The Hero Precious Metals for Your IRA

- Precious metals are long-term investments, and prices can fluctuate in the short term.

- Investors should consider the instruments they use to invest in precious metals carefully. Precious metals are long-term investments that fluctuate in value in the short term.

- Investors should consider the instruments they use to invest in precious metals carefully.

Gold and silver have had a long, steady climb as the most sought-after and enduring stores of wealth. And precious metals investing has flourished in self-directed IRAs, which give investors more tools and more flexibility than the traditional retirement accounts offered by most employers.

Gold, silver, and platinum prices have been steadily climbing since 2016, a period that has marked one of the longest bull markets for precious metals on record.

Precious Metals for an IRA

Gold

Gold has always been considered a safe haven investment. Investors have always believed that buying gold was a sure way to protect their assets from inflation.

The price of gold tends to increase during volatile periods. Investors seek refuge in gold in times of economic crisis and uncertainty.

Gold is the only precious metal that is universally accepted as money. Gold has been used in jewelry for centuries. Gold has been a reliable store of value for thousands of years.

Gold is also a good hedge against inflation. Inflation tends to erode the purchasing power of nominal assets, including stocks, bonds, and real estate. Cross-border transactions generally involve gold, as gold is universally accepted as money.

The Investment Case for Gold

Gold can be a good investment if investors believe that economic conditions are uncertain and that stocks and bonds will be hammered by inflation.

While investors can buy gold in physical form, buying gold in an IRA account allows investors to hold gold as a physical asset.

A person can buy and sell gold, or exchange gold for anything else, at any time.

Limitations on Gold

Gold is not a good long-term investment.

Gold has high storage costs. Storing gold costs money, and the cost of storage rises with the price of gold.

Gold is volatile. The price of gold can fluctuate dramatically.

Gold does not pay interest.

Gold is subject to manipulation. The price of gold can be manipulated by governments, central banks, and bullion banks.

Gold is not liquid. A person cannot quickly sell gold.

Gold is difficult to value. It is difficult to value gold because gold does not have a practical equivalent in goods or services.

Gold

Gold is the precious metal most often used in IRAs. The IRAs offered by Bullion Vault, for example, allow investors to purchase up to 400 ounces of physical gold, with 100 ounces being the minimum purchase. Gold bars, referred to as "Bars," are the most common form of gold investment, though coins are also an option. Gold coins, or "Coins," come in different sizes and weights.

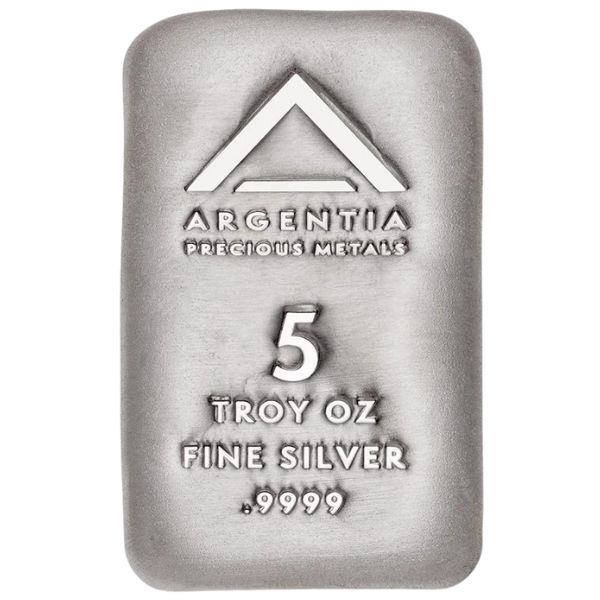

Silver

While gold is the traditional metal used in a retirement account, silver is also an option. The 401(k) Program offered by Bullion Vault allows investors to purchase up to 1,000 ounces of silver bars, with 40 ounces being the minimum purchase. Investors can choose from a variety of different sizes, ranging from 1 troy ounce to 100 ounces. Silver coins, or "Coins," are also an option.

Platinum

Platinum is more rare than gold and silver. The IRAs offered by Bullion Vault, for example, allow investors to purchase up to 400 ounces of platinum, with 40 ounces being the minimum purchase. The most common form of platinum investment is bars, though coins and jewelry are also available.

Copper

Copper is another rare and valuable metal. The IRAs offered by Bullion Vault, for example, allow investors to purchase up to 400 ounces of copper, with 10 ounces being the minimum purchase. The most common form of copper investment is copper bars, though coins and jewelry are also available.

Silver

Silver is the most precious metal of physical IRAs. Silver prices have risen significantly since 2015, when the market bottomed out.

Gold

Gold has been the primary precious metal of IRAs for decades. Gold prices have risen significantly in 2016 and 2017, and are now at a five-year high.

Platinum

Platinum is a newer precious metal choice for an IRA. Prices are near a five-year low and have yet to recover.

Platinum and Palladium

Platinum is one of the rarest precious metals in the world. However, it is widely used as a precious metal for jewelry, and in catalytic converters. Platinum is less dense than gold, and therefore it is not often used in coins. The price of platinum recently hit $1,610 per ounce, up 18.25% year-to-date (YTD).

Palladium, another rare precious metal used for jewelry, is used extensively in the automotive industry and for catalytic converters. It is approximately 30% rarer than platinum, and trades higher at $1,826 per ounce, up 39.55% YTD. Palladium also is used to make jewelry, but less commonly, since it does not scratch as easily.

Gold

Gold is the most actively traded precious metal in the world. It is by far the most popular form of investment in precious metals. The price of gold is up more than 6% YTD at $1,360 per ounce, and gold has been the most popular precious metal for IRAs for many years.

Gold is the most liquid precious metal. The yellow metal is inexpensive, and it is very easy to trade. Gold is used to make watches, jewelry, electronics, dental fillings, and medical devices.

Silver

Silver is slightly less popular than gold, but still one of the most liquid precious metals. The price of silver traded slightly north of $29 per ounce at the time of writing, up 9.6% YTD, compared with a 6.3% gain for gold.

Silver is used to make jewelry, coins, and electronics. Its purity is higher than that of gold, and therefore it is less expensive and more durable than gold.

Other Collectibles

Gold, silver, platinum, and other precious metals are among the most popular collectibles for IRAs. These metals are traded on over-the-counter (OTC) markets and are often bought in coin form or jewelry.

Gold, silver, and platinum are popular for their scarcity, portability, and relative price stability. Gold, for example, is relatively rare and has been used as currency for thousands of years.

Coins of precious metals are portable, can be easily stored in a safe, and are valuable on their own.

Gold, silver, and platinum can be used as a hedge against inflation. Though precious metals prices fluctuate, they tend to perform better than stocks, bonds, or real estate in periods of inflation.

Gold, silver, and platinum prices tend to fluctuate less than stocks, bonds, or real estate, making them a better hedge against inflation.

Rare Coins

Rare coins are another popular type of collectible for IRAs. Rare coins are minted by governments and private businesses, and their value is based on rarity, quality, and condition.

The rarity of a coin, for example, is determined by the demand for that coin. A coin minted in 1794, for example, is relatively rare because it has not been in circulation for nearly two hundred years.

The quality of a coin is determined primarily by the condition of the coin. A coin in mint condition, for example, is more valuable than a coin that has been circulated or worn.

The condition of a coin is also determined by its rarity. A coin in mint condition, for example, is more valuable than coins that have been circulated or worn.