Is $4 Million Enough to Retire Early?

Retiring early is a dream for many, but is $4 million enough to make it a reality? In this article, we explore the answer to this question and share some insights on how to plan for an early retirement.

Understanding Retirement Expenses

When planning for retirement, it's important to consider the expenses that come with it. Healthcare, housing, and leisure activities are just a few of the costs you'll need to prepare for. Understanding retirement expenses can help you determine if $4 million is enough to retire early.

Healthcare costs can be significant and are likely to increase as you age. Medicare only covers a portion of medical expenses, so you'll need to budget for out-of-pocket expenses and supplemental insurance. Long-term care is another potential expense that can quickly drain your retirement savings.

Housing is another significant expense. While you may have paid off your mortgage, you'll still need to budget for property taxes, maintenance, and repairs. Downsizing or moving to a less expensive area can help reduce these costs.

Leisure activities, such as travel and hobbies, are also expenses to consider. These activities can provide a fulfilling retirement, but they can add up quickly. Consider prioritizing your favorite hobbies and setting a budget for travel to keep costs under control.

The Importance of Saving Early

One of the most important things to keep in mind when planning for early retirement is the importance of saving early. Starting to save early on in your career can make a huge difference in the amount of money you have available for retirement.

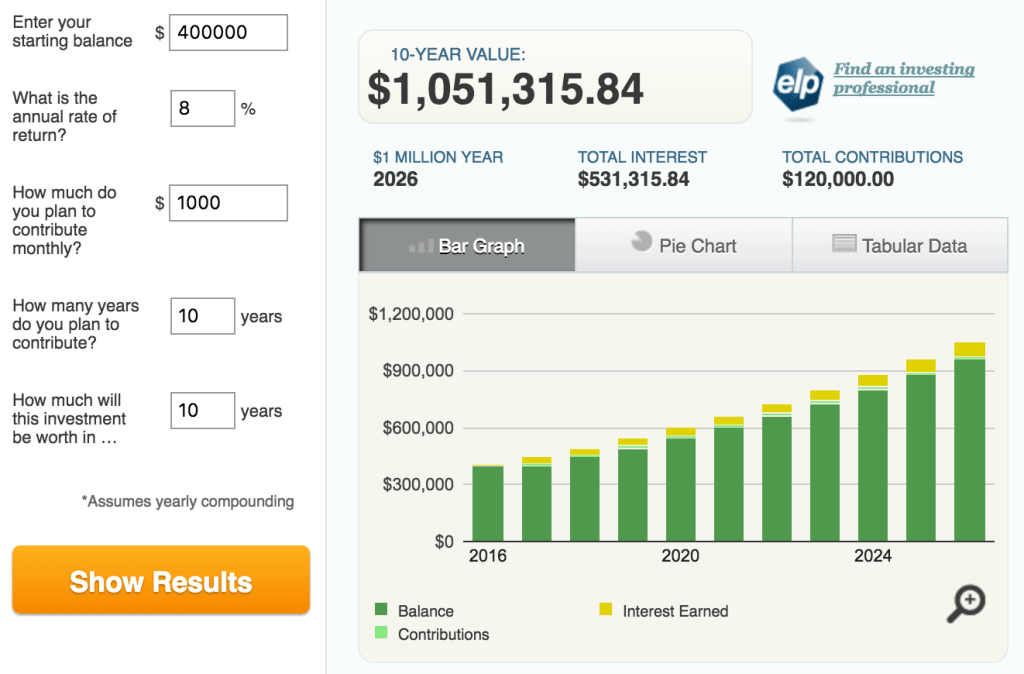

Consider the following scenario: if you start saving $500 a month at age 25 and continue to do so until age 65, you would have saved $1.2 million assuming a 7% annual return. However, if you wait until age 35 to start saving, you would have to save over $1,000 a month to reach the same $1.2 million by age 65.

The power of compound interest means that the earlier you start saving, the more time your money has to grow. Additionally, starting early gives you more flexibility in your retirement planning, allowing you to take more risks with your investments and potentially earn a higher return.

In short, if you want to retire early and comfortably, it’s crucial to start saving as early as possible. Even small contributions can make a big difference over time, so don’t underestimate the importance of starting now.

Only those with a 401k need to read this

Secure your retirement with a Gold IRA. Goldco is your trusted partner in building a more secure financial future.

