Mastering the Backdoor Roth IRA with Fidelity

Learn how to maximize your retirement savings with Fidelity's guide to mastering the Backdoor Roth IRA strategy.

What is a Backdoor Roth IRA?

A Backdoor Roth IRA is a way for high earners to contribute to a Roth IRA, even if they exceed the income limits for direct Roth IRA contributions. This strategy involves making a non-deductible contribution to a traditional IRA, then converting it to a Roth IRA. This allows individuals to take advantage of the tax-free growth and withdrawals of a Roth IRA. It's important to note that this strategy may not be suitable for everyone and can have tax implications, so it's crucial to consult with a financial advisor before proceeding. Fidelity offers resources and guidance for those looking to master the Backdoor Roth IRA strategy.

Eligibility for a Backdoor Roth IRA

To be eligible for a Backdoor Roth IRA, you must first meet the income requirements for a traditional Roth IRA. As of 2021, individuals with a modified adjusted gross income (MAGI) of less than $140,000 and married couples filing jointly with a MAGI of less than $208,000 can contribute the full amount to a Roth IRA. However, those with higher incomes may still be able to utilize the Backdoor Roth IRA strategy.

The Backdoor Roth IRA is a way for high-income earners to contribute to a Roth IRA by first contributing to a traditional IRA and then converting it to a Roth IRA. This strategy is particularly useful for those who are not eligible for direct Roth IRA contributions due to income limits.

It is important to note that individuals who already have pre-tax funds in traditional IRAs may face tax consequences when converting to a Roth IRA. It is recommended to consult with a financial advisor or tax professional before utilizing the Backdoor Roth IRA strategy.

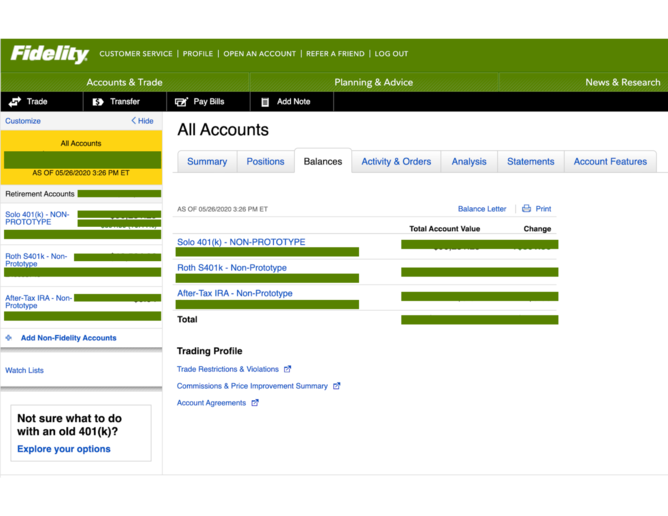

Opening a Traditional IRA with Fidelity

Opening a Traditional IRA with Fidelity is a straightforward process. You can do it online or over the phone. The first step is to gather your personal information, including your Social Security number, date of birth, and employment status. Next, you'll need to decide how much to contribute to your account. You can contribute up to $6,000 per year, or $7,000 if you're over 50. Once you've made your contribution, you can choose how to invest your money. Fidelity offers a range of investment options, including mutual funds, exchange-traded funds (ETFs), and individual stocks and bonds. Keep in mind that a Traditional IRA is a tax-deferred account, which means you won't pay taxes on your contributions until you withdraw them in retirement. You may also be eligible for a tax deduction on your contributions, depending on your income and other factors.

Converting a Traditional IRA to a Roth IRA

Converting a Traditional IRA to a Roth IRA can be a smart move for many investors, but it's important to understand the process and potential tax implications. The good news is that Fidelity offers a simple and straightforward way to make the conversion. First, you'll need to open a Roth IRA account with Fidelity if you don't already have one. Then, you'll need to initiate a transfer from your Traditional IRA account to your new Roth IRA account. This can be done online or by contacting Fidelity's customer service team. Keep in mind that you'll need to pay taxes on the amount you convert, so it's important to consider your tax bracket and potential tax liabilities before making the move. However, once your funds are in a Roth IRA, they'll grow tax-free and you won't have to worry about required minimum distributions (RMDs) in retirement. With Fidelity's easy conversion process and helpful resources, it's easier than ever to master the backdoor Roth IRA and take control of your retirement savings.

Tax Implications of a Backdoor Roth IRA

| Tax Implications of a Backdoor Roth IRA |

|---|

| Contributions to a traditional IRA are tax deductible. |

| Conversions from a traditional IRA to a Roth IRA are taxable. |

| High-income earners are not eligible to contribute to a Roth IRA directly. |

| Backdoor Roth IRA allows high-income earners to contribute to a Roth IRA indirectly. |

| Backdoor Roth IRA involves contributing to a traditional IRA and then converting it to a Roth IRA. |

| Contributions to a traditional IRA are not tax deductible for high-income earners who are eligible for a backdoor Roth IRA. |

| Conversions from a traditional IRA to a Roth IRA are tax-free for backdoor Roth IRA. |

| Backdoor Roth IRA can be a way to avoid required minimum distributions (RMDs) in retirement. |

| Backdoor Roth IRA can be a way to leave tax-free income to heirs. |

Long-Term Benefits of a Backdoor Roth IRA

A Backdoor Roth IRA offers several long-term benefits that make it a smart investment choice. Firstly, it provides tax-free growth potential, which means that all the earnings generated by the account will be free from taxes. This can result in significant savings over time.

Secondly, a Backdoor Roth IRA provides flexibility in retirement planning by allowing you to withdraw funds tax-free during retirement. This can be especially helpful for individuals who expect to be in a higher tax bracket during retirement.

Finally, a Backdoor Roth IRA provides an opportunity to pass on tax-free assets to your heirs. This means that your beneficiaries will receive the entire balance of your account without any tax liability. This can be a significant advantage when planning for the transfer of wealth to the next generation.

Overall, a Backdoor Roth IRA offers several long-term benefits that make it a wise investment choice for individuals who want to maximize their retirement savings and minimize their tax liability.

Gold IRA: Should You Open One To Save For Retirement?