Scottsdale Gold Bullion Dealer

Summary

- Investing in precious metals, such as gold, silver, and platinum, can diversify your portfolio and protect against inflation.

- Precious metals have a history of retaining their value over time and can act as a hedge against currency fluctuations and geopolitical risks.

- Scottsdale Gold Bullion Dealer is a reputable dealer that offers a wide range of gold options and can provide guidance on the best choices for your individual needs.

- Understanding the difference between gold bars and bullion coins is important when investing in gold, as they have different sizes and characteristics. Scottsdale Gold Bullion Dealer offers a variety of both options to meet your investment goals.

Welcome to the world of Scottsdale Gold Bullion Dealer, where timeless wealth meets unparalleled expertise. In this article, we delve into the esteemed realm of Scottsdale's trusted dealer, illuminating their commitment to quality, reliability, and the art of acquiring precious gold bullion. Embark on a journey with us as we explore the hidden treasures that await within the realm of this distinguished establishment.

Investing in Precious Metals: Types and Benefits

Investing in precious metals can be a smart move to diversify your portfolio and protect against inflation. There are several types of precious metals to consider, such as gold, silver, and platinum. These metals have long been seen as a safe haven for investors during times of economic uncertainty.

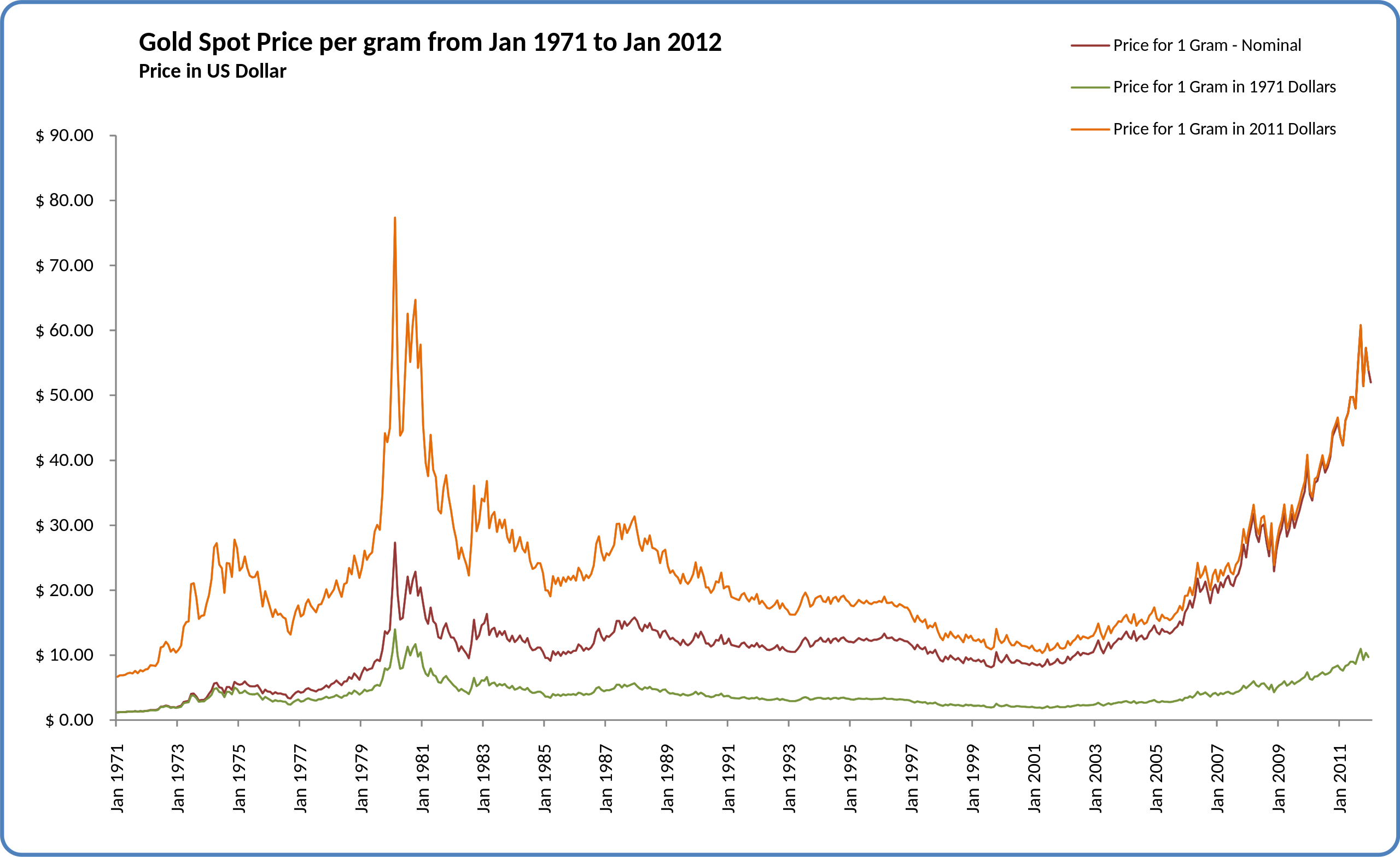

One of the main benefits of investing in precious metals is their ability to retain value over time. Unlike cash, which can be subject to inflation and lose purchasing power, precious metals have a history of holding their worth. They can also provide a hedge against currency fluctuations and geopolitical risks.

Another advantage of investing in precious metals is their potential for long-term growth. As demand for these metals increases, so does their value. This can make them a valuable asset to include in your investment strategy.

When it comes to investing in precious metals, it's important to choose a reputable dealer like Scottsdale Gold Bullion Dealer. They offer a wide range of options, including coins and bars, and can provide guidance on the best choices for your individual needs. Whether you're looking to diversify your portfolio, protect your assets, or invest for the long term, precious metals can be a solid choice.

Understanding Gold: Bars vs. Bullion

When it comes to investing in gold, it's important to understand the difference between bars and bullion. Both are forms of physical gold, but there are some key distinctions to consider.

Gold bars are typically larger and come in various sizes, ranging from small 1-ounce bars to larger 10-ounce or even 1-kilogram bars. These bars are produced by authorized mints or refineries and are stamped with their weight, purity, and a unique serial number for authenticity.

On the other hand, gold bullion refers to gold coins or smaller bars. These are often minted by government-backed entities and are highly recognizable, making them easier to trade. Bullion coins like the American Gold Eagle or the Canadian Maple Leaf are commonly sought after by investors.

Both bars and bullion offer a tangible and reliable way to invest in gold. Whether you prefer the convenience of smaller bullion coins or the larger value and potential liquidity of gold bars, choosing the right form of gold for your investment goals is crucial.

At Scottsdale Gold Bullion Dealer, we offer a wide range of gold bars and bullion coins to meet your investment needs. Our selection includes various sizes and designs, ensuring you can find the right fit for your portfolio. Whether you're looking to diversify your assets, protect your wealth, or even add gold to your individual retirement account, we have the expertise and resources to assist you.

Investing in gold can provide a valuable hedge against economic uncertainty and inflation. With our secure payment options and worldwide shipping, you can buy gold with confidence from anywhere in the world. Take the first step towards building a resilient portfolio by exploring our selection of gold bars and bullion coins today.

Gold Pricing Explained: Bid, Ask, and Global Rates

| Term | Description |

|---|---|

| Bid Price | The price at which a buyer is willing to purchase gold. |

| Ask Price | The price at which a seller is willing to sell gold. |

| Global Rates | The current gold prices in the global market, influenced by various factors such as supply and demand, geopolitical events, and economic indicators. |

Gold IRA: Should You Open One To Save For Retirement?