Understanding IRA-Approved Precious Metals

As investors seek safe haven assets amid market volatility, understanding IRA-approved precious metals can offer a valuable diversification option for retirement portfolios.

Eligibility and Restrictions

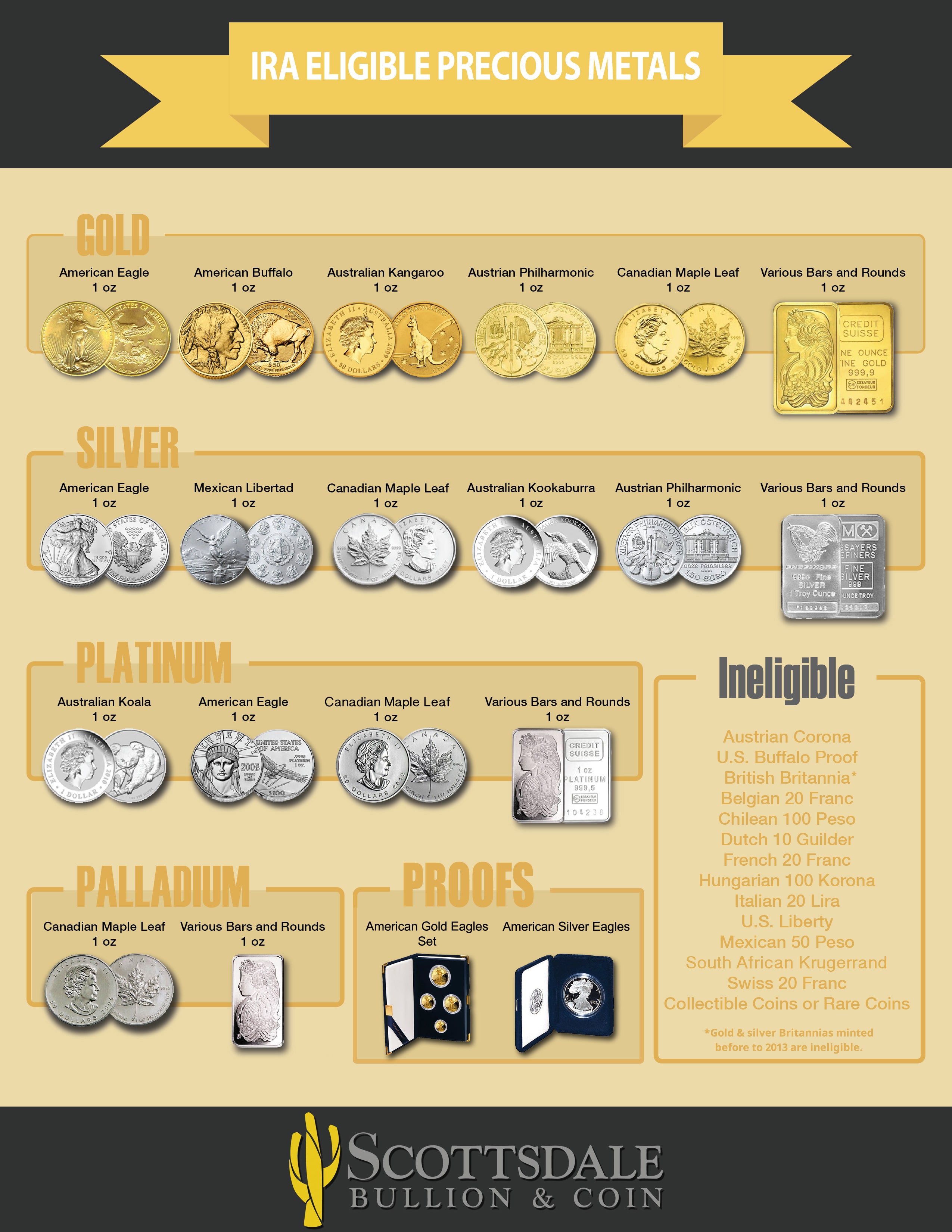

Not all precious metals are eligible to be held in an Individual Retirement Account (IRA). The IRS has a strict set of guidelines and restrictions that must be followed. The approved metals that can be held in an IRA include gold, silver, platinum, and palladium bullion coins and bars.

