Transform Your Finances with an Inflation Calculator

Calculating inflation is often overlooked when it comes to managing personal finances. However, an inflation calculator can be a powerful tool in transforming your financial outlook. In this article, we will explore the benefits of using an inflation calculator and how it can help you make better financial decisions.

Understanding the Impact of Inflation on Your Finances

Inflation is the gradual increase in the prices of goods and services over time, which causes the purchasing power of money to decrease. This means that the same amount of money will buy fewer goods and services in the future than it does today. The impact of inflation on your finances can be significant, especially in the long term.

To understand the impact of inflation on your finances, you need to consider the effect it has on your savings, investments, and debts. If you have money saved in a low-interest account, inflation can erode the value of your savings over time. Similarly, if you have a fixed-rate debt, such as a mortgage, inflation can reduce the real value of your debt.

An inflation calculator can help you understand the impact of inflation on your finances over time. By inputting your current savings, investments, and debts, as well as an estimated rate of inflation, you can see how inflation will affect your finances in the future. This can help you make more informed decisions about your finances, such as whether to invest in assets that are likely to appreciate in value, or pay off debts with a variable interest rate.

Understanding the impact of inflation on your finances is essential to achieving financial security in the long term. By using an inflation calculator and making informed decisions about your finances, you can protect your wealth and achieve your financial goals.

The Benefits of Using an Inflation Calculator

An inflation calculator is a powerful tool that can help you make informed financial decisions. It allows you to adjust for inflation and see how the value of money changes over time, giving you a clearer picture of your financial situation. Here are some of the benefits of using an inflation calculator:

1. Planning for retirement: Inflation can erode the value of your savings, making it harder to achieve your retirement goals. An inflation calculator can help you determine how much you need to save to maintain your standard of living in retirement.

2. Investment decisions: When investing, it's important to consider the effects of inflation. An inflation calculator can help you determine the real return on your investments, taking into account inflation and taxes.

3. Budgeting: Inflation can affect your budget by increasing the cost of goods and services. An inflation calculator can help you adjust your budget to account for inflation, allowing you to stay on track financially.

4. Comparing prices: An inflation calculator can help you compare prices over time. For example, you can use it to see how the cost of a gallon of gas or a loaf of bread has changed over the years.

By using an inflation calculator, you can gain a better understanding of the impact of inflation on your finances and make more informed financial decisions.

How to Calculate Inflation with an Inflation Calculator

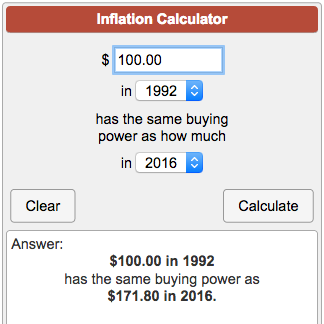

Calculating inflation is a crucial skill for anyone looking to manage their finances effectively. With an inflation calculator, you can accurately determine how much prices have increased over time and adjust your budget accordingly. To calculate inflation, you need to know the current price of an item and its price at a previous point in time. Enter these values into the inflation calculator, and it will calculate the percentage change in price over time. You can use this information to determine how much your money has depreciated in value over time and make informed decisions about your spending habits. It's important to remember that inflation rates can vary by region and industry, so it's essential to use a reliable inflation calculator that accurately reflects your circumstances. With the right tools and knowledge, you can stay ahead of inflation and transform your finances for the better.

The Different Types of Inflation Calculators Available

| Type of Inflation Calculator | Description | Pros | Cons |

|---|---|---|---|

| Simple Inflation Calculator | Calculates inflation based on a single rate of inflation over a period of time. | Easy to use, provides a quick estimate. | Does not take into account fluctuations in inflation rates. |

| Compound Inflation Calculator | Calculates inflation based on compounding interest rates over a period of time. | More accurate than simple inflation calculator, takes into account fluctuations in inflation rates. | May be more complex to use, requires more inputs. |

| Real Inflation Calculator | Calculates inflation adjusted for taxes and investment returns. | Provides a more accurate representation of inflation's impact on personal finances. | May require more complex inputs and calculations. |

| Historical Inflation Calculator | Calculates inflation rates for specific time periods in the past. | Helpful for understanding how inflation has impacted the economy over time. | May not provide a clear picture of current or future inflation rates. |

Using an Inflation Calculator to Plan for Retirement

Planning for retirement can be a daunting task, especially when you consider the impact of inflation on your savings. Inflation can erode the purchasing power of your money over time, meaning that you will need more money in the future to maintain your current standard of living. This is where an inflation calculator can come in handy.

An inflation calculator allows you to estimate how much money you will need in the future based on today's dollars. You simply input the amount of money you have saved, the number of years until retirement, and the expected rate of inflation. The calculator will then show you how much your savings will be worth in the future, adjusted for inflation.

By using an inflation calculator, you can get a better idea of how much money you will need to save for retirement. You can also adjust your savings plan to account for inflation and ensure that you are on track to meet your retirement goals. Don't let inflation catch you off guard – use an inflation calculator to stay ahead of the curve and transform your finances.

Gold IRA: Should You Open One To Save For Retirement?