Investing in a Silver Backed IRA

Summary

- Investing in a Silver Backed IRA allows you to add physical silver to your retirement portfolio, providing a hedge against market volatility and potential growth.

- Working with a reputable trust company or financial advisor is important when setting up a Silver Backed IRA, as they can guide you through the process and help you choose the right silver bullion coins for your portfolio.

- Appropriate allocation of precious metals is crucial in diversifying your portfolio and managing risk. Silver can act as a hedge against inflation and economic uncertainty.

- When establishing a Precious Metal IRA, you need to choose a reputable custodian, open an account, fund your account, select the silver products, complete the purchase, monitor and manage your IRA, and stay compliant with IRS rules and regulations.

Welcome to the world of financial security and diversification with silver-backed IRAs. In this article, we explore the promising realm of investing in a Silver Backed IRA, shedding light on its potential benefits and guiding you towards making informed investment decisions. Get ready to discover a tangible and valuable asset that could enhance your retirement portfolio.

Understanding Precious Metal IRAs

Understanding Precious Metal IRAs can be a valuable investment strategy for diversifying your retirement portfolio. With a Silver Backed IRA, you can add physical silver to your Individual Retirement Account, providing a hedge against market volatility. Silver has historically been seen as a safe haven asset, offering stability and potential growth. By investing in silver, you can potentially protect your wealth and preserve purchasing power.

When setting up a Silver Backed IRA, it is important to work with a reputable trust company or financial adviser who specializes in precious metal IRAs. They can guide you through the process and help you choose the right silver bullion coins for your portfolio.

Mechanism of a Precious Metal IRA

The mechanism of a Precious Metal IRA involves investing in a Silver Backed IRA, which is a type of Individual Retirement Account that allows investors to hold physical silver as an asset within their retirement portfolio. This type of IRA is designed to provide diversification and hedge against the volatility of the stock market. By investing in silver, investors can protect their wealth from inflation and market fluctuations. The process involves working with a trusted financial advisor or trust company to set up the IRA and purchase silver bullion coins or bars. The Internal Revenue Service has specific guidelines and requirements for a Precious Metal IRA, so it is important to consult with a professional to ensure compliance.

Appropriate Allocation of Precious Metals in Your IRA

When investing in a Silver Backed IRA, it is crucial to ensure appropriate allocation of precious metals. Asset allocation plays a vital role in diversifying your portfolio and managing risk. Consider the volatility of the market and the potential benefits of including silver in your investment strategy. Silver can act as a hedge against inflation and economic uncertainty.

Whether you choose to invest in silver coins or bullion, it is essential to work with a knowledgeable financial adviser who can guide you through the process.

Steps to Establish a Precious Metal IRA

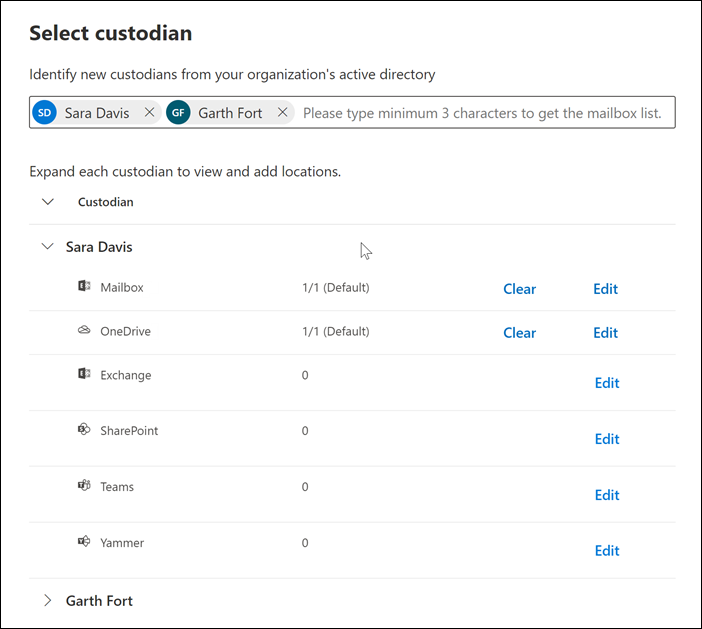

1. Choose a reputable custodian: Research and select a trusted custodian that specializes in Precious Metal IRAs. Look for one that offers a wide range of silver-backed options.

