Discover the Benefits of a Gold Investment with Fidelity

- Gold coins can be purchased directly from the government.

- Gold bullion is also sold via brokerages, banks, and precious metal dealers. ETFs are traded on a major stock exchange, and many ETFs track gold prices.

- Gold bullion funds invest in gold bullion, including coins, bars, and ETFs.

There are few investments that can guarantee the steady growth of portfolio value like gold. Gold has enjoyed a much longer, more stable period of appreciation than most investments, and its price tends to consistently move upwards. Gold investors have enjoyed annual gains averaging over 5% in the past 30 years.

While gold's price may fluctuate in the short term, its long-term price trend is relatively consistent. It has been known to regularly increase its value by 5% to 10% per year. Although its price can react quickly to economic, geopolitical, and financial market events, it typically moves slowly enough that you can plan your gold purchases accordingly.

For gold investors, it is important to remember that not all gold investments are created equally. Gold bullion bullion is often found in coin form or in bars, but gold can also be purchased in the form of exchange-traded funds (ETFs) or mutual funds.

Fidelity's Gold Investment Strategy

Fidelity's Gold Strategy (FGLDX) is an institutional-class fund that tracks the S&P Global Gold Index. The fund's goal is to provide shareholders with investment returns that closely correlate to the performance of the underlying index.

Fidelity Gold offers investors a number of significant benefits:

The fund's management is highly experienced, and its expense ratio, at 0.50%, is the lowest among its competitors.

The fund is passively managed, which means that its underlying index is tracked without trying to beat it.

The fund's fund family, Fidelity Funds, is one of the world's largest, with more than $3.5 trillion in assets under management (as of Sept. 2, 2020).

