversion is allowed once every five years, and the owner cannot contribute money to the Roth IRA account.

Traditional IRAs

Traditional IRAs are similar to 401(k)s, but they allow for tax-deductible contributions. IRAs are not taxed until withdrawal. The owner can deposit money into the IRA every year, and the money grows tax-deferred. The owner is allowed to withdraw the money after age 59 1/2.

SEP IRAs in Portland

A SEP IRA allows you to contribute money each year, pre-tax, for up to 25% of your compensation. You can establish one of these accounts by yourself, just as you would a Traditional IRA, or through a Portland SEP IRA employer.

Rollovers in Portland

If you currently hold a retirement account with another institution, you may be able to roll it over to a Portland IRA. However, some institutions allow you to transfer only a certain amount of money out of your existing retirement funds, while others require that you withdraw the money before transferring it to an IRA.

A rollover gives you more control over the money in your IRA and can be a better option than a transfer. However, some institutions limit the number of rollovers you can make over a certain period of time, and you may incur fees or taxes.

Retirement account conversions

You can convert your retirement accounts in Portland to a different account or investment (such as a Roth IRA or annuity). However, this can be a costly option, as you will have to pay taxes on the amount converted.

Roth IRA conversions

You can transfer a Roth IRA or Traditional IRA to a Roth IRA. However, you will have to pay taxes on the amount converted, and you may also have to pay a penalty of 10% of the amount converted if your conversion is done prior to age 59.5.

Tax-deferred annuities

You can convert a Traditional IRA or 401(k) to a deferred annuity.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

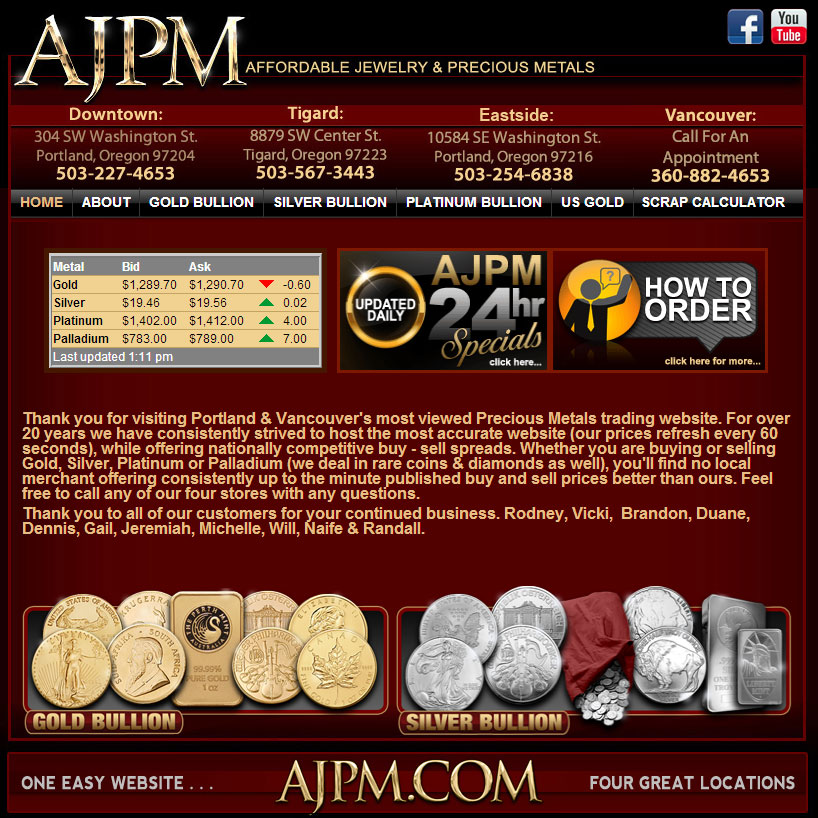

Portland IRA (www.portlandir.com) has been in the Portland and Vancouver markets since 2009 and handles a wide range of IRA products. Its fee structure will depend on the type of IRA, but in general, it will be lower than traditional brokers. Its customer service is top-notch, and it offers some of the industry's most competitive minimum investment requirements.