To be eligible for an IRA, the bullion coins or bars must meet certain purity requirements. Gold must have a purity of at least 99.5%, while silver must have a purity of at least 99.9%. Platinum and palladium must have a purity of at least 99.95%.

Additionally, there are restrictions on the types of coins or bars that can be held in an IRA. For example, collectible coins are not allowed in an IRA, but certain types of proof coins may be permitted. It is important to consult with a financial advisor or IRA custodian to ensure that the metals being considered for an IRA meet all eligibility requirements and restrictions.

Benefits of Investing in IRA-Approved Gold

Investing in IRA-approved gold can offer several benefits to investors. Firstly, gold is considered a safe-haven asset and can provide a hedge against inflation and economic uncertainty. With its intrinsic value, gold has historically held its worth during market downturns and can add diversification to a portfolio.

Additionally, investing in gold through an IRA can provide tax advantages. An IRA-approved gold investment can be made with pre-tax dollars, potentially lowering the investor's taxable income. Furthermore, gains on the investment can be tax-deferred until distribution, which can result in significant tax savings.

Investors can also enjoy greater flexibility with an IRA-approved gold investment. They can choose to hold physical gold, including bullion or coins, or invest in gold ETFs or mutual funds. Additionally, they can hold the investment in a traditional IRA or a Roth IRA, depending on their individual needs and retirement goals.

Tax Implications of IRA-Approved Precious Metals

| Tax Implications of IRA-Approved Precious Metals |

|---|

| IRA-approved precious metals, such as gold, silver, platinum, and palladium, can provide diversification to your retirement portfolio. However, it is important to understand the tax implications of investing in these metals through your IRA. |

Tax advantages:

|

Tax considerations:

|

|

Conclusion:

Investing in IRA-approved precious metals can be a smart strategy for diversifying your retirement portfolio. However, it is important to understand the tax implications and consult with a financial professional to ensure that it aligns with your overall financial goals. |

Custodians and Storage Options

When investing in IRA-approved precious metals, it is important to consider the custodian and storage options available to you. The Internal Revenue Service (IRS) requires that all precious metals held in an IRA be stored by an approved custodian. This ensures that the metals are kept secure and that proper record-keeping is maintained.

There are several custodians to choose from, each with their own fees and services. It is important to research and compare custodians before selecting one for your IRA. Some custodians specialize in precious metals, while others offer a wider range of investment options.

In addition to choosing a custodian, you will also need to select a storage option. Precious metals can be stored either at a depository or at home. If storing at home, the IRS requires that the metals be kept in a secure location and that records are kept regarding their storage and value. Storing at a depository can provide added security and insured storage.

It is important to note that there are fees associated with both custodians and storage options. These fees can vary widely and should be taken into consideration when making investment decisions.

Market Trends and Performance

| Year | Gold Price | Silver Price | Platinum Price | Palladium Price | S&P 500 Index |

|---|---|---|---|---|---|

| 2015 | $1,060.20 | $13.81 | $941.90 | $603.00 | 2,044.81 |

| 2016 | $1,248.10 | $17.14 | $978.00 | $614.00 | 2,238.83 |

| 2017 | $1,257.50 | $17.06 | $941.00 | $1,023.00 | 2,673.61 |

| 2018 | $1,273.70 | $15.71 | $795.00 | $1,048.00 | 2,506.85 |

| 2019 | $1,393.34 | $16.21 | $831.00 | $1,346.00 | 3,231.72 |

| 2020 | $1,773.50 | $18.99 | $1,032.00 | $2,405.00 | 3,756.07 |

| 2021 | $1,820.00 | $25.00 | $1,209.00 | $2,674.00 | 4,128.80 |

Gold IRA: Should You Open One To Save For Retirement?