Discover the Countries Buying Gold

- Gold has been in a strong bull market since 2016.

- Investors who want to invest in gold can do so by purchasing the SPDR Gold Shares ETF (GLD), which is backed by physical gold.

- D is the second-largest gold ETF in the world. Investors who want to invest in gold but are afraid of being a victim of fraud can look for gold-backed ETFs.

- These ETFs are designed to track the price of gold, but do not include physical gold.

In 2016, gold prices reached an all-time high of $1,350 per ounce. The commodity's price has been climbing steadily since then, but gold investing has been a serious thorn in investor's sides.

In 2018, new gold-backed ETFs were introduced, which gave investors the opportunity to purchase gold without physically owning it. This investment vehicle has really helped fuel the bull market in gold.

Gold is in high demand, not the least because it's used as a hedge against economic and political uncertainty. The rising popularity of gold ETFs has created a whole new breed of investors interested in gold investing.

Keeping this in mind, let's have a look at some of the countries that have been purchasing gold in 2019.

How Much Gold is Being Consumed?

In 2019, 3,300 metric tons of gold were produced, but only 2,500 metric tons were consumed. When a commodity like gold is consumed, it's an indication that more gold is being purchased than is mined. Since gold production doesn't keep pace with gold demand, the supply/demand balances have shifted.

The demand side of the equation is driven by a number of factors, including:

The demand for jewelry and coins

The demand for investment purposes

The demand for gold for industrial purposes

The demand for gold for jewelry, coins, and investment purposes rose 38.4% in 2019, due to the factors mentioned above.

Gold Demand in China

The People's Bank of China (PBOC) is China's central bank and one of the most influential central banks in the world. The bank has a monopoly on the issuance of bank notes in China. The PBOC has been buying gold since 2002.

The PBOC has been buying gold primarily to diversify its foreign exchange reserves. China's foreign exchange reserves are second only to those of the United States.

Gold demand in China has been increasing steadily since 2002. Gold demand in China in 2021 was 1,245 metric tonnes. This was down from 1,318 metric tonnes in 2020, and up from 1,104 metric tonnes in 2019.

Gold demand in China is tightly correlated with the Chinese yuan. The yuan and gold prices are inversely correlated. When the dollar weakens, gold prices rise and vice versa.

Gold Demand in India

India has been the world's second-largest consumer of gold since 2013. Gold demand in India rose 18% to 1,044 tonnes in 2018, after falling 8% in 2017, primarily due to a sharp decline in the wedding season.

The demand in India is expected to continue rising in 2019, driven by higher gold prices. The country's central bank, the Reserve Bank of India (RBI), has been selling gold from its reserves, which it has accumulated since 2013. As of Aug. 2019, the RBI had 566 tonnes of gold in its reserves.

Gold Demand in China

China has been the world's largest consumer of gold since 2013. The Chinese gold market accounts for 40% of the global demand for gold. Gold demand in China rose 9% in 2018 to 1,054 tonnes, after rising 20% in 2017.

The Chinese gold demand is expected to post a strong rise in 2019. The Chinese yuan has depreciated 9% against the dollar since April 2018. This is expected to support gold prices, leading to higher consumer gold demand in the country.

Gold Demand in the UAE

Gold demand in the UAE is estimated to have increased by 6.3% in 2018, according to the World Gold Council. Dubai and Abu Dhabi are large consumers of gold in the UAE, with Dubai having 23.7% of the country's total gold demand in 2018.

Gold demand in Saudi Arabia increased by 9.2% in 2018, with Saudi Arabia's consumption of gold accounting for 19.8% of the country's total gold demand.

Gold Demand in India

Gold demand in India is estimated to have increased by 1.9% in 2018, according to the World Gold Council. India's consumption of gold accounted for 1.5% of the country's total gold demand in 2018.

Gold Demand in China

Gold demand in China is estimated to have increased by 4.7% in 2018, according to the World Gold Council. China's consumption of gold accounted for 8.6% of the country's total gold demand in 2018.

Gold Demand in Turkey

Gold demand in Turkey is estimated to have increased by 8.9% in 2018, according to the World Gold Council. Turkey's consumption of gold accounted for 7.6% of the country's total gold demand in 2018.

Gold Demand in Nigeria

Gold demand in Nigeria rose from 221.6 tons in 2015 to 634.1 tons in 2021, according to data from the International Monetary Fund. Nigeria's growth was mainly driven by import demand. Gold demand in Nigeria is forecast to rise by 5.7% in 2021 to 819.7 tons, according to a new report from Capital Economics.

Gold Demand in China

Gold demand in China rose sharply in 2021 as consumers sought to protect themselves against the country's economic slowdown. China's gold demand rose from 1,205 tons in 2015 to 3,762 tons in 2021, according to data from the International Monetary Fund.

China's gold demand is forecast to rise by 3.6% in 2021 to 4,109 tons, according to the latest report from Capital Economics.

Gold Demand in India

Gold demand in India was relatively flat from 2015 to 2020. India's gold demand was 1,514 tons in 2020, up 0.1% from 1,513 tons in 2019, according to the International Monetary Fund.

India's gold demand is forecast to rise by 6.3% in 2021 to 1,598 tons, according to data from Capital Economics.

Gold Demand in Russia

In Russia, gold demand and holdings are significant. Russia has historically been a holder of gold and, as of 2018, Russian gold holdings were reported to be 2,928.5 tons. The Central Bank of Russia does not have any official restrictions on gold ownership.

