Discover the Risks of Bear Trap Investing

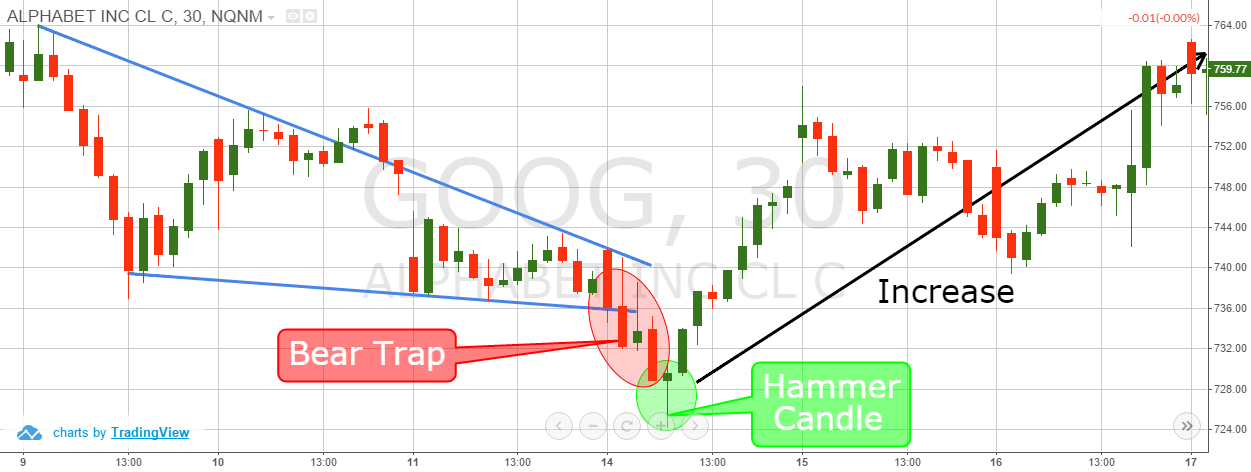

- A bear trap is a trading strategy used by short sellers and hedge funds to lure investors into buying and then quickly selling at lower prices. Traps are set up by traders to trick investors into making quick trades that result in a financial loss. Traps typically occur when a stock's price rises above a resistance level. Traps can also be set when a stock's price falls to a level where it is likely to bounce.

- Bear traps are a type of market manipulation, and they can catch even skilled investors unprepared.

- However, understanding what to look for can help you avoid these traps and stay ahead of the game.

Bear traps are a type of market manipulation, and they can catch even skilled investors unprepared. However, understanding what to look for can help you avoid these traps and stay ahead of the game.

A bear trap is a strategy used by short sellers and hedge funds to lure investors into buying and then quickly selling at lower prices. These traps are set up to trick investors into making quick trades that result in a financial loss.

What Is Bear Trap Investing?

A bear trap refers to an investment that appears to be attractive but isn't. The investor is lured in by the initial positive news, which leads to an extended upward movement in the price of the investment. After the upward movement, the price slows down and reverses.

For example, if a stock has been moving upward for the past few months, its price increases by $50. After the price increase, the price remains flat for a week or two. At this point, some investors believe that this stock will continue its upward movement and purchase more shares. However, after a week or so, the price reverses and moves downward. So, those investors who bought more shares during the original upward movement are disappointed in their investment.

Understanding Bear Trap Investing

In general, a bear market is a stock market decline lasting longer than a few months. During a bear market, stock prices generally fall by 20% or more from their recent high.

This definition is somewhat vague, but is usually used as a broad term. The markets can fall by 20% or more and remain in a bear market, while stocks can remain in a bear market for an extended period of time.

A bear market is one type of market cycle. Cycles are a part of the market's natural ebb and flow. Bear markets, like bull markets, are short-term events, lasting for several months to a few years.

Bear markets are not part of an intentional investment strategy. They do not occur frequently, but they happen periodically. Using historical data, we can estimate how long a bear market will last for, but there is no way to know for certain.

Bear markets have a number of common characteristics, including:

An economic decline, such as a recession

A sharp drop in stock prices

A decline in investor confidence

A spike in volatility

Bear Market Traps

A bear market is a market in which prices fall significantly. A bear market is the opposite of a bull market. During a bear market, prices fall significantly, and investor sentiment turns sour. Many investors panic and sell their investments at low prices.

A bear trap is a strategy in which investors buy stocks at low prices, usually when the market is in a bear market. After buying the stocks, there is a temporary market rebound, and prices start moving upward. Investors then sell the stock at the temporary high, and incur losses.

Bear traps are difficult to predict, and often fail to deliver the returns that investors expect. Bear trap investing is risky, and can lead to significant losses.

Bear Trap Investing Example

Investor A buys a share of stock at $10 per share. The stock then goes to $9.50 per share, and Investor A sells the stock. The investor then buys a share of stock at $9.50 per share. The stock then goes to $10 per share, and Investor A sells the stock. The investor then buys a share of stock at $10 per share. The stock then goes to $9.50 per share, and Investor A sells the stock.

The investor buys the stock three times, and sells the stock three times. The investor loses money on the trades, and ends up losing 30% on the buys and sells.

Bear Market Trap Examples

The bear market in stocks that started in 2007 and ended in 2009 is an example of a bear market trap. Investors who bought stocks during the bull market in 2000 and 2007 and then sold them at the bottom to lock in losses-an example of short-selling-experienced even more losses.

In October 2007, the Dow Jones Industrial Average (DJI) traded at 14,164. In the months that followed, it fell 39%, eventually reaching a low of 6,547 in March 2009. Those who sold their stocks in March 2009 to lock in their losses would have experienced losses of 56%.

Bear Trap Investing Risk

A bear trap is the opposite of a bull trap. A bear trap occurs when a stock's price drops too far, too fast. The price drop indicates that investors have dumped the stock in fear of impending disaster.

Bear traps are risky, as it means that the market has already priced in a worst-case scenario. However, if a stock does go bust, the bear trap investors have made profits. Legal insider trading often occurs around bear traps, so bear trap investing is best left to professional investors.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

The tactical asset allocation strategy used by hedge fund managers relies on maintaining a net exposure of 2% to 5%. By holding this trading range, they avoid the risk of being fully invested in equities during a major market reversal. Bear trap investing is a strategy that hedge funds use to profit from short-term market fluctuations.