Gold Price Charts and Historical Lear Capital Spot Price

Unveiling the Mysteries: Unlocking the Historical Journey of Gold Prices and its Intricate Patterns

Factors Affecting Gold Prices

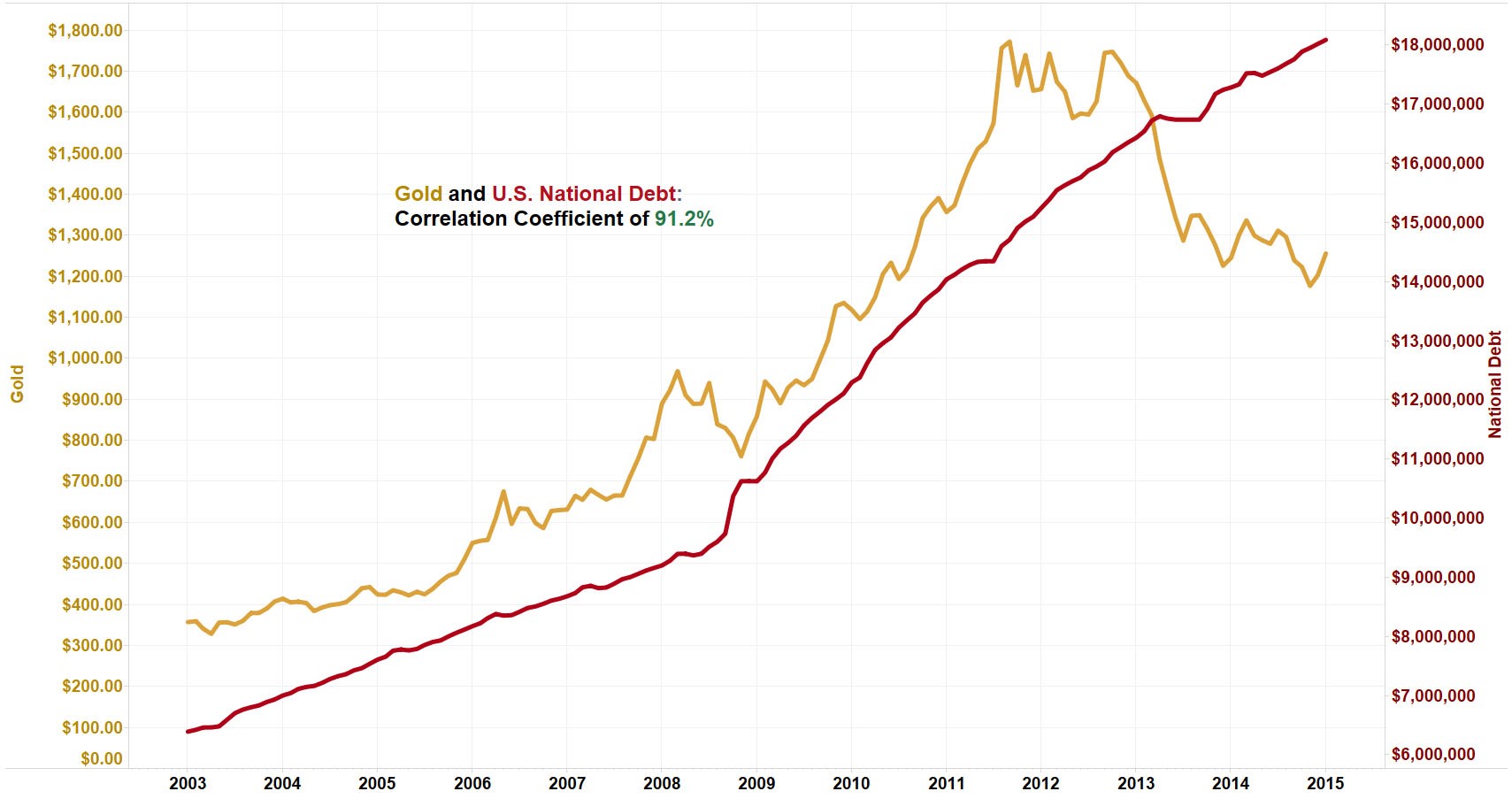

Factors affecting gold prices include economic indicators, geopolitical events, central bank policies, and investor sentiment. These factors can impact the demand and supply of gold, which in turn affects its price. For example, economic uncertainty can drive up demand for gold as a safe-haven asset, while a strong economy and rising interest rates may decrease its appeal. Additionally, changes in currency values, particularly the US dollar, can also influence gold prices. It's important to monitor these factors and consult with experts to make informed decisions when buying or selling gold. Lear Capital offers gold price charts and historical spot prices to help investors track and analyze gold's performance.

Understanding the Gold Spot Price

Understanding the Gold Spot Price is crucial for anyone interested in investing in gold. The spot price refers to the current market price of gold per ounce. This price is determined by various factors including supply and demand, economic conditions, and market sentiment. It is important to track the spot price regularly as it can fluctuate throughout the day. Gold price charts and historical data can provide valuable insights into the performance of gold over time. Lear Capital offers a Gold Holdings Calculator that allows investors to calculate the value of their gold holdings based on the spot price. By staying informed about the spot price and historical trends, investors can make more informed decisions about their gold purchases.

Calculating and Changing Gold Spot Prices

Calculating and changing gold spot prices is essential for investors and traders in the precious metals market. Gold price charts provide historical data that can help you track trends and make informed decisions. Lear Capital's spot price charts offer valuable information on the value of gold in different currencies and units such as ounces and grams. By using the Holdings Calculator, you can easily determine the value of your gold holdings based on the current spot price. When requesting information or making purchases, be sure to provide accurate details like weight and quantity to get the right price. Keep in mind that factors like currency exchange rates and market conditions can impact the value of gold. Stay informed and consult experts for up-to-date analysis.

Gold Spot Price and Market Dynamics

The Gold Spot Price and Market Dynamics play a crucial role in understanding the value of gold. By analyzing Gold Price Charts and Historical Lear Capital Spot Price, investors can gain insights into market trends and make informed decisions. The price of gold is determined by various factors such as supply and demand dynamics, geopolitical events, and economic indicators. Central Banks and the Federal Reserve Chairman's actions also impact gold prices. Additionally, factors like the weight of gold (in ounces or grams), the value of the US dollar, and historical data from the World Gold Council can provide valuable information. It is important to consider the balance between risk and potential profit when investing in gold.

Gold Trading and Financial Instruments

Gold trading and financial instruments are crucial aspects of the gold market. Understanding gold price charts and historical data can help investors make informed decisions. Lear Capital's spot price for gold is a reliable resource for tracking gold prices over time. These charts provide valuable insights into the price fluctuations of gold, allowing investors to identify trends and potential opportunities. Whether you are interested in buying or selling gold, staying updated with gold price charts can be instrumental in making profitable decisions. Lear Capital is a reputable company in the industry, known for its expertise in gold trading. By analyzing historical data and staying informed about market trends, investors can navigate the gold market with confidence.

Buying Gold and Tax Considerations

When buying gold, it's important to consider the tax implications. Gold prices charts can help you make informed decisions, but it's also crucial to understand the tax rules. The Federal Reserve Chairman and Central Banks play a role in the gold market, so it's important to monitor their actions. If you're buying gold from a company like Rosland Capital, make sure to provide your telephone number or email address for communication purposes. Additionally, be aware of any SMS message or text message consent you may need to provide. Understanding the tax implications and staying informed about the market will help you make the right decisions when buying gold.

Gold IRA: Should You Open One To Save For Retirement?