Learn MoreAssessing Your Retirement Goals

Retiring early is a dream for many Americans, but how much money do you really need to make it a reality? While the answer will vary depending on your lifestyle and goals, $4 million is a common benchmark for those looking to retire comfortably.

To assess whether this amount is enough for you, consider your expected expenses and income sources in retirement. Will you have any outstanding debts or mortgages to pay off? What will your healthcare costs be? Do you plan to travel extensively or live a more modest lifestyle?

Additionally, think about how long you expect to live and whether you want to leave any inheritance for your loved ones. Adjusting for inflation and market fluctuations is also crucial when determining if $4 million will sustain you throughout your retirement.

Ultimately, assessing your retirement goals requires careful planning and consideration of your unique circumstances. While $4 million may be enough for some, others may need more or less to achieve their desired lifestyle in retirement. Consulting with a financial advisor can help you make informed decisions and create a solid retirement plan.

Maximizing Retirement Benefits

| Maximizing Retirement Benefits | |

|---|---|

| Article Title | Is $4 Million Enough to Retire Early? |

| 1. Start Saving Early | Starting to save early will give your money more time to grow and compound. The earlier you start, the more you can save and the more time your money has to grow. |

| 2. Contribute to Retirement Accounts | Contribute to your employer's qualified retirement plan, such as a 401(k), and individual retirement accounts (IRAs) to maximize your retirement benefits. Take advantage of any employer matching contributions to your retirement accounts. |

| 3. Consider Delaying Social Security Benefits | Delaying Social Security benefits can increase your monthly benefit amount. If you can afford to delay taking benefits until age 70, you can increase your monthly payout by as much as 32 percent. |

| 4. Invest in a Diverse Portfolio | Investing in a mix of stocks, bonds, and other assets can help reduce risk and maximize returns. Diversifying your portfolio can help you weather market fluctuations and generate income during retirement. |

| 5. Consider Working Part-Time | Working part-time during retirement can help boost your retirement savings and provide additional income. This can also help you delay taking Social Security benefits and increase your monthly payout. |

| 6. Consult with a Financial Advisor | A financial advisor can help you create a retirement plan and make investment decisions that align with your retirement goals. They can help you maximize your retirement benefits and ensure you have enough money to retire comfortably. |

Alternative Ways to Boost Retirement Income

While $4 million may seem like a substantial amount, it may not be enough to retire early and live comfortably for the rest of your life. Fortunately, there are alternative ways to boost your retirement income and make your savings work harder for you.

One option is to invest in real estate, either by purchasing rental properties or investing in real estate investment trusts (REITs). Rental properties can provide a steady stream of passive income, while REITs allow you to invest in a diversified portfolio of properties without the hassle of managing them yourself.

Another option is to start a side hustle or turn a hobby into a profitable business. This can be anything from freelance writing or consulting to selling handmade crafts online. By generating additional income, you can supplement your retirement savings and potentially retire earlier than you originally planned.

Finally, consider delaying Social Security benefits until you reach your full retirement age, or even later. By doing so, you can increase your monthly benefits and potentially receive a larger total payout over the course of your retirement.

While $4 million may seem like a lot, it's important to explore alternative ways to boost your retirement income and ensure a comfortable retirement.

Retiring Comfortably with $4 Million

Retiring early is everyone's dream, but is $4 million enough to retire comfortably? The answer is a resounding yes! With proper planning and management, you can retire comfortably with $4 million.

Investment is key to retiring comfortably. With $4 million, you can invest in a diversified portfolio of stocks, bonds, and mutual funds to ensure long-term growth. A well-diversified portfolio provides a stable income stream that can last for many years.

Another important factor to consider is budgeting. You need to create a budget that can sustain your desired lifestyle. It's important to factor in expenses such as housing, food, healthcare, and travel.

Health insurance is also crucial to your retirement plan. With the rising cost of healthcare, it's important to have insurance that covers your medical expenses. You can opt for a Medicare supplement plan or a private health insurance plan.

Finally, it's important to have a solid retirement plan. This includes creating a will, power of attorney, and a trust to ensure your assets are protected and distributed according to your wishes.

In conclusion, retiring comfortably with $4 million is not only possible but achievable with proper planning, investment, budgeting, health insurance, and a solid retirement plan. Start planning for your retirement today!

Gold IRA: Should You Open One To Save For Retirement?