Oxford Gold Group Reviews & Pricing

Welcome to our article on Oxford Gold Group Reviews & Pricing. In this piece, we will delve into the world of Oxford Gold Group and provide you with valuable insights on their reviews and pricing. So, sit back and discover all you need to know about this renowned company.

Overview of Oxford Gold Group

Oxford Gold Group is a reputable company that specializes in helping individuals diversify their investment portfolios through self-directed IRAs. With a focus on precious metals like gold, silver, platinum, and palladium, Oxford Gold Group provides individuals with the opportunity to protect their wealth and hedge against market volatility. Backed by a strong reputation and positive customer reviews, Oxford Gold Group offers competitive pricing and excellent customer service. They work with investors of all experience levels, providing them with the knowledge and understanding they need to make informed investment decisions. With secure storage options through Brink's and Delaware Depository, Oxford Gold Group ensures the safety and privacy of their clients' assets.

Investing in precious metals with Oxford Gold Group

Investing in precious metals with Oxford Gold Group offers a secure and profitable way to diversify your investment portfolio. With a strong reputation and positive Oxford Gold Group reviews from satisfied customers, you can trust their expertise and guidance. Whether you are interested in purchasing gold, silver, platinum, or palladium, Oxford Gold Group provides competitive pricing and ensures the authenticity of each precious metal. Their self-directed IRA options allow for tax advantages and greater control over your retirement savings. By investing in precious metals, you can hedge against inflation and protect your wealth for the long term.

Don't wait, start investing in precious metals with Oxford Gold Group today.

Pros and cons of Oxford Gold Group

Oxford Gold Group is a company that specializes in helping individuals invest in precious metals like gold. One of the main advantages of working with Oxford Gold Group is their expertise in the field, providing customers with valuable knowledge and information to make informed investment decisions. They offer a range of options, including self-directed IRAs, which allow investors to have more control over their retirement funds. Additionally, Oxford Gold Group has a strong reputation in the industry, with positive reviews and a high rating from the Better Business Bureau. However, it's important to note that investing in precious metals comes with risks, such as potential price depreciation and market volatility. It's recommended to do thorough research and understand the market before investing.

Fees and pricing at Oxford Gold Group

Oxford Gold Group Reviews & Pricing

| Product | Price | Fees |

|---|---|---|

| Gold Bullion | $1,500 per ounce | 2% commission fee on purchase |

| Silver Bullion | $25 per ounce | 3% commission fee on purchase |

| Platinum Bullion | $900 per ounce | 2.5% commission fee on purchase |

Comparing Oxford Gold Group to competitors

Comparing Oxford Gold Group to competitors, you will find that they offer a range of benefits that set them apart. With a focus on customer service and privacy, Oxford Gold Group ensures a smooth and secure transaction process. They have a trusted reputation, as evidenced by their A+ rating with the Better Business Bureau. Oxford Gold Group specializes in self-directed IRAs, offering individuals the opportunity to diversify their retirement portfolio with precious metals.

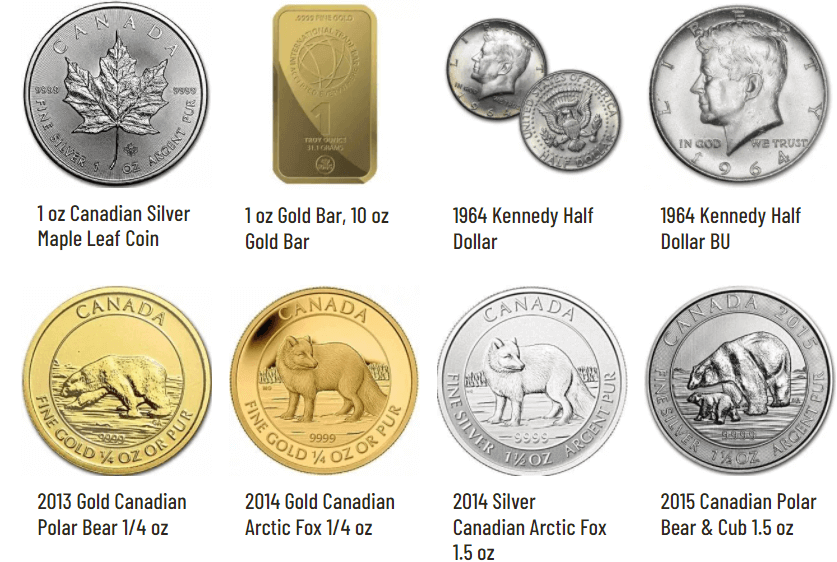

Their team of experts can assist you in understanding the risks and benefits of investing in gold and other metals. With competitive pricing and a wide selection of coins and bars, Oxford Gold Group is a reliable choice for those looking to invest in tangible assets.

Setting up and maintaining a Precious Metal IRA with Oxford Gold Group

Setting up and maintaining a Precious Metal IRA with Oxford Gold Group is a straightforward process that can provide financial security and protection against market volatility. With a self-directed IRA, investors have the freedom to choose their own assets, including precious metals like gold and silver. This allows for diversification and a hedge against inflation. Oxford Gold Group offers competitive pricing on a wide range of precious metal products, including coins and bars. They also provide secure storage options through trusted partners like Brink's and Delaware Depository.

By investing in a Precious Metal IRA, individuals can take control of their retirement savings and potentially benefit from the long-term appreciation of precious metals.

Security and storage of precious metals with Oxford Gold Group

When it comes to the security and storage of your precious metals, trust the expertise of Oxford Gold Group. With their years of experience and knowledgeable team, they provide a reliable and secure solution for safeguarding your assets. Whether you're looking to protect your stock portfolio, hedge against market fluctuations, or diversify your retirement account, Oxford Gold Group has you covered. Their state-of-the-art storage facilities ensure the safety and integrity of your coins and gold, giving you peace of mind.

Don't leave your valuable assets to chance - choose Oxford Gold Group for secure and trusted storage.

Tax advantages of investing in a gold IRA with Oxford Gold Group

Tax advantages are one of the key benefits of investing in a gold IRA with Oxford Gold Group. By utilizing a gold IRA, investors can enjoy potential tax benefits such as tax-deferred growth and tax-free withdrawals. This can help individuals maximize their investment returns and potentially reduce their overall tax liability. Additionally, investing in a gold IRA allows for diversification within one's retirement portfolio, providing a hedge against stock market volatility and other economic uncertainties. With Oxford Gold Group as a trusted partner, investors can take advantage of these tax benefits while also benefiting from the expertise and resources of a reputable company in the gold investment industry.

Gold IRA: Should You Open One To Save For Retirement?