Maximizing Your Wealth: Investing 10 Million Like a Boss

Discover the smartest ways to invest a large sum of money through the insights shared in this article titled "Maximizing Your Wealth: Investing 10 Million Like a Boss".

Understanding the Power of Compounding

Compounding is a powerful tool that can help you grow your wealth over time. It is the process of reinvesting earnings to generate even more earnings. This means that the longer you can keep your money invested, the more it will grow.

For example, if you invest $10 million today and earn an average return of 8% per year, you will have $21.6 million after 10 years. However, if you leave that money invested for another 10 years, you will have $46.6 million. That's the power of compounding at work.

The key to maximizing the power of compounding is to start investing early and to be patient. The longer you can keep your money invested, the more time it has to compound. It's also important to choose investments that have a high potential for growth and to diversify your portfolio to reduce risk.

Compounding is not a get-rich-quick scheme. It requires discipline, patience, and a long-term view. But if you can harness the power of compounding, you can build significant wealth over time and achieve your financial goals.

Diversifying Your Portfolio for Long-Term Growth

| Diversifying Your Portfolio for Long-Term Growth | |

|---|---|

| Asset Class | Allocation Percentage |

| Stocks | 40% |

| Bonds | 25% |

| Real Estate | 20% |

| Alternative Investments | 10% |

| Cash and Cash Equivalents | 5% |

Exploring Alternative Investment Opportunities

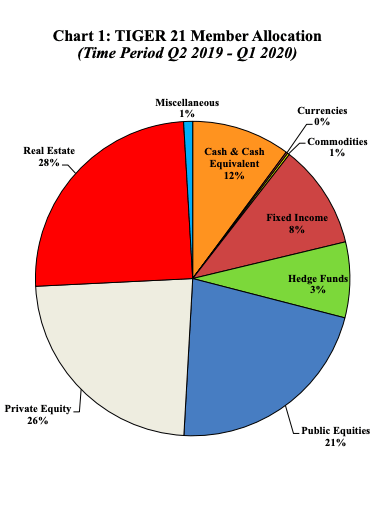

Diversification is crucial to investing like a boss, and that means exploring alternative investment opportunities. While traditional investments like stocks and bonds are important, they may not be enough to maximize your wealth. Alternative investments like real estate, private equity, and commodities can offer higher returns and lower volatility.

Real estate can provide both rental income and appreciation potential. Private equity investments can offer the opportunity to invest in growing companies before they go public. Commodities like gold and oil can provide a hedge against inflation and market volatility.

However, alternative investments often come with higher fees, less liquidity, and more risk. That's why it's important to do your research and work with a trusted advisor who can help you navigate these opportunities.

By exploring alternative investment opportunities, you can diversify your portfolio and potentially increase your returns. Investing 10 million like a boss means being open to new opportunities and taking calculated risks to maximize your wealth.

Working with a Financial Advisor to Optimize Returns

Investing 10 million dollars is a significant amount of money, and it requires careful planning and execution to maximize returns. One way to ensure you are making the most out of your investments is by working with a financial advisor. A financial advisor can help you determine your financial goals and develop a customized investment strategy that aligns with your objectives. They can provide valuable insights and guidance on market trends, investment opportunities, and risk management.

When choosing a financial advisor, it's essential to do your due diligence and work with someone who has a proven track record of success. Look for advisors who have experience working with clients similar to you and who have a deep understanding of the investment landscape. Additionally, make sure to ask about their fee structure upfront to ensure it aligns with your budget.

By working with a trusted financial advisor, you can optimize your returns and achieve your financial goals. Together, you can build a diversified investment portfolio that balances risk and reward, ensuring you make the most out of your 10 million dollar investment.

Staying Informed and Adapting to Market Changes

Investing $10 million requires staying informed about the market and being flexible enough to adapt to changes. It is crucial to monitor market trends and keep up with the latest news and economic events. This will help you make informed decisions and adjust your investment strategy accordingly.

To stay informed, read financial news, follow respected analysts, and attend conferences and events related to your investments. Additionally, diversifying your portfolio can help you minimize risk and adapt to changes in the market.

Being adaptable is also essential in wealth management. Markets can be unpredictable, and sudden changes can impact your investments. Staying flexible and open to new opportunities can help you make the most of changing market conditions.

Maximizing your wealth requires a mix of staying informed and being adaptable. With these skills, you can make informed decisions and adjust your strategy to take advantage of market trends and opportunities.

Gold IRA: Should You Open One To Save For Retirement?