2. Open an account: Complete the necessary paperwork to open a Precious Metal IRA account. Provide the required personal information and funding details.

3. Fund your account: Decide how much you want to invest in a silver-backed IRA and transfer the funds from your existing retirement account or make a new contribution.

4. Select the silver products: Work with your custodian to choose the specific silver products for your IRA. Consider factors such as purity, weight, and liquidity.

5. Complete the purchase: Once you have chosen the silver products, your custodian will coordinate the purchase and ensure it is securely stored in an IRS-approved depository.

6. Monitor and manage your IRA: Stay informed about the market and regularly review your silver-backed IRA. Consider working with a financial advisor to optimize your asset allocation and minimize risk.

7. Stay compliant: Adhere to IRS rules and regulations regarding your Precious Metal IRA. Consult with a tax professional to ensure you meet all reporting requirements.

Selecting a Self-Directed IRA Custodian

When it comes to selecting a self-directed IRA custodian for your silver backed IRA, it's important to choose wisely. Look for a custodian with a strong reputation and experience in handling precious metal investments. Consider their fees, services, and the level of customer support they provide. It's also crucial to ensure that the custodian is compliant with IRS regulations and can help you navigate the complexities of self-directed IRAs. Take the time to research and compare different custodians to find the one that best fits your investment goals and preferences.

Choosing a Trusted Precious Metals Dealer

When investing in a silver-backed IRA, choosing a trusted precious metals dealer is crucial. A reputable dealer will ensure you are purchasing genuine and high-quality silver products. Look for a dealer with a long-standing reputation in the industry and positive customer reviews. It is important to research their credentials and verify their certification, such as being a member of the Professional Numismatists Guild.

Additionally, consider their selection of silver products, as well as their pricing and transparency. A trusted dealer will provide you with all the necessary information and guidance to make informed investment decisions.

Selecting a Secure Depository

When selecting a secure depository for your silver-backed IRA, it is important to consider a few key factors. First, look for a depository that is highly secure and has a proven track record of protecting investor assets. Look for depositories that offer advanced security measures such as 24/7 surveillance and state-of-the-art vaults. Additionally, consider the accessibility of the depository. It should be easy to access your silver holdings when needed, while still maintaining a high level of security. Finally, consider the reputation and credibility of the depository.

Look for depositories that are well-established and trusted in the industry. By selecting a secure depository, you can have peace of mind knowing that your silver investments are protected.

Making Withdrawals from a Precious Metal IRA

When it comes to withdrawing funds from your Silver Backed IRA, the process is fairly straightforward. First, you'll need to contact your custodian and request a withdrawal form. Once you've completed the necessary paperwork, your custodian will initiate the transfer of funds from your IRA to your designated bank account.

It's important to keep in mind that withdrawals from a Precious Metal IRA may have tax implications. Depending on your age and the type of IRA you have, you may be subject to early withdrawal penalties or taxes. Consulting with a tax professional is recommended to fully understand the potential consequences.

When withdrawing from a Silver Backed IRA, you have the option to receive the funds in cash or in-kind. In-kind withdrawals allow you to transfer the physical silver from your IRA to your possession. This can be a convenient option if you plan to sell or use the silver immediately.

Remember to consider the current market conditions and your investment goals before making any withdrawals. Precious metals, like silver, can be subject to volatility, so it's important to have a well-diversified portfolio that includes other assets such as stocks, real estate, or cryptocurrencies.

Gold IRA: Should You Open One To Save For Retirement?