Read Bullionmax Reviews

- The retirement savings plan, known as 401(k), is one of the most popular retirement savings plans in the US.

- The 401(k) is a defined contribution plan, which sets aside a portion of an employee's salary for retirement savings.

- The 401(k) is a pre-tax account, meaning contributions are made before taxes.

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site.

Pros Explained

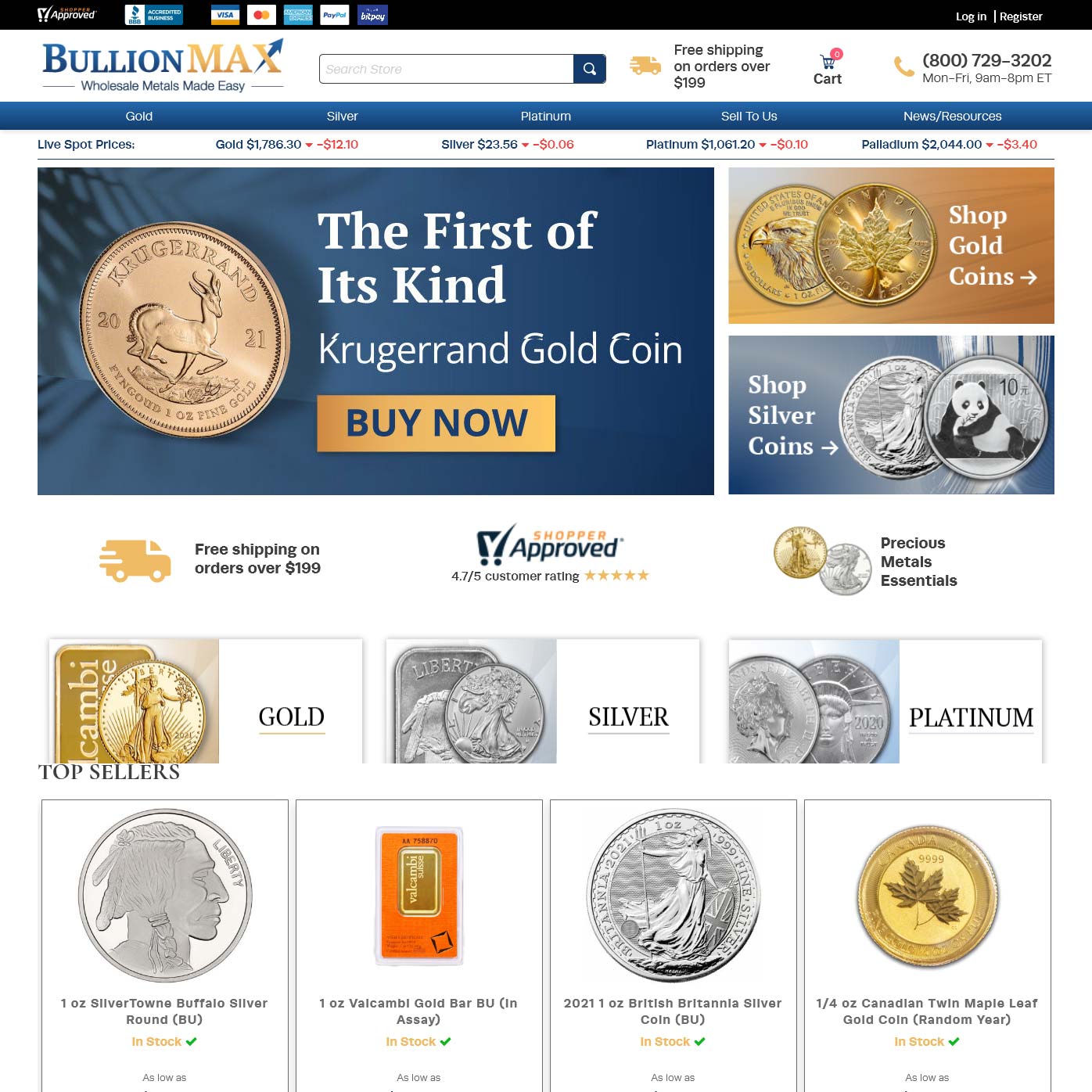

Bullionmax has a solid record of providing its clients with fair, transparent prices. The company's website says that it is committed to providing 24/7 access to bullion prices, and having live, online dealers available to help clients. The website also says that Bullion Securities Limited (BSL) is "the parent company of Bullionmax."

Bullionmax's website states that the company is the oldest company in the bullion industry. It has been in business for more than 30 years.

Cons Explained

Bullionmax.com offers pricing at markups of up to 20% (sometimes even more). The markups are justified because the dealer has to pay for the storage, insurance, transportation, and grading itself. Still, the markups are higher than what you'll find elsewhere.

The markups are 20% higher even than the markups charged by other dealers such as APMEX.

The markups charged by Bullionmax.com are similar to those charged by other dealers such as Apmex, Goldline, and Kitco.

The markups charged by Bullionmax.com are higher than those charged by other dealers such as Apmex, Goldline, and Kitco.

The markups charged by Bullionmax.com are lower than those charged by other dealers such as Apmex, Goldline, and Kitco.

Available Courses

There are two main courses offered by Bullionmax. The first is the people who are interested in this field and want to learn about the details of gold and bullion trading, as well as learn the fundamentals of the commodity market. The second set of people are the people who want to invest in gold, bullion, and commodities. The courses cater to both of these sets of people.

Why Invest In Gold

Even though gold prices have been falling, investors still purchase gold as a hedge against inflation and uncertainty. And investors remain bullish on gold despite the recent pullback.

Gold has historically been seen as a safe investment during times of economic uncertainty and volatility. The precious metal was used as a hedge against inflation in the past, and during times of fear in the markets, investors turned to gold as a safe-haven asset.

The Federal Reserve and the European Central Bank have both been very aggressive in their efforts to boost the global economy, but their efforts have backfired. Their policies have created asset bubbles and inflated stock and real estate prices. This has created a great deal of uncertainty for both investors and businesses.

Gold Price Forecast

The gold price has rallied since November, with gold prices closing above their 200-day moving average for the first time since early 2013.

Goldman is now forecasting that gold prices will rally to $1,300 by 2020, up from $1,050 now.

"Gold has underperformed vs. other assets, as central banks have recommitted to easing, and the U.S. dollar has appreciated vs. most currencies," Goldman says.

Gold ETF Investment

Gold ETFs are exchange-traded funds that invest in both bullion and futures positions.

The SPDR Gold Shares (GLD) is the largest gold ETF, with $40.87 billion in assets under management (AUM). This fund tracks the price of gold bullion and futures, and it does not charge a management fee.

The iShares Gold Trust (IAU) is another popular fund, with $13.62 billion in AUM. This fund follows the price of gold bullion, and it too does not charge a management fee.

The iShares Silver Trust (SLV) invests primarily in silver futures, with $1.61 billion in AUM. This fund charges a management fee of 0.25%.

Gold Investment Strategies

Investing in commodities is not just about buying precious metals. Gold and silver have stable values, making them excellent assets for portfolio diversification. Gold prices tend to rise during periods of recession, when investors seek alternative assets or safe havens. When inflation picks up, the price of gold also shoots up, as investors seek to preserve their wealth.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

Bullionmax stands out compared to its competition in several ways. In addition to taking physical delivery of precious metals, it offers competitive pricing and a 7% discount on all purchases over $1,000. It also provides a live gold price feed, unlike some competitors. The only drawback is that Bullionmax only trades in precious metals, which may limit its appeal to some investors.