Maximize Your Cash Back Rewards with a Chime Investment Account

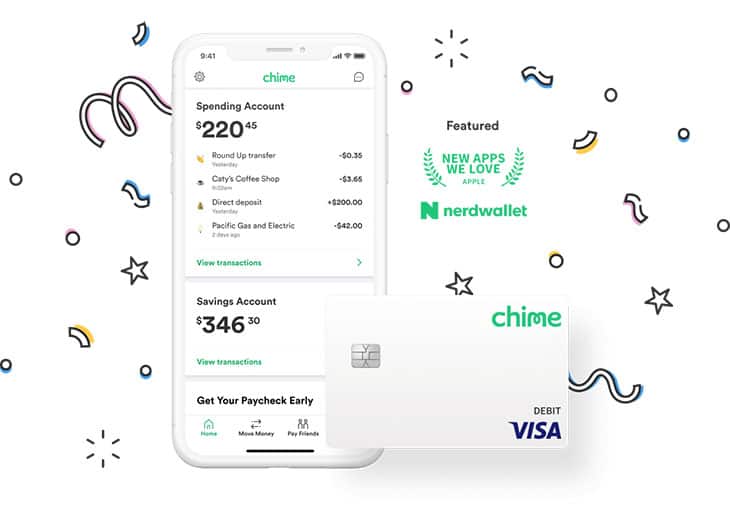

- Chime is a digital bank that offers debit and credit cards, as well as a high-interest savings account.

- Chime is a mobile-only bank, so it doesn't have a physical ATM network, nor will it mail checks.

- Chime is a mobile-only bank that offers debit and credit cards, as well as a high-interest savings account.

Chime is an online bank that aims to enrich the lives of its customers through a variety of online tools and services. A Chime investment account enables you to earn cash back on purchases you make with Chime debit cards.

Chime Savings Account

Chime's free checking account allows you to receive free digital coins, refunds, and interest when you meet minimum balance requirements. You can also transfer funds between your Chime account and other bank accounts for free and 24/7.

Chime's savings account offers competitive interest rates with no minimum balance requirement, so you can start saving now.

Chime CD

Invest up to $100,000 in a certificate of deposit (CD) and earn 1.33% APY. With a 2-year CD, interest compounds monthly, and with a 3-year CD, interest is compounded quarterly.

There's no monthly or annual fee, but there will be a $10 charge for an early withdrawal.

Chime Money Market

Chime's Money Market account earns 3.05% APY. That rate rivals the top savings rates and money market rates offered by top banks, but it offers more flexibility.

There are no monthly service fees, and you won't pay any overdraft fees. However, there's a daily withdrawal limit of $5,000, and you can't make deposits or access your Chime account by ATM.

Chime Money Market is FDIC-insured, and your money is FDIC-insured to $250,000.

Chime's free mobile app makes it easy and convenient to manage your Money Market account. The app lets you check your balance, transfer money between accounts, view transaction history, and deposit checks.

Chime Money Market Plus

Minimum Deposit: $1,000

Annual Percentage Yield (APY): 2.25%

Minimum Balance to Earn Interest: $1,000

No Annual Fee

Monthly Maintenance Fee: $5

Chime Money Market Plus is a low-risk savings account. However, it pays a higher interest rate than a standard savings account. The account requires a minimum opening deposit of $1,000. Monthly maintenance fees are waived when the minimum daily balance is met. All withdrawals made prior to statement closing date are charged a $5 fee.

Chime Money Market IRA

This account has a minimum opening deposit of $5,000. It offers a 1.45% APY, with no monthly or annual maintenance fees.

Chime Money Market Checking

This account has a minimum opening deposit of $1,000. It offers a 1.45% APY, with no monthly or annual maintenance fees.

Chime Savings

This account has a minimum opening deposit of $1,000. It offers a 1.45% APY, with no monthly or annual maintenance fees.

Chime Regular Checking

This account has a minimum opening deposit of $1. It offers a 0.75% APY, with no monthly or annual maintenance fees.

Chime Money Market IRA Plus

Chime's money market account comes with a 1.25% APY. Interest accrues daily, and grows monthly, so you can set aside a monthly amount and earn interest on your entire balance. No fees are charged, and you can have both a checking and a savings account with this account.

Chime 529 College Savings Plan

While you can open a 529 with any state, many 529s offer additional perks. The Chime 529 College Savings Plan offers up to 2.00% cash back on your investments, depending on your balance.

The additional cash back is tiered, and your rewards increase as your account grows. For example, with a $2,500 balance, you'll earn 0.50% cash back. With a $25,000 balance, you'll earn 1.00% cash back.

Chime offers a competitive rate, competitive fees, and appealing investment options. However, this 529 plan is only available to residents of Colorado, North Carolina, South Carolina, and Utah.

Chime 529 College Savings Plan Plus

A 529 College Savings Plan is, as its name suggests, a savings vehicle used to save for college. But it also offers other investment options, such as a managed investment account.

The Chime 529 College Savings Plan Plus offers customers a managed investment account, which is similar to a mutual fund. The benefits of a managed investment account include:

Access to professionally managed portfolios

Daily rebalancing

Tax-free withdrawals

All managed investment accounts have an annual expense ratio of 0.50%, which is 10 times less expensive than the expense ratio for actively managed mutual funds.

Chime Business Checking

Chime Business Checking accounts offer $0 per-check fees (with up to 500 checks per quarter), 3% cash back on purchases, unlimited check writing, unlimited debit cards, and ACH and P2P payments. There are no monthly maintenance fees, no minimum balance requirement, and you'll receive a $200 cash bonus when you open a new Chime Business Checking account.

Chime's Business Money Market

Chime's Business Money Market account offers unlimited check writing, unlimited debit cards, and ACH and P2P payments. There is no monthly maintenance fee, no minimum balance requirement, and you'll receive a $200 cash bonus when you open a new Chime Business Money Market account.

Chime's Business Savings

Chime's Business Savings accounts offer $0 per-check fees (with up to 500 checks per quarter), 1.25% APY on balances of $0-$2,999.99, 1.50% APY on balances of $3,000-$29,999.99, 1.75% APY on balances of $30,000-$99,999.99, 2.00% APY on balances of $100,000 or more, and 0.25% APY for balances below $100,000. There are no monthly maintenance fees, no minimum balance requirement, and you'll receive a $200 cash bonus when you open a new Chime Business Savings account.

Gold IRA: Should You Open One To Save For Retirement?

Chime Business Checking Plus

Chime Business Checking Plus earns 1% cash back on eligible debit card purchases. There are no limits to how much you can earn cash back.

Chime Business Savings

Chime Business Savings earns 2% APY on balances up to $5,000. No minimum balance is required to earn interest.