Read These Boston Bullion Reviews Before Your Next Investment

- Investing in gold bullion is a physical investment in gold bars.

- Gold bars can be purchased from well-known refineries such as Valcambi, Heraeus, or the US Gold Bureau.

- Gold bars can be melted down, re-coined, and resold, or stored as a hedge against inflation.

If you are considering investing in gold bullion, there are a few things you should know. Gold bullion is the investment of physical gold bars. These bars can be purchased from well-known refineries such as Valcambi Suisse, Heraeus, or the US Gold Bureau.

Gold bullion is usually bought in 1-ounce increments. These bars can then be melted down, re-coined, and resold, or stored as a hedge against inflation.

Gold bullion is often the preferred option for many investors, as gold tends to retain its value well, and, unlike stocks and bonds, it does not fluctuate in value on a daily basis.

Boston Bullion Review: An Overview

Boston Bullion (BOS) is an Internet-based precious metals dealer with its headquarters in Portsmouth, New Hampshire. The company has been in business since 2010.

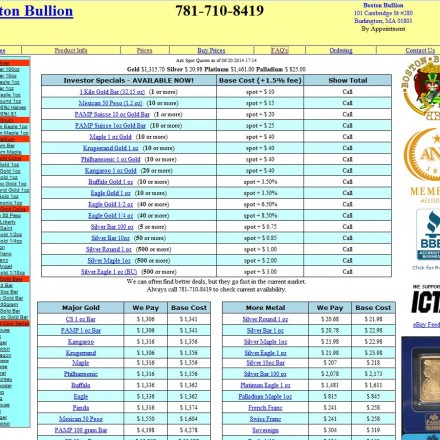

Boston Bullion buys precious metals from dealers and manufacturers and then resells them to customers. Its customers can trade precious metals in bullion form (bars), coins, or rounds. Customers can purchase precious metals for investment or for collecting purposes.

The company sells gold, silver, platinum, and palladium. It also offers gold and silver IRAs.

Pros Explained

Boston Bullion offers customers the security of working with a company that has been in business for more than 50 years and is backed by the stability of American Bullion, Inc.

A variety of different bullion and coin products are available for customers to purchase, including silver and gold rounds, bullion coins, and collectible coins.

Customers can also take advantage of the following benefits:

Free Shipping on Orders $2,500 or More: Free shipping is available for orders over $2,500.

Free Coin Appraisal: Boston Bullion provides free appraisals on all coins, bullion, and precious metals.

IRA Accounts: Customers can purchase precious metals for their IRAs and set up IRAs through Boston Bullion.

BBB Accreditation: Boston Bullion is accredited with the BBB.

Cons Explained

The Better Business Bureau has given Boston Bullion a rating of F for customer complaints.

Cons Explained

Boston Bullion offers two different types of investment plans: gold and silver. Silver costs $50 per contract, while gold costs $100 per contract. You have the choice of making a single purchase or investing in a 12-month plan.

The 12-month plan allows you to make monthly payments of $50 per contract. If you decide to make a single purchase, you will be charged a $150 fee.

Boston Bullion charges a $25 fee for withdrawing your investment. The minimum deposit is $50, and the minimum amount for withdrawal is $250.

Available Plans

Through a tiered membership structure, Boston Bullion offers three investment plans:

Silver

Gold

Platinum

Gold and Silver Plans

Gold and Silver plans are only available to residents of Massachusetts.

Gold and Silver Plans offer 1 oz. of physical gold, silver, or platinum, in either bullion or numismatic form, every month for a $99.95 monthly membership fee.

Bullion Plans

Bullion plans lock in the price of gold and silver, which is determined by the market value of gold, silver, and platinum on trading days preceding the delivery. Bullion plans offer 1 oz. of physical gold, silver, or platinum, in either bullion or numismatic form, every month for a $149.95 monthly membership fee.

Platinum Plans

Platinum plans offer 1 oz. of physical platinum, in either bullion or numismatic form, every month for a $199.95 monthly membership fee.

Additional Services

Boston Bullion also offers additional services such as storage, vaulting, and IRA accounts.

Storage services offer .999+ fine coins and bars in secure locations for $3.50 per ounce per month.

Vaulting services offer .999+ fine coins and bars in secure locations for $5.00 per ounce per month.

IRA accounts offer precious metals, including silver, gold, and platinum, for a low annual fee.

Example Plans

You can choose from a variety of gold, silver, platinum, and palladium bullion plans. As a comparison, here is how various plans break down.

$249.95/month for 1-ounce gold bars

$1,255.95/month for 1-ounce gold bars

$503.95/month for 1-ounce silver bars

$1,255.95/month for 1-ounce silver bars

$2,500/month for 1-ounce platinum bars

$2,500/month for 1-ounce palladium bars

Customer Service

Customer service is one of the factors that put Boston Bullion ahead of other gold and silver companies. With a team of highly trained experts, the company is ready to help customers anytime. The customer service representatives are friendly, knowledgeable, and helpful. Customers can call the company anytime between 9:30 a.m. and 6:00 p.m. EST and speak to one of the helpful representatives.

The website of the company also has an extensive FAQ section that answers most of the frequently asked questions regarding the company, its products, and its services. The FAQ section also provides useful information on how customers can invest in gold and precious metals and how to protect against any risk related to their investment.

Gold IRA: Should You Open One To Save For Retirement?

Other Ways to Invest With Boston Bullion

Boston Bullion offers customers several ways to invest with precious metals. The company purchases physical bullion from consumers and sells it on to the public. These third-party sellers include coin shops, jewelers, pawn shops, and other precious metal shops.

In addition to selling bullion to interested parties, Boston Bullion also buys precious metals from individuals by its mail-in program. Consumers simply mail their precious metals to the company, and the company pays for it.