Safest Gold Buying Methods

Summary

- When buying gold, consider the current price of gold and market trends.

- Safe methods for purchasing physical gold include buying gold coins, investing in a Gold IRA, and purchasing gold bars.

- Follow safe methods when purchasing gold bars and coins, such as researching reputable dealers and diversifying your holdings.

- Investing in gold stocks, trading gold futures and options, and buying gold jewelry are other options to consider. Research and understand the risks before making a purchase.

Welcome to a comprehensive guide on the most secure and reliable ways to purchase gold. In this article, we will explore the safest gold buying methods that will give you peace of mind and protect your investment. Whether you are a seasoned investor or a first-time buyer, this information will equip you with the knowledge to make wise and secure gold purchases.

Price of Gold Today

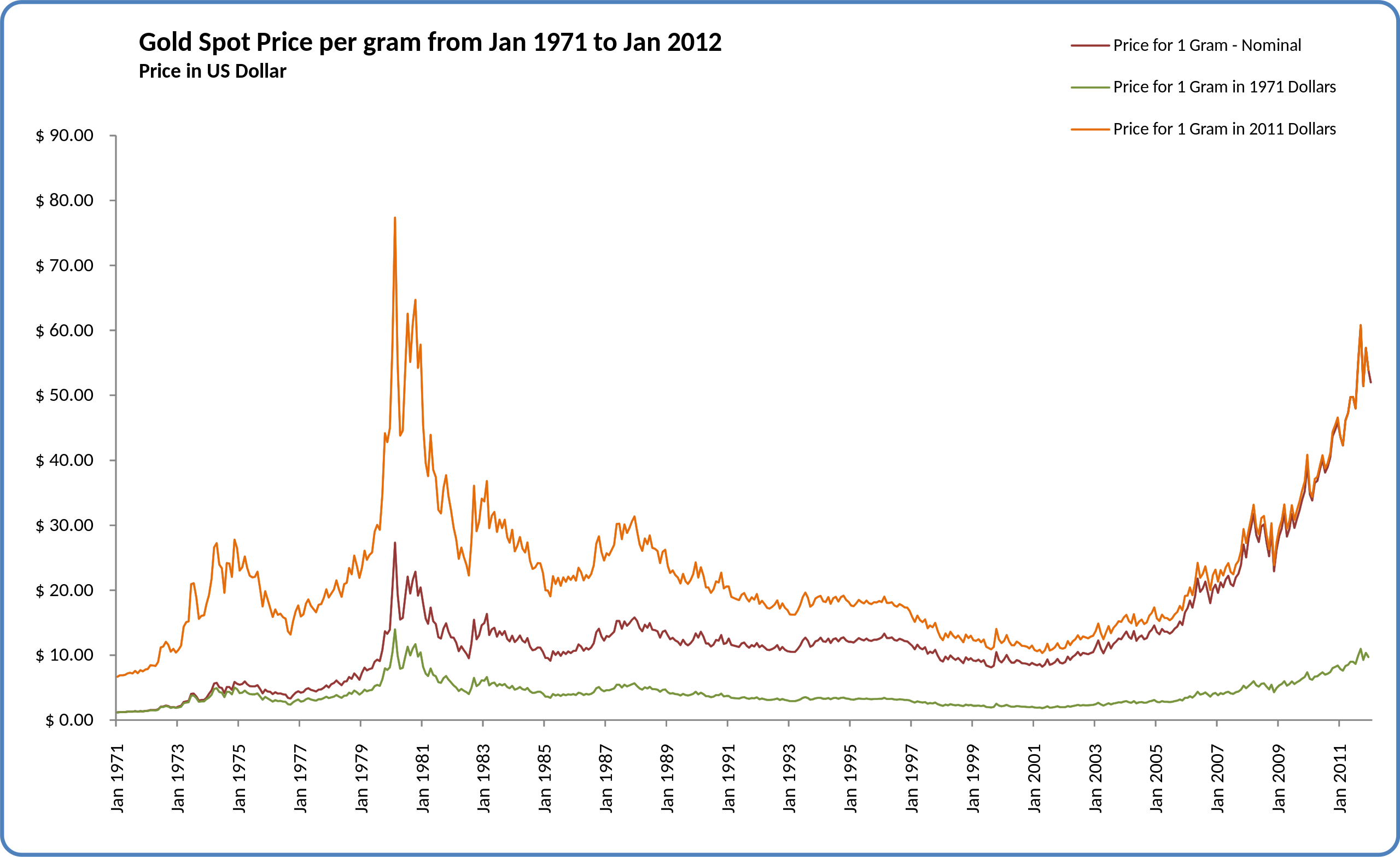

The price of gold today is an important factor to consider when buying gold, especially if you're looking for safe methods. Gold coins and gold bars are popular options for investors, as they hold their value over time. You can also consider investing in a Gold IRA, which allows you to hold physical gold in a tax-advantaged retirement account. Another safe option is to invest in a gold exchange-traded product, which provides exposure to the price of gold without the need for physical ownership. When buying gold, it's important to do your due diligence and research the current market trends and valuation of gold. Additionally, consider the supply and demand dynamics, as well as the inflation and recession risks that could affect the price of gold.

By carefully considering these factors and using safe buying methods, you can protect your investment and potentially benefit from the stability and growth of gold in the market.

Buying Physical Gold

When buying physical gold, there are several safe methods to consider. One option is to purchase gold coins, such as the Canadian Gold Maple Leaf or the American Gold Eagle, which are recognized worldwide and easy to sell. Another option is to invest in a Gold IRA, which allows you to hold physical gold in a tax-advantaged retirement account. You can also buy gold bars, which offer a lower premium compared to coins.

It's important to do your due diligence and research the current market trends, as well as understand the valuation and weight of the gold you're buying. Additionally, consider storing your gold in a secure location, such as a bank or a reputable storage facility, and make sure you have insurance to protect your investment.

Purchasing Gold Bars and Coins

When purchasing gold bars and coins, it is important to follow the safest methods to protect your investment. Start by researching reputable dealers and verifying their credentials. Look for sellers who offer secure storage options or use a trusted third-party storage provider. Consider purchasing gold coins from well-known mints like the Canadian Gold Maple Leaf or the American Gold Eagle.

These coins are recognized worldwide and have a high level of liquidity. Additionally, diversify your gold holdings to mitigate risk and consider purchasing gold exchange-traded products or investing in a gold-focused investment fund. Lastly, regularly assess the value of your gold and stay informed about market trends to make informed decisions.

