Learn About Your Arizona Teacher Pension

- The Arizona Public Employees Retirement System (APERS), the state pension fund, is one of the most profitable in the country.

- S, as it is colloquially known, has about $20 billion invested in domestic and international equities, private equity, real estate, timber, and other assets.

- S is one of the first pension funds to adopt a 100 percent sustainable investment mandate.

Arizona teachers have a lot to be proud of. The Arizona Public Employees Retirement System (APERS), their state pension fund, is one of the most profitable in the country and is regularly ranked as one of the top five plans in the nation.

Public Teacher Pensions

In Arizona, only public school teachers are covered by teacher pensions. Employers in the private sector aren't required to offer pensions, but those that do are regulated by Arizona Revised Statutes (A.R.S.) 38-431-100 (2018).

The Arizona Revised Statutes also specify which public employees are eligible to receive and participate in the Arizona State Retirement System, or ASRS.

Understanding Arizona Teacher Pensions

Arizona teachers endure rigorous education requirements, including at least a bachelor's degree, certification, and passing scores on teacher competency exams. Arizona teacher certification requires a bachelor's degree or 60 semester credits with a major in an appropriate discipline and passing scores on one or more state-approved exams.

Arizona teacher competency exams are required for all teachers who do not have a Master's in teaching or education. For example, a special education teacher would need certification in special education. The Arizona Department of Education's (ADE) Office of Educator Certification and Standards (OECS) administers teacher competency exams. The OECS website provides instructions for test-takers and test preparation.

Arizona Teachers' Retirement Plan

The Arizona Teachers' Retirement Plan is a defined benefit plan. It is a defined contribution plan, a 403(b) plan, and a 457(b) plan.

Arizona teachers contribute to the plan through mandatory payroll deductions. The contribution rate for 2021 is 8.50% of a teacher's salary. Teachers who are age 50 or older can suspend their contributions to the plan.

Retirement benefits are calculated based on a formula that considers a salary credit multiplier, years of credited service and years of credited service. Eligibility to retire at age 60 is established after 25 years of service.

The Arizona Teachers' Retirement Plan provides optional retirement benefits, including a deferred compensation plan, supplemental plans, and survivor benefits.

Arizona Public Employee Retirement System (APERS)

APERS is Arizona's statewide public pension for state workers and teachers. You may opt to retire from teaching after 25 years of service. Two important retirement factors for APERS are your highest average salary and your years of service.

You can calculate your estimated pension using APERS' retirement estimator.

Arizona Teacher Retirement System (ATRS)

ATRS is Arizona's teacher pension fund. ATRS has two types of pension plans available: a defined benefit plan and a defined contribution plan.

The defined contribution plan is a 401(k) plan. Under the defined benefit plan, the payout is based on your salary and years of contributions.

You can calculate your estimated pension using the ATRS retirement estimator.

Your Arizona Teacher Pension

The Arizona State Retirement System (ASRS) is the retirement system for Arizona teachers. The ASRS has been in operation since 1937 and, at that time, was known as the Arizona State Employees Retirement System.

The ASRS is a defined benefit plan. Contributions are mandatory and your employer determines the amount.

Current State of the Arizona Teacher Pension System

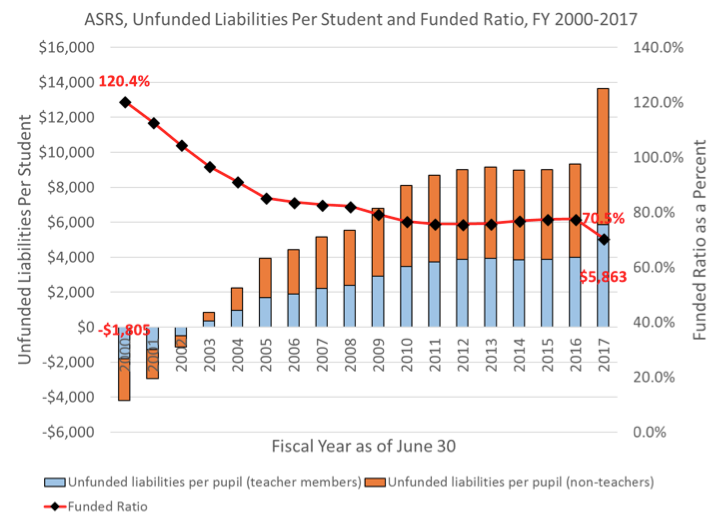

In 2018, the Arizona teacher pension system was underfunded by $5.1 billion as a result of inadequate contributions by public employees and lawmakers. The state's pension debt per capita of $52,600 was the seventh highest in the nation.

It was recently announced that Arizona had finally begun contributing toward the pension system.

Recent Developments in Arizona Teacher Pensions

In 2017, PERA introduced a plan for members with 30 years of service, offering them as much as an 85% lump sum buyout, payable in monthly installments over 10 years, in addition to a monthly lifetime annuity.

The plan had a cap of $100,000 per member or $200,000 per married couple. But the governor announced in July 2021 that the cap would be lifted.

A Look at the Pension Debt

The Arizona teacher pension is currently in approximately $4.4 billion of debt. The pension began accruing this debt in 2007, when it began paying out benefits to Arizona teachers. Although benefits began in the 2007-2008 academic year, the first contributions were made in fiscal year (FY) 2008.

The pension system's FY 2012 annual report shows that total debt outstanding stood at $3.8 billion. The $1.6 billion increase in debt outstanding in FY 2012 compared to FY 2011 was the result of investment losses, increases in benefits due to inflation, and increases in prior years' unfunded liabilities.

Gold IRA: Should You Open One To Save For Retirement?

A Look at Public Employee Pensions Across the Country

The Arizona Public Employee Retirement System (PERS) is the state pension for teachers in Arizona. The pension fund is funded on a pay-as-you-go basis, so teachers do not lock in lifetime coverage. However, they can build a substantial retirement nest egg through the system.