The Truth About Angel Investors and Their Legitimacy

Angel investors are a popular source of funding for startups, but their legitimacy has been a topic of debate. In this article, we explore the truth about angel investors and what entrepreneurs need to know before seeking their investment.

What are angel investors?

Angel investors are high net worth individuals who provide financial support to startups, usually in exchange for equity in the company. They are often seen as the answer to the funding challenges that many young entrepreneurs face, but there are some misconceptions about their legitimacy.

One of the most common myths about angel investors is that they are only interested in investing in tech startups. While it is true that many angels are drawn to tech companies, they are also interested in other industries such as healthcare, entertainment, and fashion.

Another myth is that angel investors are only interested in investing in companies that are already generating revenue. In reality, angels are often willing to invest in pre-revenue startups that have a strong business plan and a solid team in place.

Finally, some people believe that angel investing is a shady practice and that investors are only interested in making a quick profit. While there are certainly some unscrupulous investors out there, most angels are legitimate and genuinely interested in helping entrepreneurs succeed.

How to find legitimate angel investors

If you're an entrepreneur looking for funding, you've probably heard of angel investors. These high net worth individuals provide financial backing to promising startups in exchange for equity. But with so many scams and fraudulent schemes out there, it can be hard to separate legitimate angel investors from the fakes. Here are some tips to help you find the real deal:

1. Start with your network. Ask other entrepreneurs, mentors, and industry experts for recommendations. They may know angel investors who are actively investing and looking for opportunities.

2. Attend networking events. Angel investors often attend conferences, pitch events, and other gatherings where entrepreneurs are present. Look for events in your industry or niche and make sure to come prepared with a solid pitch.

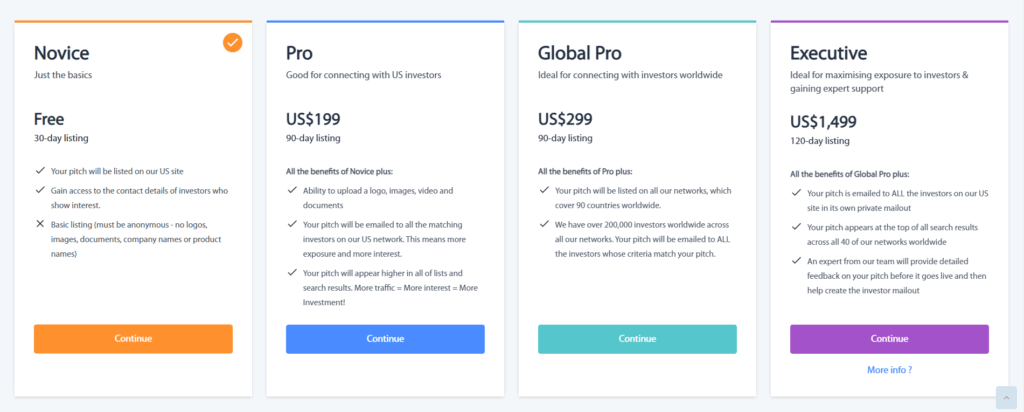

3. Use online resources. There are several websites and platforms that connect startups with angel investors, such as AngelList, Gust, and SeedInvest. Make sure to do your research and read reviews before signing up for any of these services.

4. Do your due diligence. Before accepting funding from an angel investor, make sure to thoroughly research their background and track record. Look for news articles, social media profiles, and other information that can help you verify their legitimacy.

Remember, finding the right angel investor takes time and effort. Don't rush into any deals without doing your homework first. With a little patience and persistence, you can find legitimate angel investors who can help take your startup to the next level.

What to look for in an angel investor

| Key Factors to Consider When Evaluating an Angel Investor |

|---|

| 1. Industry Expertise |

| 2. Investment Track Record |

| 3. Network and Connections |

| 4. Investment Philosophy |

| 5. Ability to Add Value |

| 6. Investment Horizon |

| 7. Communication Style and Availability |

| 8. Compatibility with Founder's Vision and Goals |

| 9. Reputation and Credibility |

Common scams associated with angel investing

As with any investment opportunity, there are always risks involved. Unfortunately, there are also scams that can take advantage of unsuspecting investors looking to get involved in angel investing. One common scam involves fraudulent companies that claim to have a great idea or product but are actually just looking to take your money and disappear. Another scam involves "investment clubs" that promise high returns but require you to recruit more members to join in order to continue receiving returns.

It's important to do your research and thoroughly vet any company or individual before investing your money. Look for legitimate angel investor groups or networks that have a track record of successful investments. Be wary of any investment opportunity that promises guaranteed returns or seems too good to be true. Always read the fine print and seek advice from a trusted financial advisor before making any investment decisions. By staying vigilant and informed, you can avoid falling victim to common scams associated with angel investing.

Alternatives to angel investing

Alternatives to Angel Investing

If you're looking to invest in startups but are wary of angel investing, there are alternative options available that may suit your investment style better. One alternative is crowdfunding, where individuals can pool their money together to fund a startup. Another option is venture capital, where a firm invests in a startup in exchange for equity. Incubators and accelerators are also options, as they provide resources and mentorship to startups in exchange for a percentage of equity.

While angel investing can be risky and often requires a high level of involvement, these alternatives offer a more hands-off approach. It's important to do your research and assess the risks and benefits of each option before making any investments. Remember, there is no one-size-fits-all approach to investing, and finding the right fit for your investment style is key to success.

Gold IRA: Should You Open One To Save For Retirement?