Investing in Gold Stocks

Investing in gold stocks can be a safe and profitable way to diversify your investment portfolio. Gold has historically been a reliable hedge against inflation and economic downturns, making it a popular choice for investors. When investing in gold stocks, it is important to do thorough research and consider factors such as the company's financial stability and the current market trend. Additionally, you can choose to invest in gold through options like gold exchange-traded products or physical assets like gold coins or bars.

Gold Futures and Options

By trading gold futures and options, investors can participate in the gold market without the need for physical storage or security concerns. This method also allows for greater flexibility and liquidity compared to other gold buying methods, such as purchasing gold coins or bars.

It's important to note that trading gold futures and options does come with risks, as the market can be volatile. Investors should carefully consider their risk tolerance and consult with a financial advisor before entering into these types of investments.

Buying Gold Jewelry

When buying gold jewelry, there are a few key methods that are considered the safest. One option is to purchase gold from a reputable jewelry store or dealer. This ensures that the gold is genuine and of high quality. Another method is to buy gold coins or bars from a trusted gold dealer.

These can be easily stored and sold when needed. Additionally, investing in a gold exchange-traded product can provide exposure to the gold market without the need for physical ownership. It's important to research the various buying methods and choose the one that aligns with your goals and risk tolerance.

Where to Buy Gold

When looking to buy gold, there are several safe methods to consider. One option is to purchase gold coins or bars from a reputable dealer or the United States Bullion Depository. Another option is to invest in gold through an investment fund, which provides diversification and professional management. Additionally, some banks offer gold accounts where you can buy and store gold securely. It's important to consider factors such as valuation, market trends, and the current price of gold before making a purchase.

Whether you choose to buy physical gold or invest in gold securities, it's crucial to research and understand the costs, fees, and potential risks involved.

Is Gold a Recommended Investment?

When considering investments, many people wonder if gold is a recommended option. The answer depends on various factors such as your financial goals and risk tolerance. Gold is often seen as a safe haven during times of economic uncertainty, making it a popular choice for diversification. It has historically held its value during market downturns and can act as a hedge against inflation. Gold can be purchased in various forms, such as coins or bars, and can be stored at home or in a secure facility. It's important to research reputable sellers and understand the associated costs, such as management fees and commissions.

Ultimately, investing in gold should be a well-informed decision based on your individual circumstances.

Gold IRA: Should You Open One To Save For Retirement?