A Guide to Indiana State Teachers' Retirement Fund

If you are a teacher in Indiana, you are likely familiar with the Indiana State Teachers' Retirement Fund. However, if you are new to the profession or simply want to learn more about this retirement plan, this guide will provide you with the essential information you need to know.

Understanding the Indiana State Teachers' Retirement System

The Indiana State Teachers' Retirement Fund (TRF) is a pension plan for public school teachers and administrators in the state of Indiana. Membership in TRF is mandatory for all public school teachers and administrators, including those working in charter schools and vocational schools.

The retirement benefits offered by the TRF are based on a combination of the teacher's years of service and their highest average salary for a consecutive five-year period. Teachers are eligible to receive full retirement benefits at age 65 or after 30 years of service, whichever comes first.

In addition to retirement benefits, the TRF also provides disability and survivor benefits to eligible members. Eligibility for these benefits varies depending on the individual's circumstances.

It is important for all TRF members to stay informed about their retirement benefits and the rules and regulations that govern the system. Members can access information about their account online, and can also attend informational meetings or schedule appointments with TRF representatives for personalized assistance.

Eligibility Criteria for Indiana Teacher Pension

To be eligible for the Indiana State Teachers' Retirement Fund (TRF), you must meet certain requirements. First, you must have worked as a teacher or administrator in a public school or charter school in Indiana for at least ten years. Additionally, you must have contributed to the TRF during that time. If you have worked in multiple school corporations, your years of service will be aggregated to determine your eligibility.

There are also age requirements for receiving full retirement benefits. If you are at least 65 years old and meet the years of service requirement, you can receive full benefits. If you are between the ages of 60 and 65 and have at least 30 years of service, you can also receive full benefits.

There are also options for early retirement with reduced benefits, as well as disability retirement for those who are unable to work due to a disabling condition.

Calculation of Benefits in Indiana State Teachers' Retirement Fund

| Benefit Calculation | Formula |

|---|---|

| Final Average Salary | The average of the highest 5 years of salary |

| Service Credit | Years of service |

| Benefit Factor | 2.0% for each year of service |

| Annual Benefit | (Final Average Salary x Benefit Factor x Service Credit) / 12 |

Investment Strategies of Indiana State Teachers' Retirement System

The Indiana State Teachers' Retirement System (TRF) is committed to providing retirement benefits to Indiana teachers and their families. To achieve this goal, TRF invests in a diversified portfolio of assets that includes both traditional and alternative investments.

TRF's investment strategies are designed to achieve long-term growth while minimizing risk. To achieve this, TRF invests in a diversified mix of stocks, bonds, and alternative investments such as private equity, real estate, and infrastructure.

Additionally, TRF employs a disciplined investment process that involves extensive research and analysis of investment opportunities. This approach allows TRF to identify investments that have the potential to generate higher returns while minimizing risk.

TRF also works with experienced investment managers who have a proven track record of success. These managers are selected through a rigorous vetting process that includes extensive due diligence and evaluation of their investment track record.

Survivor Benefits for Indiana State Teachers' Retirement System

The Indiana State Teachers' Retirement System (IN-TRF) provides survivor benefits for the beneficiaries of deceased members. If a member passes away before retirement, their beneficiaries are entitled to a survivor's benefit. The amount of the benefit depends on the member's years of service and contributions made to the fund.

If the member was eligible for retirement but had not yet started receiving benefits, the surviving spouse may be eligible for a monthly benefit. If the member had already retired and was receiving benefits, the surviving spouse may be eligible for a portion of those benefits.

In the event that there is no surviving spouse, the benefit may be paid to the member's dependent children. If there are no dependent children, the benefit may be paid to the member's estate.

It is important for IN-TRF members to keep their beneficiary information up to date to ensure that their loved ones receive the survivor benefits they are entitled to. Members can update their beneficiary information through their online account or by contacting IN-TRF directly.

Challenges and Reforms in Indiana Teacher Pension System

The Indiana State Teachers' Retirement Fund (TRF) is facing several challenges in maintaining its long-term financial stability. The state's aging teacher population and increasing life expectancy have led to a rise in pension costs. This has put a strain on the TRF's funding, which relies on contributions from both teachers and the state.

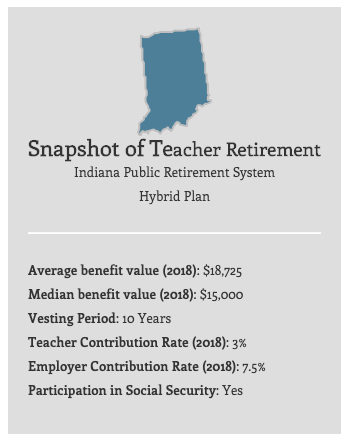

In response, the Indiana government has implemented several reforms to address these challenges. These include increasing the retirement age, reducing cost-of-living adjustments, and shifting to a hybrid pension plan that combines elements of both traditional pensions and 401(k)-style plans.

While these reforms have helped to stabilize the TRF's finances, they have also raised concerns among current and retired teachers who worry about the impact on their retirement benefits. The TRF is also facing pressure from national pension reform advocates who argue that the state should further reduce benefits and shift to a fully-funded 401(k) plan.

Despite these challenges, the TRF remains a crucial retirement benefit for Indiana's teachers. It provides a stable source of income and retirement security for educators who have dedicated their careers to serving the state's students. As the state continues to grapple with the challenges facing its pension system, it will be important to balance the need for financial stability with the need to support teachers and ensure their retirement security.

Gold IRA: Should You Open One To Save For Retirement?