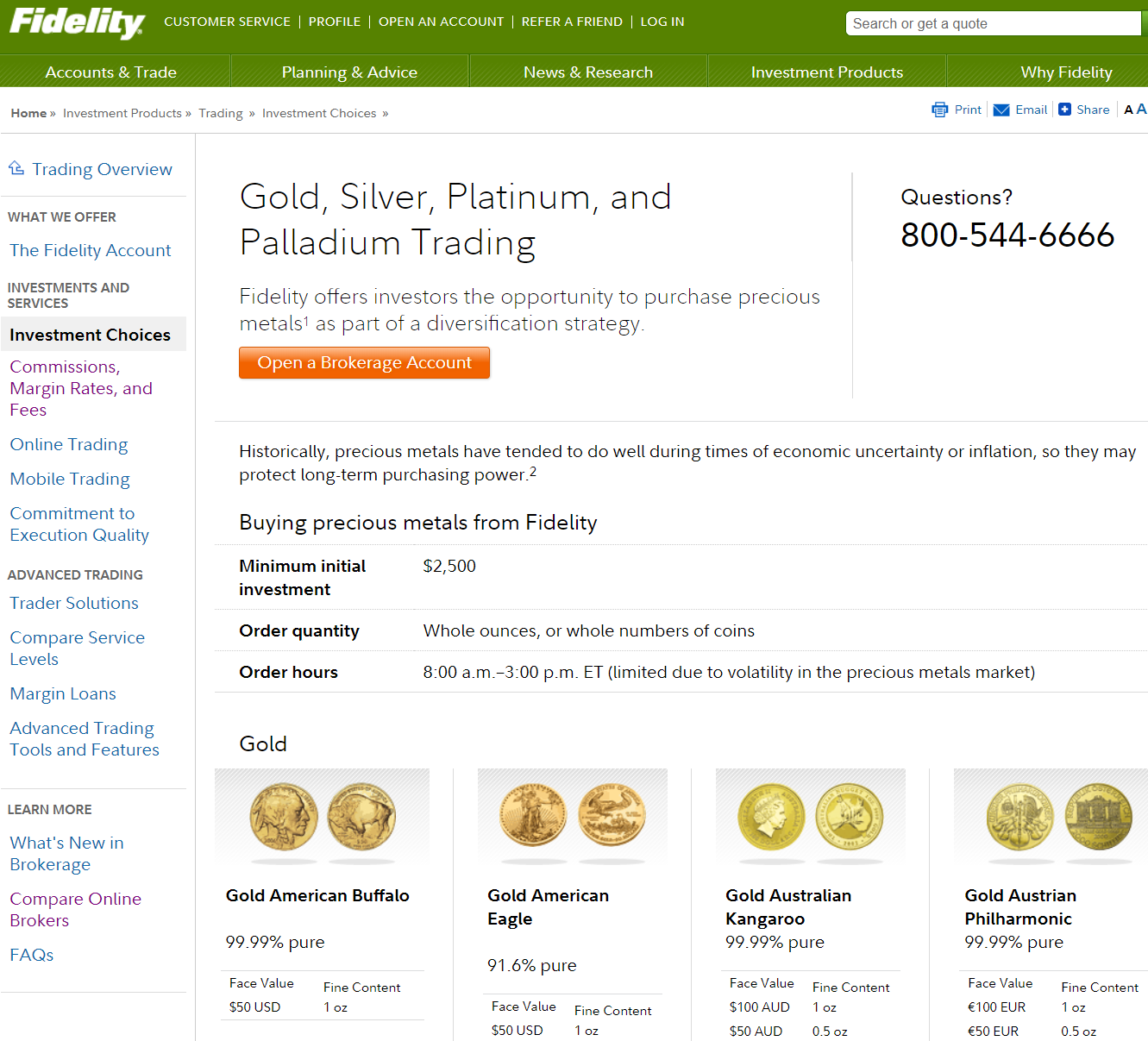

Fidelity's Gold Investment Options

Gold is a time-tested, stable asset that has been known to increase in value during times of market turmoil, making it an ideal alternative to stocks while providing you peace of mind.

Fidelity offers both physical gold and bullion to its more than 27 million retail customers in 13 countries, including the United States, Canada, and the U.K.

Fidelity's 100-ounce Gold Bullion Bar is 100% physical gold, which is a cost-effective way to invest in gold, and manufactured and guaranteed by PAMP Suisse. Each bar is individually sealed and carries an assay card detailing its fineness, weight, and purity.

Fidelity's Gold Bullion Cash Account is where your gold is stored, and is managed by PAMP Suisse. You can hold gold in the form of your Fidelity Gold Bullion Cash Account, or transfer your gold or silver from another 401(k) or IRA account.

The cash account allows you to either order your gold online, or by phone (1-800-343-3548), or you can transfer your existing gold, silver, or platinum from another 401(k) or IRA account.

Once you've bought your gold, it will be stored with PAMP in secure vaults in Zurich, New York, London, and Toronto.

Fidelity's Gold Investment Pros

Fidelity is one of the world's largest investment firms, boasting over $6.8 trillion in assets under management (AUM) as of June 30, 2021.

Fidelity offers clients access to more than 100 funds that span a wide range of asset classes, including commodities, fixed income, international equities, emerging market equities, REITs, and money market funds.

Fidelity now offers 24- and 12-month Guaranteed Investment Certificates (GICs).

Fidelity offers 24- and 12-month GICs with rates ranging from 1.00% to 2.80%. The 24-month GICs are backed by physical gold, while the 12-month GICs are backed by physical silver.

Fidelity's 24- and 12-month GICs carry no withdrawal fees and no surrender fees.

Fidelity also offers 36-month GICs, which carry a minimum investment of $1,000.

Fidelity's 36- and 24-month GICs carry minimum investment rates of 1.00%.

Fidelity's Gold Investment Cons

Fidelity's Gold Investment Pros

Has one of the highest minimum online investments for gold mutual fund: $3,000.

Has a 0.25% expense ratio, which is high compared to other gold investment vehicles

Has a 0.25% redemption fee on redemptions, which is high compared to other gold investment vehicles