Avoid These Gold Buying Scams

- Gold scams may attempt to convince investors to purchase fake jewelry or coins, fake government gold auctions, or fake gold loan programs.

- The gold market has a long history of being peppered with scams and frauds.

- This ranges from fake jewelry and coins, fake government gold auctions, and fake gold loan programs.

- Other scams include alleged price manipulation by central banks and illegal gold trading by money-laundering operations.

Gold is one of the popular targets for con artists, and there are plenty of ways they can try to separate you from your money. Gold scams include fake sales of jewelry and coins, fake government gold auctions, and fake gold loan programs.

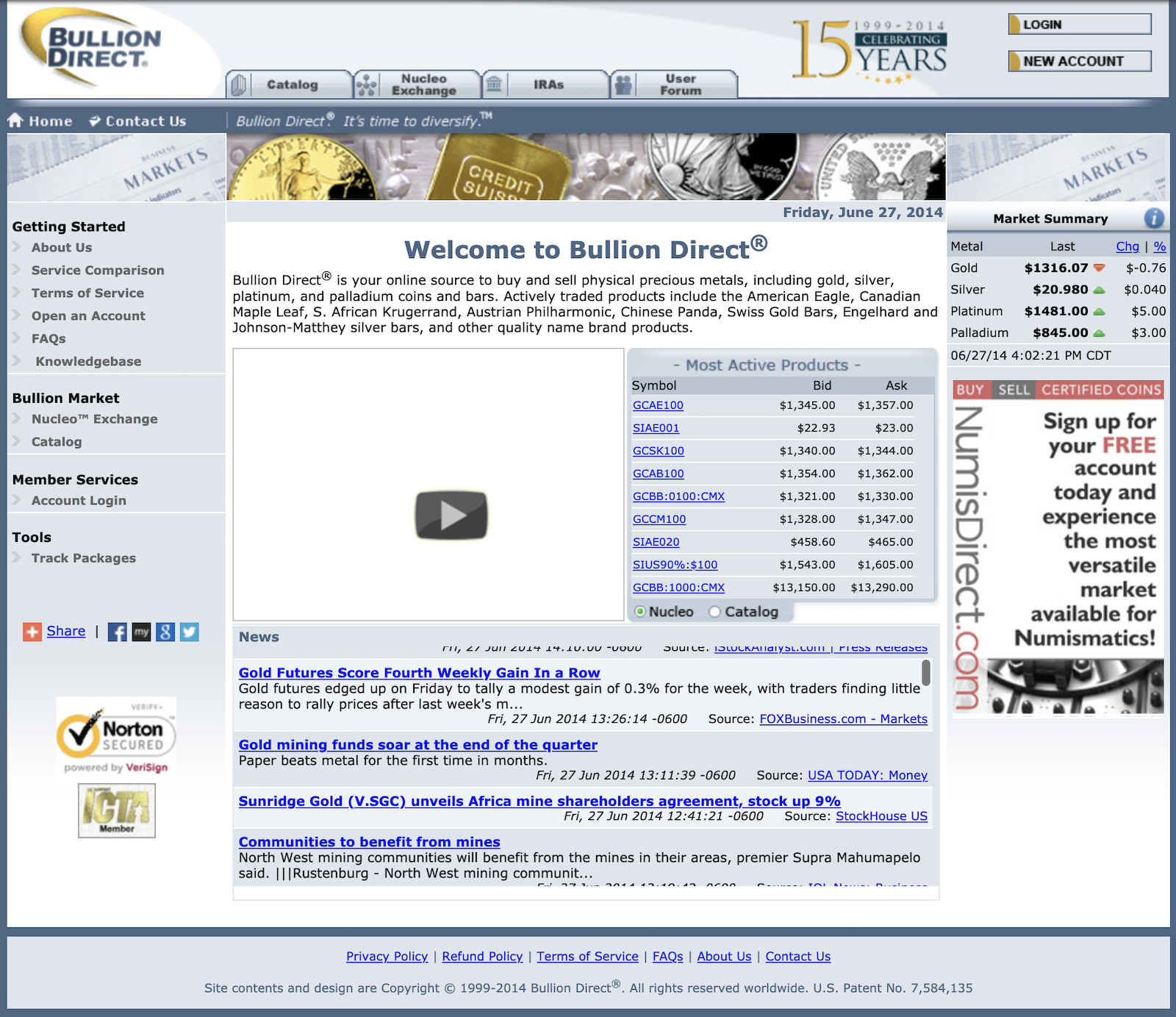

Phony Gold Dealers

Gold dealers are everywhere, from newspaper advertisements to television commercials. Unfortunately, many bogus gold dealers have set up shop to prey on the unwary.

