Unlocking the secret to a secure retirement, this article explores the intricacies of New Jersey’s pension tiers and unveils indispensable insights for effective retirement planning.

Retirement Estimate Calculators and Pension Tiers

Retirement Estimate Calculators are valuable tools for individuals in New Jersey who want to plan for their retirement. These calculators allow individuals to input their current financial information and receive an estimate of how much income they can expect to receive during retirement. They take into account factors such as salary, years of service, and contribution rates.

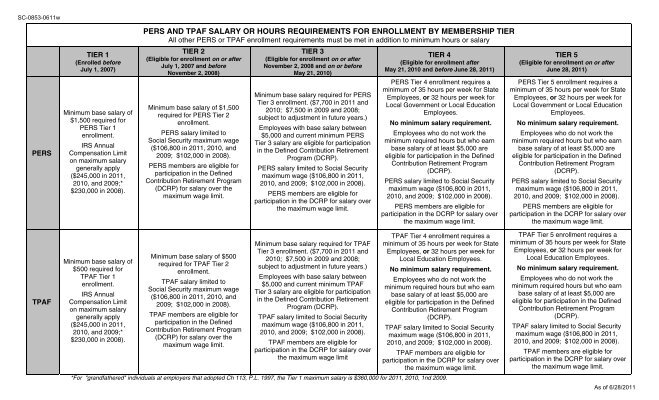

NJ Pension Tiers play a crucial role in retirement planning for public employees in the state. The pension tiers determine the benefits and eligibility requirements for different groups of employees. It is important to understand which tier you fall into, as it will impact your retirement benefits.

By utilizing Retirement Estimate Calculators and understanding NJ Pension Tiers, individuals can make informed decisions about their retirement savings and ensure a financially secure future.

Unpaid Leaves of Absence and Pension Considerations

When taking an unpaid leave of absence, it’s important to consider the impact on your pension. Pension tiers in New Jersey have different rules regarding the treatment of unpaid leaves. For Tier 1 and Tier 2 members, unpaid leaves do not count towards pension credit. However, for Tier 3 and Tier 4 members, unpaid leaves of up to one year will still count towards pension credit. It’s crucial to understand your specific tier and the implications of an unpaid leave on your pension benefits. Consulting with a financial advisor or the New Jersey Division of Pensions and Benefits can help you navigate these considerations and make informed decisions about your retirement planning.

Importance of Updating Beneficiaries and Retirement Savings Programs

Updating beneficiaries and retirement savings programs is a crucial aspect of retirement planning in New Jersey. By ensuring that your beneficiaries are up to date, you can ensure that your hard-earned savings are distributed according to your wishes. Additionally, regularly reviewing and updating your retirement savings programs can help you maximize your savings potential and adjust your strategy as needed. Life events such as marriage, divorce, or the birth of a child may warrant a change in beneficiaries, while changes in employment or financial goals may necessitate adjustments to your retirement savings plans. Taking the time to regularly update these important aspects of your retirement planning can provide peace of mind and help secure your financial future.

NJ Division of Pensions and Benefits and Pension Plans

| NJ Division of Pensions and Benefits | |

|---|---|

| Agency | NJ Division of Pensions and Benefits |

| Website | https://www.state.nj.us/treasury/pensions/ |

| Contact | Phone: 1-800-843-0020 Email: [email protected] |

NJ Pension Tiers and Retirement Planning

The NJ Division of Pensions and Benefits administers various pension plans to provide retirement benefits to eligible employees in the state of New Jersey. These pension plans are categorized into different tiers, each with its own set of rules and benefits. Understanding the different pension tiers is crucial for effective retirement planning.

Pension Tiers

| Tier | Description |

|---|---|

| Tier 1 | Members enrolled before July 1, 2007, with the most generous benefits and retirement options. |

| Tier 2 | Members enrolled between July 1, 2007, and September 30, 2011, with slightly reduced benefits compared to Tier 1. |

| Tier 3 | Members enrolled between October 1, 2011, and June 27, 2019, with further reduced benefits compared to Tier 2. |

| Tier 4 | Members enrolled on or after June 28, 2019, with the least generous benefits and retirement options. |

Each tier has specific rules regarding retirement eligibility, contribution rates, and benefit calculations. It is important for employees to familiarize themselves with the pension tier they belong to in order to make informed decisions regarding their retirement planning.

For more information about the NJ Division of Pensions and Benefits and the different pension tiers, please visit their official website: https://www.state.nj.us/treasury/pensions/.

Gold IRA: Should You Open One To Save For Retirement?