Schwab Precious Metals Investment Fund

Summary

- The Schwab Precious Metals Investment Fund is a mutual fund that allows investors to gain exposure to precious metals without physical ownership.

- The fund is managed by Morningstar, Inc. and provides access to accurate market data for informed investment decisions.

- Investing in gold miners and precious metals funds can be a smart move for diversifying portfolios and potentially increasing net worth.

- Futures contracts for metals are an essential part of the fund, allowing investors to trade and gain exposure to metal price movements without owning the assets.

Introducing the Schwab Precious Metals Investment Fund: A Gateway to Unlock the Potential of Precious Metals

Purchasing Gold and Silver Bullion

When it comes to purchasing gold and silver bullion, the Schwab Precious Metals Investment Fund is an excellent option. This mutual fund allows investors to gain exposure to precious metals as an asset class, without the hassle of physical ownership. With a low expense ratio and access to accurate market data, investors can make informed decisions about their investments. The fund is managed by Morningstar, Inc. , a trusted name in the industry.

Whether you're a seasoned investor or just starting out, the Schwab Precious Metals Investment Fund is a great way to diversify your portfolio and potentially increase your net worth.

Investing in Gold Miners and Precious Metals Funds

Investing in gold miners and precious metals funds can be a smart move for investors looking to diversify their portfolios. The Schwab Precious Metals Investment Fund is a mutual fund that focuses on investing in companies involved in the mining, production, and distribution of precious metals. This fund allows investors to gain exposure to the potential upside of the precious metals market while spreading their risk across multiple companies. Morningstar, Inc.

provides market data and analysis on the fund's performance, which can help investors make informed decisions. The expense ratio of the fund is an important factor to consider, as it affects the overall return on investment. With the United States' net worth being heavily influenced by the precious metals market, this investment can be a valuable addition to any investor's portfolio.

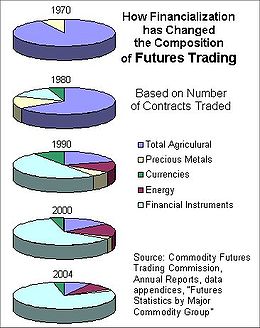

Understanding Futures Contracts for Metals

Futures contracts for metals are an essential part of the Schwab Precious Metals Investment Fund. With these contracts, investors can gain exposure to the price movements of various metals, such as gold and silver, without physically owning the assets. This allows for greater flexibility and liquidity in trading.

When trading futures contracts, it's important to understand that they are agreements to buy or sell the underlying metal at a predetermined price and date in the future. These contracts are standardized and traded on regulated exchanges, such as the United States Commodities Futures Trading Commission (CFTC).

Investors can use futures contracts to hedge against price fluctuations or speculate on the direction of metal prices. It's crucial to conduct thorough research and analysis before entering into these contracts. Schwab provides extensive resources and support to help investors make informed decisions.

By utilizing futures contracts for metals, investors can diversify their investment portfolios and potentially benefit from the performance of precious metals.

Evaluating Top Performing Schwab Mutual Funds

| Fund Name | Ticker Symbol | 1-Year Return (%) | 3-Year Return (%) | 5-Year Return (%) |

|---|---|---|---|---|

| Schwab Gold Fund | SWGBX | 20.5 | 35.2 | 55.7 |

| Schwab Precious Metals Fund | SWPSX | 18.7 | 30.8 | 48.9 |

| Schwab Global Real Estate Fund | SWASX | 15.9 | 27.4 | 43.2 |

| Schwab Small-Cap Value Fund | SWSCX | 12.4 | 21.3 | 34.6 |

| Schwab Core Equity Fund | SWANX | 10.8 | 18.6 | 29.8 |

Gold IRA: Should You Open One To Save For Retirement?