These are the Best Bullion to Buy for Your IRA

- Investors who want to hold precious metals in their IRAs can do so, but the investments must be in the form of bullion coins or bars.

- Gold IRAs are a special type of IRA that invests primarily in physical gold.

- A gold IRA is a special type of IRA that invests primarily in physical gold.

Many investors use Individual Retirement Accounts (IRAs) as a way to grow their portfolios with tax-favored savings. Since these accounts are tax-sheltered, most investors want to grow their investments as much as possible. But, some IRA investors also want more tangible assets to hold, like gold, silver, platinum, or palladium.

A Brief History of Bullion

Precious metals and coins have been valued for thousands of years. In the 19th century, the discovery of new ore bodies around the world and the growing popularity of photography led to the production of coins from gold, silver, and other metals.

Even then, coins made of gold, silver, or copper were not considered valuable as bullion. They were used for commerce and everyday transactions. The real value of gold, silver, and other metals was derived from their industrial use.

In 1821, the East India Company, which controlled much of the trade in the East, was dissolved. This set the stage for India's independence from the British Empire.

India was the world's largest producer of gold, accounting for 80% of the world's production in 1890.

What Type of Bullion Should You Buy?

Bullion comes in many forms, including:

Bullion bars

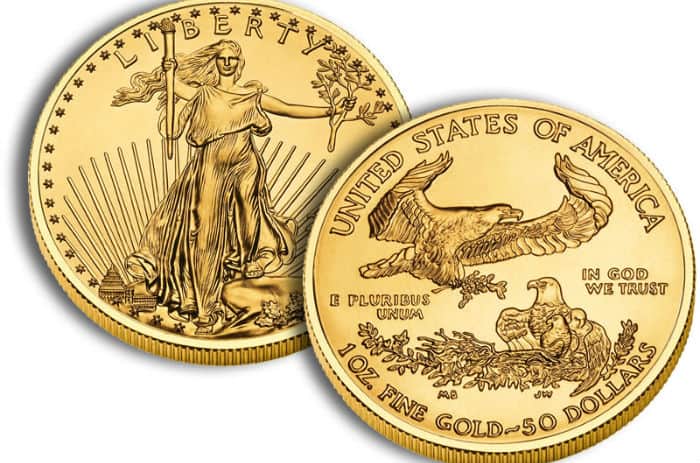

Bullion coins

Bullion rounds

Bullion bars come in many sizes, ranging from 1/10 ounce up to 400 ounces. They are often sold in 1-, 5-, 10-, and 100-ounce sizes. The smaller bars tend to cost more per troy ounce than the larger ones, so buying large bars makes sense.

Bullion coins and rounds come in many sizes, ranging from 1/10 ounce up to 1 troy ounce. Most coins and rounds weigh 40 to 80 troy ounces. Most coins and rounds weigh 40 to 80 troy ounces.

Gold

Gold prices have been on a tear in 2018. The yellow metal is up 15.7% year-to-date (YTD), according to Kitco. While gold is not a fiat currency, it is widely recognized as a hedge against inflation and could be used in a self-directed IRA to invest in physical gold.

Gold bullion is also very popular as a store of wealth. Gold coins are sought after not only for their inherent beauty, but also for their proven value. Since gold is a finite resource, its demand tends to rise in times of world market uncertainty.

Silver

Silver also has surged in price this year. The price is currently up 23.3% YTD, according to Kitco. Like gold, silver bullion can be used to establish a physical hard asset in an IRA.

Gold tends to be more expensive per ounce than silver, but investors often purchase silver bullion coins over gold ones due to the lower premium per ounce.

Copper

Copper is another popular choice for an IRA. While copper has historically been used as currency, it is now more commonly used as a raw material for manufacturing. Copper bullion is also less expensive than gold, silver, and other precious metals.

Platinum

Gold

Silver

Gold prices have dipped in recent years, but this precious metal has still yielded gains over the years. Gold prices surged by more than 60% between 2000 and 2010, before falling by around 20% in the succeeding 10 years.

A December 2021 research report from Goldman Sachs Group Inc. (GS) predicted that gold prices would rise further in 2022, predicting that gold will trade at $3,000 an ounce by 2023.

Palladium

Palladium is an alternative precious metal to gold. The metal is rarer than gold and is more affordable than silver. Palladium is also classified as a rare-earth metal. It is widely used in the manufacturing of catalytic converters and exhaust systems for cars.

Buying palladium requires a minimum investment of $1,000.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

Precious metals have long been considered a safe haven for investors' portfolios. When compared to many other assets, precious metals have little to no correlation to stocks, bonds, or real estate. Gold, silver, and platinum have all proven to be good long-term investments, but the safest way to invest in them is to purchase physical gold, silver, or platinum bullion.