How to Maximize Your Roth IRA Returns

This article aims to provide practical tips on how to make the most out of your Roth IRA investments and increase your potential returns.

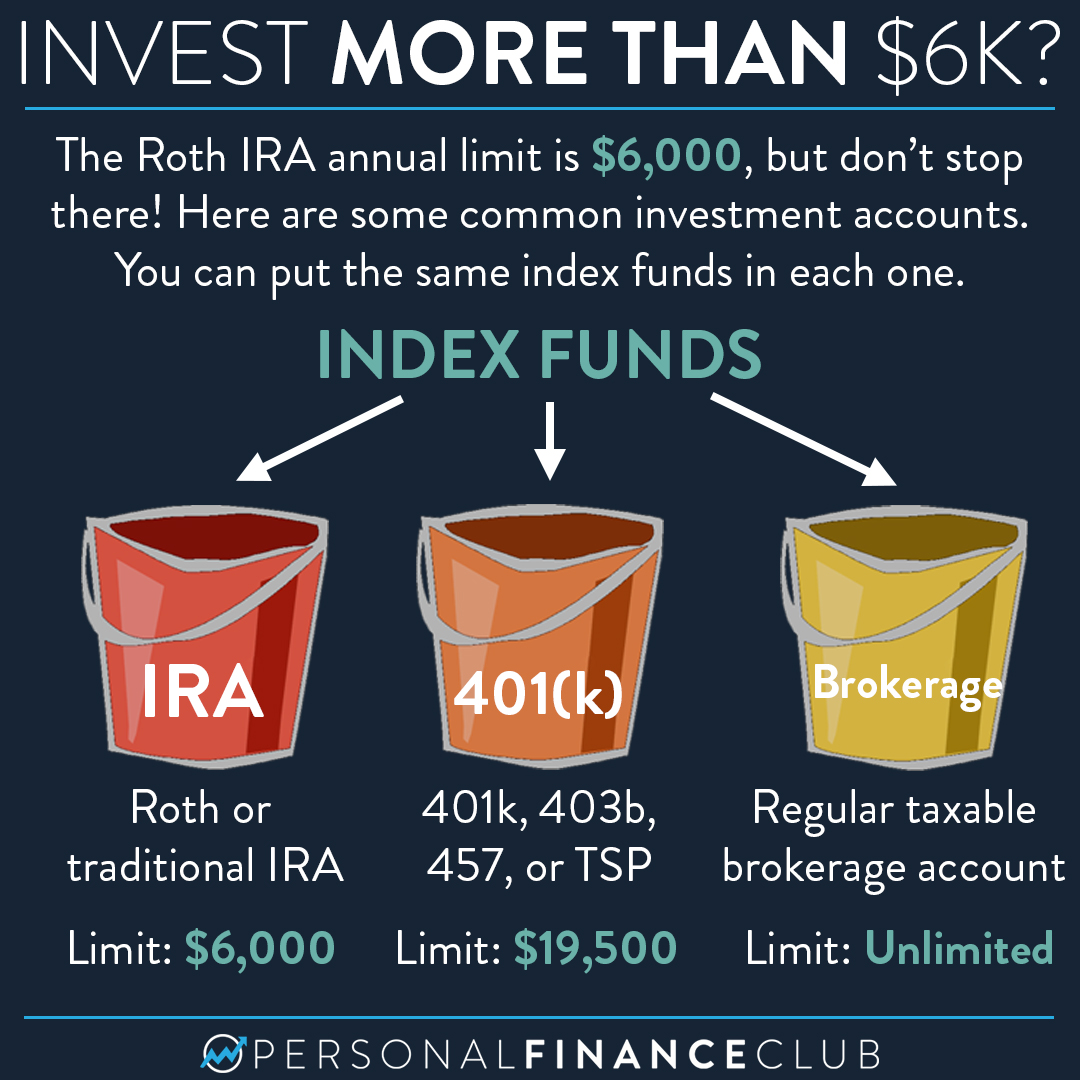

Understanding Roth IRA Contribution Limits

Before you start maximizing your Roth IRA returns, it is important to understand Roth IRA contribution limits. For the year 2021, the maximum contribution limit is $6,000, or $7,000 if you are 50 or older. These limits are based on your modified adjusted gross income (MAGI).

If your MAGI is less than $125,000 (single filer) or $198,000 (married filing jointly), you can contribute the full amount. However, if your MAGI is between $125,000 and $140,000 (single filer) or $198,000 and $208,000 (married filing jointly), your contribution limit will be reduced. If your MAGI is over these limits, you may not be eligible to contribute to a Roth IRA.

It is important to keep track of your contributions and MAGI to avoid over-contributing, which could result in tax penalties. It is also important to note that the contribution limits may change in the future, so it is important to stay informed.

Understanding Roth IRA contribution limits is the first step towards maximizing your returns. By staying within the limits and contributing regularly, you can take advantage of the tax-free growth potential of a Roth IRA.