Gold Demand in China

China has been raising its gold reserves since 2016. The People's Bank of China (PBOC) has been buying gold since 2015. In 2018, the PBOC purchased 651.3 tons, which represented 76% of the country's total gold demand.

Gold Demand in India

India has been seeking to raise its gold reserves since 2015. In 2018, India purchased 466.6 tons, which was 33% of the country's total demand. India is also seeking to reduce its reliance on the U.S. dollar.

Gold Demand in Other Countries

Gold demand is steadily increasing in countries including Turkey, Vietnam, and South Korea.

Gold Demand in Bangladesh

Gold demand in Bangladesh is steadily increasing. In 2012, gold demand in Bangladesh stood at only 20.5 metric tons. However, in 2019, the gold demand in Bangladesh increased to 48.5 metric tons. The main drivers of the surge in gold demand in Bangladesh are:

Rising prices of gold

Increased investment (both local and foreign investment)

The increasing trend of gold jewelry demand

Gold demand in Bangladesh is forecasted to rise further over the next few years as bullion demand is likely to increase.

Gold IRA: Should You Open One To Save For Retirement?

Gold Demand in Other Countries

Gold demand is driven by a number of factors, including:

Global GDP growth

Inflation levels

Political risk

Currency exchange rates

Central Bank monetary policy

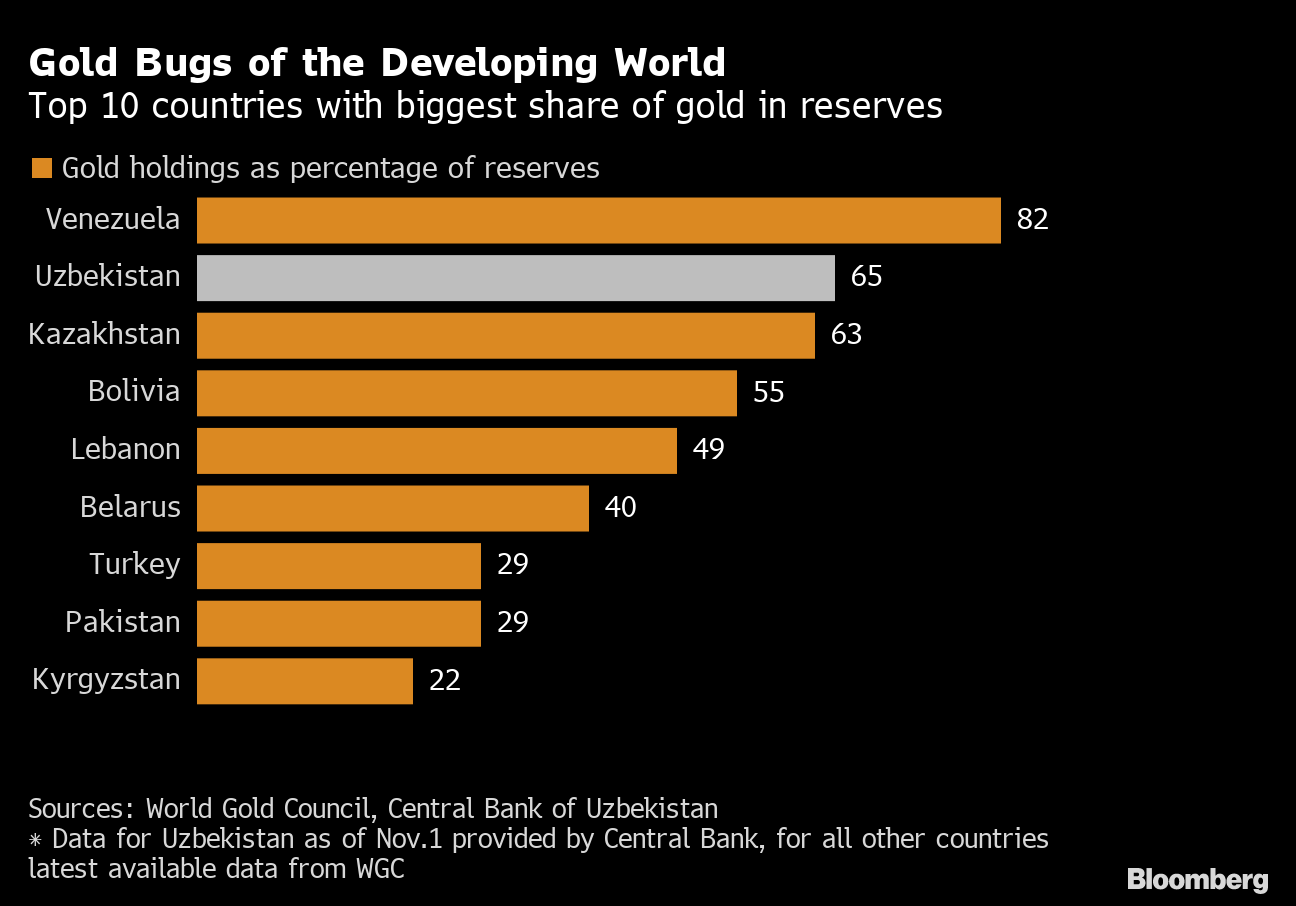

The chart below from [@Bloomberg] shows gold demand by country in 2020.