Gold dealers often operate under a variety of names including:

Security brokers

Portfolio managers

Gold exchange-traded funds

Gold mutual funds

Gold savings plans

Precious metal dealers

The "Legal" Gold Dealer

Gold dealers that deal in precious metals and coins must abide by certain regulations. That's why you should only deal with a "legal" dealer who is licensed. Dealers that are licensed and authorized to buy gold from refineries include:

U.S. Mint

U.S. Treasury

Federal Reserve Bank

St. Louis Gold and Silver Exchange

General Tips for Gold Buying

When buying gold, always buy from a reputable dealer that has a history of paying its customers.

When buying gold, always buy at least 10% more ounces than you intend to sell. For example, if you want to sell 1 ounce of gold, buy 11 ounces.

Always store your gold in a safety deposit box or in a safe in your home.

Gold is usually priced per ounce, gram, or kilo. That's why you should always buy in multiples of these weights. For example, you should buy 50 ounces rather than 49.9 ounces.

Investing in gold is an excellent asset investment. However, you should consider whether it's the right investment for you.

Fake Gold Bars

The scam goes like this: you receive an email or call from someone purporting to be a gold trader. The emails or calls claim the person has gold to sell to you at a bargain.

Of course, the gold is fake. The scammers will fabricate gold bars, or procure them from a legitimate gold dealer and then forge the serial numbers, or add fake serial numbers, to make the gold appear legitimate. These fake gold bars can then be used to launder money, or they can simply be melted down and sold, thereby cashing in the phony gold bar investment.

Gold Investment Schemes

Some gold investment schemes are legitimate, while others are not. A legitimate gold investment scheme is a gold-backed mutual fund or exchange-traded fund (ETF). These funds hold physical gold, but the gold is held by the gold fund's custodian, not by the fund manager.

In a legitimate gold investment, the fund manager does not control the gold; the fund manager's job is simply to manage the fund's investments, which include the gold. The gold fund's custodian holds the physical gold.

Gold Storage

Gold storage scams typically involve pre-purchasing gold, paying storage fees, and paying annual storage fees thereafter. The gold is never actually delivered or purchased, and the storage fees continue to pile up.

Gold Bullion Delivery

Gold bullion delivery scams involve pre-purchasing gold bullion and receiving a certificate that states how much gold has been purchased. The certificate is issued by a fraudulent company, and the bullion is never actually delivered.

Gold Bullion Leasing

Gold bullion leasing scams involve pre-purchasing gold bullion and receiving a certificate that states how much gold has been purchased. The certificate is issued by a fraudulent company, and the gold is never actually delivered.

Gold Bullion Vault

Gold bullion vault scams involve purchasing gold bullion and receiving a certificate that states how much gold has been purchased. The certificate is issued by a fraudulent company, and the bullion is never actually delivered.

Gold IRAs

Scammers have used the IRA system to prey on unsuspecting investors, especially older investors facing retirement. Gold IRAs, in particular, have become a popular option for investors looking to diversify their portfolios. However, many of these so-called gold IRAs are actually scams.

The Federal Trade Commission (FTC) has warned investors to be wary of gold IRAs offered by local brokerage firms, financial advisors, and employers.

The FTC warns investors that gold IRAs carry fees and penalties, and that investors should take the time to research the fees and penalties associated with account options before choosing one.

Precious metals scams

Scammers have used precious metals scams as a way to scam innocent investors out of their hard-earned money. Precious metal scams involve companies that sell fake or misrepresented gold, silver, and platinum. These scam companies often target investors with high-pressure sales tactics and false claims.

The FTC warns that investors should be cautious about investing in precious metals. Investors should consult a licensed precious metals dealer or broker before making any investment.

Gold Bullion

Gold bullion is the shiny stuff you see in commercials and movies. It's pure gold that you can purchase in 1-ounce, 10-ounce, and 1 kilo weights. These are physical stores of value and can be used as currency.

Gold ETFs

Gold exchange-traded funds (ETFs) are funds that track the price of gold. ETF owners receive a certificate showing their ownership. The fund then divides the gold into shares that track the price of gold.

Gold Certificates

Gold certificates, or paper gold, is gold represented as an asset. Gold certificates are sometimes called fiat gold. These certificates are debts, or claims against the gold. The certificates trade on exchanges and trade just like stocks.