Investing in Growth-Oriented Stocks

One way to maximize your Roth IRA returns is to invest in growth-oriented stocks. These are stocks of companies that are expected to grow at a faster rate than the overall market. Growth-oriented stocks tend to have higher earnings growth potential, which can lead to higher stock prices over time.

When selecting growth-oriented stocks for your Roth IRA, it's important to do your research and look for companies with a strong track record of growth and a solid financial position. Look for companies that have a competitive advantage in their industry, a strong management team, and a clear growth strategy.

It's also important to diversify your portfolio by investing in stocks across multiple industries and sectors. This can help reduce your overall risk and provide exposure to a range of growth opportunities.

While investing in growth-oriented stocks can be more volatile than investing in other types of stocks, it can also lead to higher returns over the long term. As with all investments, it's important to consult with a financial advisor and carefully consider your investment goals and risk tolerance before making any investment decisions.

Maximizing Tax Benefits through Roth IRA

One of the biggest advantages of investing in a Roth IRA is the tax benefits it offers. Unlike traditional IRAs, Roth IRAs allow you to contribute after-tax dollars, meaning you won't have to pay taxes on your withdrawals in retirement. Additionally, Roth IRAs offer tax-free growth, meaning you won't have to pay taxes on any capital gains or investment income earned within the account.

To maximize your tax benefits through a Roth IRA, consider contributing the maximum amount allowed each year. As of 2021, the maximum contribution limit for those under 50 is $6,000, while those over 50 can contribute up to $7,000.

Another way to maximize your tax benefits is to convert traditional IRA or 401(k) funds to a Roth IRA. While you'll have to pay taxes on the converted amount, the tax-free growth and withdrawals in retirement can make it a smart long-term investment strategy.

Lastly, consider investing in a diversified portfolio that aligns with your long-term goals and risk tolerance. This can help maximize your returns while also minimizing the tax implications of your investments.

Benefiting from Compound Interest

One of the most powerful tools for maximizing your returns in a Roth IRA is compound interest. This is the process of earning interest on your initial investment, as well as on the interest that your investment earns over time. As a result, your money grows exponentially over the long term, allowing you to achieve greater returns without having to make additional contributions.

To benefit from compound interest, it's important to start investing as early as possible and to maintain a consistent investment strategy over time. This means contributing to your Roth IRA on a regular basis, rather than simply making a one-time investment and forgetting about it. It also means choosing investments that offer compound interest, such as mutual funds or exchange-traded funds (ETFs).

In addition to maximizing your returns, compound interest can also help to offset the effects of inflation over time. By earning interest that keeps pace with or exceeds inflation, you can ensure that your savings maintain their purchasing power over the long term.

To make the most of compound interest in your Roth IRA, consider working with a financial advisor who can help you develop a personalized investment strategy that aligns with your goals and risk tolerance. With the right strategy in place, you can benefit from the power of compound interest and achieve greater long-term returns in your Roth IRA.

Strategies for Diversifying Your Portfolio

| Strategy | Description |

|---|---|

| Asset Allocation | Diversify your portfolio by investing in a mix of asset classes such as stocks, bonds, and real estate. This helps to spread out risk and potentially increase returns. |

| Invest in International Markets | Investing in international markets can provide exposure to different economies and industries, reducing risk and potentially increasing returns. |

| Invest in Different Sectors | Investing in different sectors such as technology, healthcare, and finance can help to diversify your portfolio and potentially maximize returns. |

| Invest in Different Size Companies | Investing in companies of different sizes such as small-cap, mid-cap, and large-cap can help to diversify your portfolio and potentially maximize returns. |

| Invest in Different Investment Vehicles | Investing in different investment vehicles such as mutual funds, exchange-traded funds (ETFs), and individual stocks can help to diversify your portfolio and potentially maximize returns. |

Planning for Retirement with Roth IRA

A Roth IRA is an excellent way to save for retirement while also minimizing your taxes. The contributions you make to a Roth IRA are made with after-tax dollars, meaning you pay taxes on the money before you contribute it to the account. However, all withdrawals in retirement are tax-free, making it an attractive option for those looking to reduce their tax burden in retirement.

To maximize your Roth IRA returns, it's essential to start contributing as early as possible. The longer your money is invested, the more time it has to compound and grow. Additionally, try to make the maximum contribution each year. For 2021, the maximum contribution limit is $6,000 for individuals under 50 and $7,000 for those over 50.

Investing in a diverse set of assets within your Roth IRA can also help maximize returns. Consider investing in a mix of stocks, bonds, and mutual funds to reduce risk and increase the potential for higher returns. Lastly, avoid withdrawing any funds before retirement age to maximize the tax-free benefits of the Roth IRA.

In summary, a Roth IRA is an excellent option for retirement planning, and maximizing your returns involves starting early, contributing the maximum amount, diversifying your investments, and avoiding early withdrawals.

Gold IRA: Should You Open One To Save For Retirement?