Vanguard Silver Fund Strategies Global Capital ETF

Summary

- The Vanguard Silver Fund Strategies Global Capital ETF offers investors exposure to the silver market and potential for growth.

- The fund focuses on equities in precious metals and mining, providing diversification and professional management.

- Potential risks include the use of leverage, market volatility, and changes in energy prices and precious metals.

- Investors should carefully review the fund's prospectus and consult with a financial advisor before investing.

Introducing the Vanguard Silver Fund Strategies Global Capital ETF, an article that explores the innovative investment strategies and global potential of this unique silver-focused exchange-traded fund.

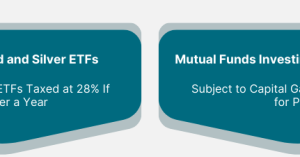

ETF Alternatives and Commodity Funds

The Vanguard Silver Fund Strategies Global Capital ETF offers investors an alternative to traditional ETFs and commodity funds. With a focus on silver, this fund provides exposure to the metal's price movements and potential for growth. By investing in a diversified portfolio of silver-related assets, investors can benefit from the potential upside of the commodity market while managing risk. This fund is managed by The Vanguard Group, a trusted name in the investment industry, and offers investors a convenient way to add silver to their portfolio.

With low fees and a transparent approach, this ETF is a valuable tool for investors seeking to diversify their holdings and potentially profit from the silver market.

Equities in Precious Metals and Mining

The Vanguard Silver Fund Strategies Global Capital ETF is an exchange-traded fund that focuses on equities in precious metals and mining. As an alternative investment, it offers investors exposure to the potential benefits of these sectors. With a diverse portfolio of stocks in the precious metal and mining industries, the fund aims to capture price movements and opportunities in this space. The fund is managed by The Vanguard Group, a trusted name in the industry known for its expertise in security selection and risk management.

By investing in this fund, investors can gain access to the potential growth and diversification benefits of precious metals and mining, while leaving the complexity of individual stock selection and management to the professionals.

Risks in Alternative Investment Funds

One potential risk is the use of leverage, which can amplify both gains and losses. The fund may also invest in stocks, securities, mortgage-backed securities, and commodities, which can be subject to market volatility. Real estate investing, including investments in real estate investment trusts (REITs) and master limited partnerships (MLPs), carries its own set of risks, including changes in property values and tax implications.

Investors should be aware of the complex nature of alternative investments and the potential for high fees and expenses. Additionally, the fund's performance may be influenced by factors such as changes in energy prices, fluctuations in precious metals, and shifts in the overall market.

Before investing, it is important to carefully review the prospectus and consult with a financial advisor to determine if this fund is suitable for your investment goals and risk tolerance.

Gold IRA: Should You Open One To Save For Retirement?