Safe and Secure IRA-Approved Palladium Investments

Investing in precious metals is a popular strategy to diversify portfolios and hedge against inflation. Palladium, in particular, has gained attention as a valuable investment option. However, it is crucial to ensure that the investment is safe and secure. This article explores IRA-approved palladium investments that offer a reliable way to invest in this precious metal.

Diversify Your IRA with Precious Metals

Investing in precious metals like palladium can be a wise decision to diversify your IRA portfolio. Precious metals are tangible assets that tend to retain their value even in times of economic uncertainty. Palladium, in particular, has seen a surge in demand due to its use in the automotive industry for catalytic converters.

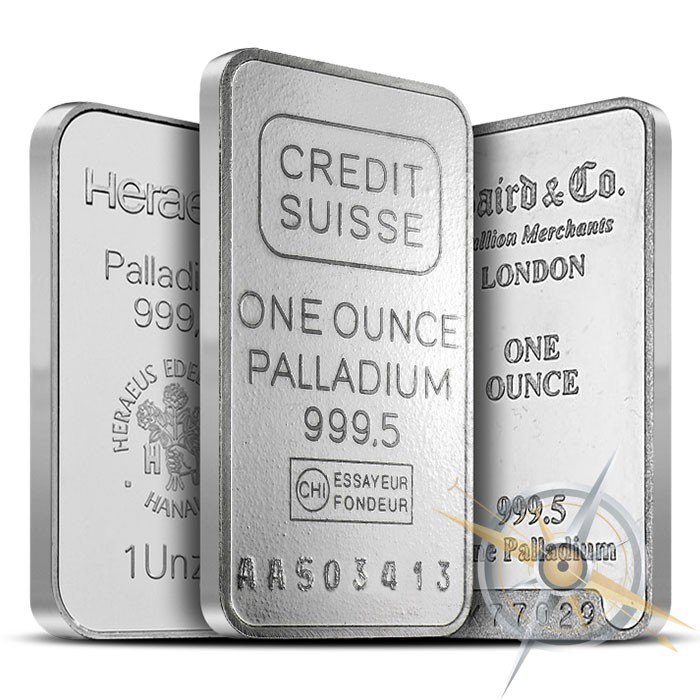

To add palladium to your IRA, you must purchase IRA-approved palladium coins or bars from a reputable dealer. These coins and bars must meet certain purity and quality standards set by the IRS. It's important to do your research and only invest with a dealer who has a good reputation and experience in the precious metals market.

Diversifying your IRA with palladium can provide a level of safety and security to your retirement savings. When the stock market fluctuates, precious metals tend to hold their value or even increase in value. Adding palladium to your IRA can help protect your assets and provide a hedge against inflation.

Why Palladium is a Smart Investment

Palladium is a rare precious metal that has become increasingly popular among investors due to its unique properties and high demand in various industries. With a limited supply and growing demand, palladium prices have been steadily rising over the years. In fact, in 2020, palladium outperformed other precious metals such as gold and silver, making it a smart investment choice.

One of the main reasons to invest in palladium is its industrial use. Palladium is widely used in the automotive industry for catalytic converters, which reduce harmful emissions from vehicles. As more countries implement stricter emissions regulations, the demand for palladium is expected to increase further.

Palladium is also a popular choice for jewelry making and electronics manufacturing. As technology continues to advance, the demand for palladium in these areas is likely to grow.

Investing in palladium can provide a hedge against inflation and economic uncertainty. As a tangible asset, palladium can hold its value even during times of market volatility.

With its growing popularity and increasing demand, palladium is an IRA-approved investment option that can provide a safe and secure way to diversify your portfolio. So, investing in palladium can be a smart move for those looking for a long-term investment strategy.

How to Protect Your Retirement Savings with Palladium

Protect Your Retirement Savings with Palladium

Investing in Palladium is a smart way to protect your retirement savings. It is a rare metal that is in high demand due to its various industrial uses, making it a valuable addition to your investment portfolio. The good news is that it is an IRA-approved investment, so you can add it to your retirement account.

One way to invest in Palladium is through physical bullion such as coins or bars. This method offers long-term security and stability as you own the physical asset. Another way is through Palladium ETFs, which are traded on stock exchanges. These funds allow you to invest in Palladium without owning the physical asset.

Palladium has proven to be a reliable investment, especially during economic uncertainties, as its value tends to increase in such situations. It is also a great hedge against inflation, as its value often rises with inflation rates.

To ensure that you make the most of your Palladium investment, always work with a reputable dealer who can guide you through the purchasing process. Do your research and understand the market trends before investing any amount of money.

Investing in Palladium is a smart move to protect your retirement savings in uncertain times. With its IRA-approved status, you can add it to your retirement account and enjoy long-term growth and stability.

Understanding the Risks and Rewards of Palladium Investments

Investing in palladium can be a wise decision for those looking to diversify their portfolio and hedge against inflation. However, like any investment, there are risks and rewards to consider. Palladium is a precious metal with a wide range of industrial applications, including catalytic converters, electronics, and jewelry. This makes it a valuable commodity with a strong demand.

One of the rewards of investing in palladium is its potential for growth. Over the past decade, palladium prices have increased significantly, outpacing other precious metals like gold and silver. Additionally, palladium is a rare metal, with most of the world's supply coming from just two countries, Russia and South Africa. This limited supply can drive up prices, making it an attractive investment opportunity.

However, there are also risks associated with investing in palladium. Like all commodities, palladium prices can be volatile, with significant fluctuations over short periods. Additionally, palladium is subject to geopolitical risks, as the majority of the world's supply comes from countries with political instability and economic sanctions.

Investors should carefully weigh the risks and rewards of palladium investments before making a decision. It's essential to work with a trusted financial advisor to develop a diversified investment strategy that aligns with your goals and risk tolerance. With proper planning and research, palladium investments can provide a safe and secure IRA-approved option for investors looking to diversify their portfolios.

Choosing the Right Palladium Investment for Your IRA

| Investment Option | Minimum Investment | IRA Eligible | Storage Options |

|---|---|---|---|

| Palladium Coins | $500 | Yes | Depository or home storage |

| Palladium Bars | $1,000 | Yes | Depository or home storage |

| Palladium ETFs | No minimum investment | Yes | Held by brokerage firm |

| Palladium Mining Stocks | No minimum investment | No | Held by brokerage firm |

Gold IRA: Should You Open One To Save For Retirement?